Ethereum fees spike as bots spend millions to frontrun punters of PEPE, CHAD

Shovel makers benefit the most in a gold rush, and crypto trends are no different.

Sandwich bots are frontrunning punters of newly-issued tokens such as pepe (PEPE) and chad (CHAD) – memecoins with no intrinsic value that caught wind of Crypto Twitter degens almost overnight as the tokens zooted over 10,000%.

A sandwich attack, traps a user's transaction between two transactions, which is then further manipulated to gain profits. This is done by frontrunning the victim's trade by buying the same asset, and then selling tokens to the victim in the same trade for a slightly higher price.

Sandwich attackers aren’t typically a form of exploit but are looked upon in crypto circles as a type of predatory behavior, which skims value from users, leads to a spike in gas fees and doesn’t benefit either the network or the user.

The victim might not notice it, but for sandwich bots, the gains can run into millions of dollars as they target thousands of wallets and skim a few dollars each time.

A wallet named “Jaredfromsubway.eth,” a likely nod to the popular sandwich chain, has spent over $2 million in the past week on Ethereum network fees trying to sandwich traders punting on predominantly low-cap tokens.

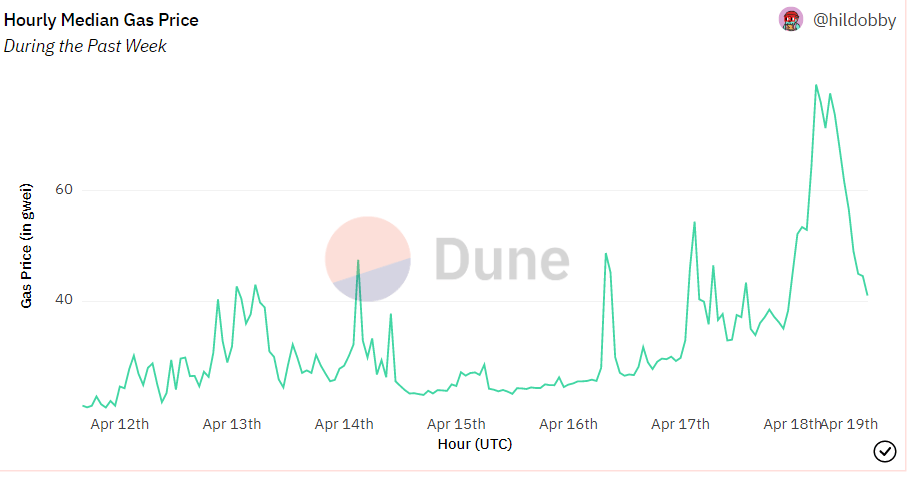

That has driven up fees of the entire network, data from Dune Analytics shows. Each transaction on the Ethereum network costs over $10 as of Asian morning hours on Wednesday – ten times more than last week’s $1 level.

Gas fees have spiked. (Dune)

The actions of Jaredfromsubway.eth mean they spent 7% of all fees on Ethereum in the past 24 hours, the data shows, becoming the top spender on the network.

That is ahead of fees spent by Arbitrum, a layer 2 blockchain that batches transactions on the Ethereum network, and Uniswap, the most-used decentralized exchange.

It is unclear how much Jaredfromsubway.eth made from their frontrunning actions, but given they spent a significant amount – and continue to do so – the gains likely exceed costs by a significant amount.

Meanwhile, the pepe frenzy is on in full force. Pepe tokens nearly doubled in the past 24 hours as Crypto Twitter traders moved over their doge-themed token obsession to bet on the internet meme instead, as CoinDesk reported.

Scores of pepe wannabes have popped up as well, as have chad, wojak, and babypepe – each a nod to internet memes.

Most of these are unlikely to last beyond a few weeks. But unlike then, entities like Jaredlikesubway.eth is eating the gains while fresh.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.