Ethereum Classic Price Forecast: ETC explodes to new record highs

- Ethereum Classic price has printed an all-time high this week.

- ETC rally strength only exceeded by the rally into the end of May 2017.

- Grayscale has gone all-in on the altcoin with a stake of over 160,000 ETC.

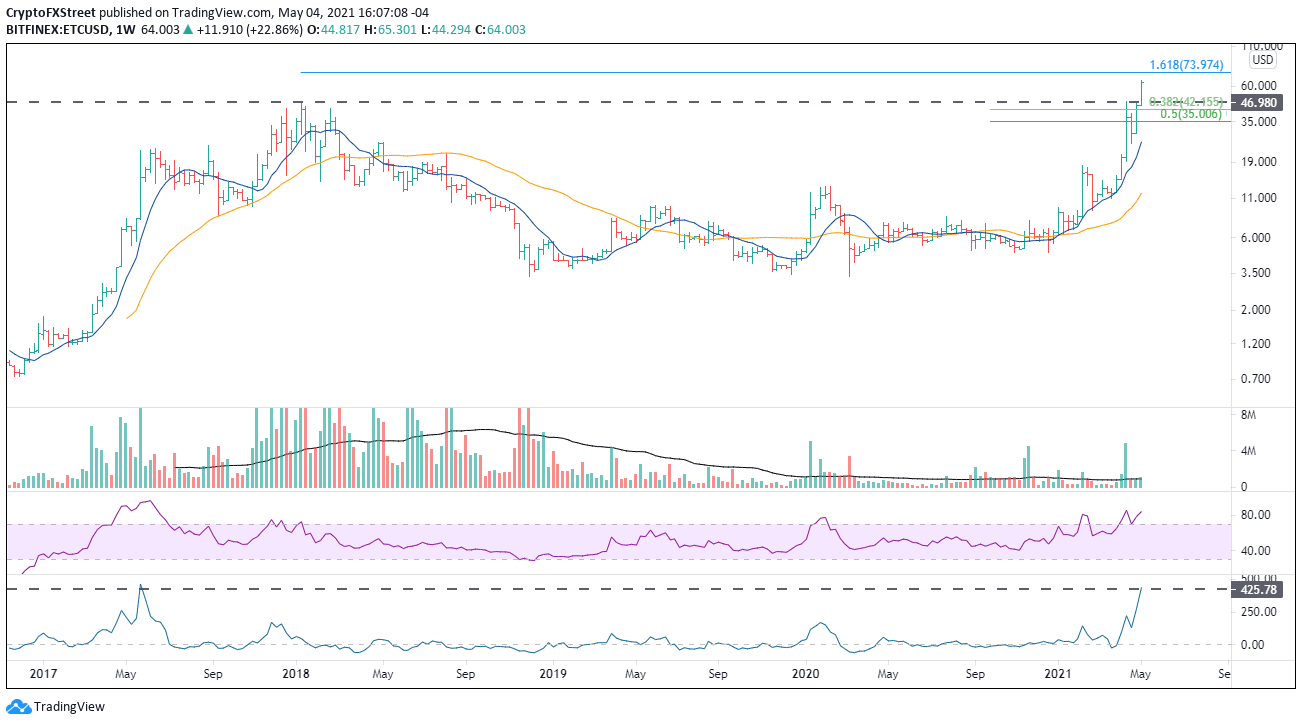

Ethereum Classic price is up 39% this week at the time of writing and is inching towards the 161.8% Fibonacci extension of the 2018 bear market. Due to the extended condition, price progress will be limited in the short term with a high probability consolidation.

Ethereum Classic price substantially less expensive than Ether

Ethereum and Ethereum Classic should not be confused. They separated from each other in 2016 after a contentious hard fork on the ETH blockchain generated a disagreement over reverting the blockchain to reverse a hacking. ETC is the section of the chain that did not revert.

The fundamental difference is in security vs. efficiency; Ethereum is built on boosting the performance of the original blockchain, while Ethereum Classic is focused on maintaining its smart contracts secure.

Ethereum is the most visible and carries more extensive investor support, particularly institutionally, but Ethereum Classic does command some support as Grayscale has a stake of over 160,000 ETC.

Since the December 2020 low, Ethereum Classic price has advanced almost 1300%, and over the last six weeks, it has gained 433%. The six-week gain is only exceeded by a six-week rally of 465% between April and May of 2017.

In 2017 Ethereum Classic price rallied an additional 40% before a significant correction. Still, the correction was not confronted by an important Fibonacci extension level, nor was price printing new highs after forming a three-year base.

The overbought condition will force a correction to the 2018 high at $46.98, or slightly beyond, to release the price compression and evacuate any weak holders. If a wholesale liquidation erupts, Ethereum Classic price will locate support at the 38.2% retracement of the rally since the December 2020 low at $42.15, followed by the 50% retracement at $35.00.

ETC/USD weekly chart

Of course, the momentum and a buoyant ETH price could hoist Ethereum Classic price to the 161.8% extension at $73.97 and maybe to $117.64. Additionally, there is no negative momentum divergence as the daily or weekly Relative Strength Indexes (RSI) are printing new highs, indicating that a rally continuation is likely following a corrective process.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.