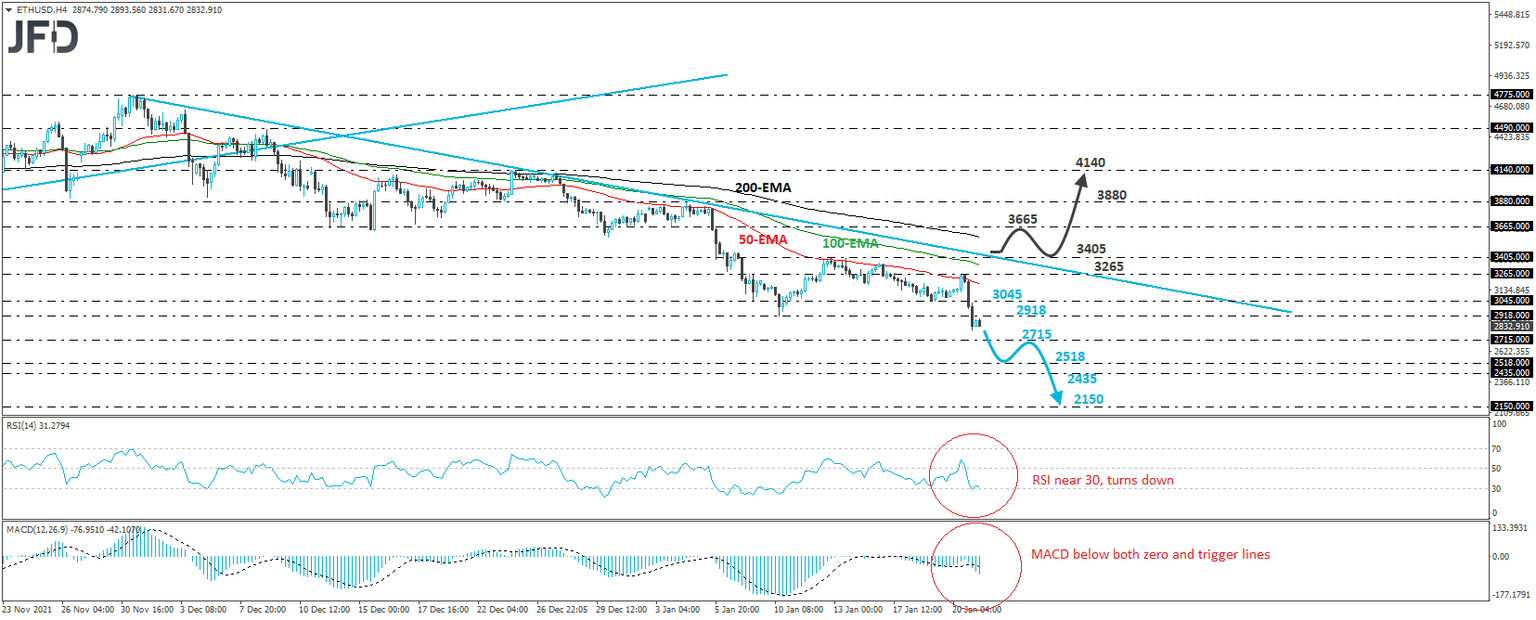

Ethereum confirms a forthcoming lower low

ETH/USD traded sharply lower yesterday, after hitting resistance at 3265. The slide took the crypto below the 2918 level, marked by the low of January 10th, thereby confirming a forthcoming lower low. Overall, Ethereum is printing lower highs and lower lows below the downside line taken from the high of December 1st, which paints a negative short-term picture, in our view.

We believe that the break below 2918 may have encouraged more bears to join the action, and thereby push the price to the 2715 barrier, marked by the low of September 24th. If they don’t stop there, we could see them diving towards one of the 2518 or 2435 barriers, marked by the lows of August 5th and 3rd respectively. Should they stay willing to continue lower, the next step may be the 2150 territory, marked by the low of July 27th.

Taking a look at our short-term oscillators, we see that the RSI, already near 30, turned down again, while the MACD lies below both its zero and trigger lines. Both indicators detect strong downside speed and support the notion for further declines.

On the upside, we would like to see a clear break above 3405 before we start examining the case of a bullish reversal. This could confirm the break above the aforementioned downside line and perhaps pave the way towards the 3665 barriers, which acted as strong support between December 13th and January 3rd. If the bulls have the strength to keep sailing north, we could see the targeting the 3880 barriers, marked by the high of January 4th, where another break could carry extensions towards the 4140 zone, defined as resistance by the peak of December 23rd.

Author

JFD Team

JFD