Ethereum co-founder Vitalik Buterin calls for 33% increase in Gas limit

Ethereum co-founder Vitalik Buterin has advocated for a “modest” gas limit increase to potentially improve network throughput.

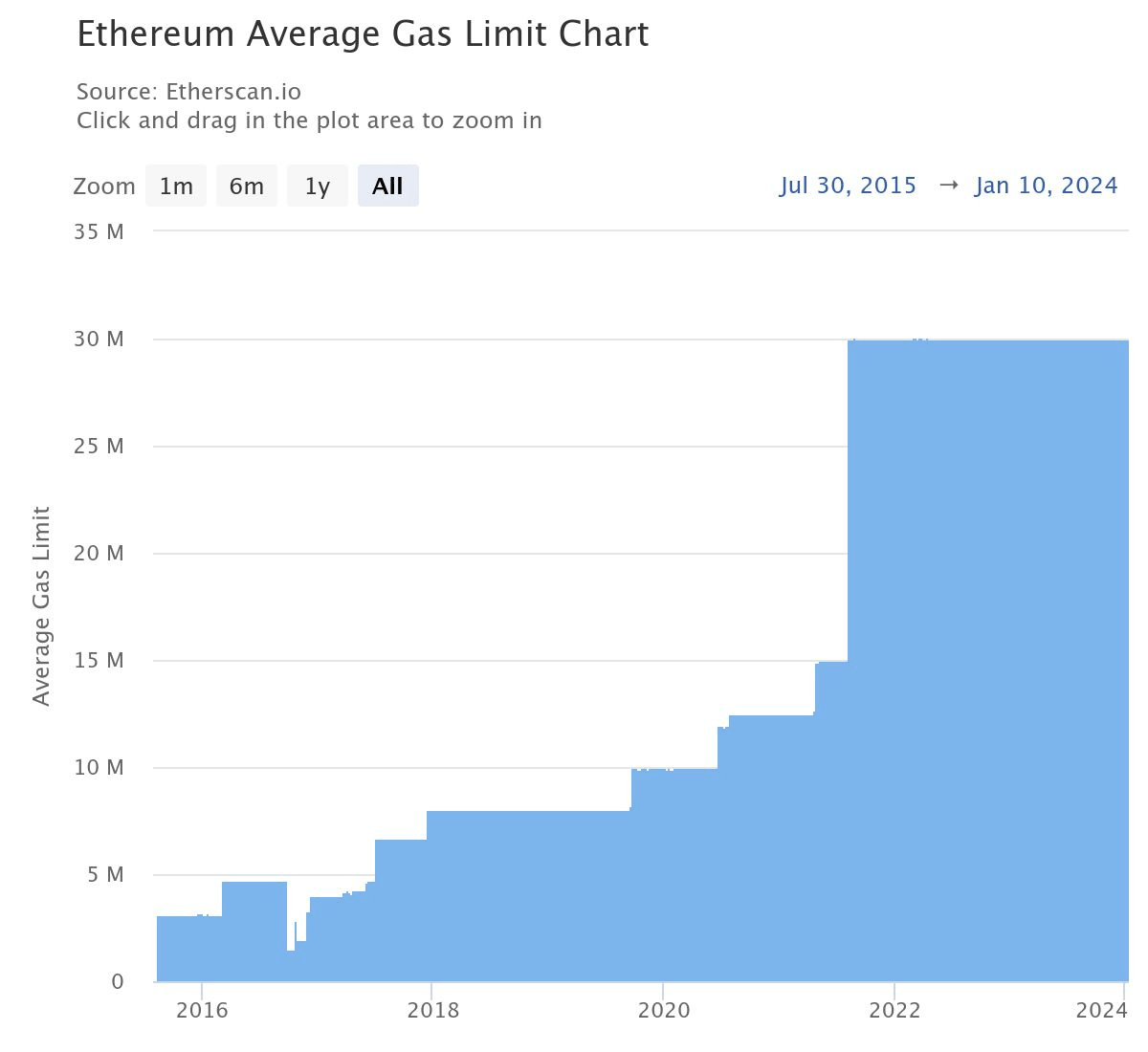

During a Reddit ask-me-anything (AMA) organized by the Ethereum Foundation’s research team on Jan. 10, Buterin noted that the gas limit has not been increased for nearly three years, the longest time ever in the protocol’s history.

“Honestly, I think doing a modest gas limit increase even today is reasonable,” said Buterin during the research team’s 11th AMA.

Buterin also made some brief calculations, saying this would imply an increase to around 40 million. The current gas limit is 30 million, according to Etherscan, so Buterin suggests an increase of 33%.

Ethereum average gas limit over time. Source: Etherscan

The average gas limit just after Ethereum’s genesis in 2015 was around 3 million, which has increased over time along with network usage and adoption.

The Ethereum gas limit refers to the maximum amount of gas spent on executing transactions or smart contracts in each block. Gas is the fee required to conduct a transaction or execute a contract on the blockchain.

A gas limit is set to ensure that blocks are not too large, which would impact network performance and synchronization. Validators can also adjust the gas limit dynamically within specific parameters as they produce blocks.

Increasing the gas limit allows more transactions into each block, which theoretically increases the overall throughput and capacity of the network. However, it also increases loads on hardware and the potential risk of network spam and attacks.

Average gas prices, or the cost of transacting on Ethereum, are currently around 35 gwei or $1.89, according to Etherscan. However, they have increased since the beginning of 2024 and are much higher for complex smart contract operations.

Network gas fees spiked to a 2023 high of 150 gwei in May due to the inscriptions craze. A gwei is a denomination of Ethereum that represents one billionth of a single Ether (ETH $2,642). In November 2023, Ethereum and Bitcoin users reignited the scalability debate as fees surged amid another round of inscriptions hype.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.