Ethereum Classic PoW hype dissipates as hash rate declines by almost 50% in 10 days

- Ethereum Classic banked on Ethereum’s Merge to draw all Proof of Work supporting miners to its network.

- Right before the Merge, Ethereum Classic’s hash rate jumped by more than 370% within 24 hours but then declined.

- Still, ETC’s price is down by 28% and approaching critical support.

The Proof of Work (PoW) vs. Proof of Stake (PoS) debate heated up this month as Ethereum mainnet officially shifted to the PoS consensus method. However, not everyone was a taker since many of the miners preferred the older methods instead of switching to staking.

Ethereum Classic reaped the benefits of this decision, although only for a short while.

Ethereum Classic returning to normalcy

Ethereum went through the Merge two weeks ago, which marked a historic moment for not just the Ethereum but the crypto community as well. This is because the second biggest cryptocurrency network shifted its mainnet to a whole different consensus method, moving to PoS from PoW.

The ones that did not shift to staking found their PoW market in an older hard fork of Ethereum, Ethereum Classic. Twenty-four hours before the Merge, these miners flocked over to Ethereum Classic and its hash rate skyrocketed by over 370%, reaching 307.1 Th/s.

Ethereum Classic’s team also banked on this opportunity persuading miners to jump to this network.

PoW miners can go with ETC. Stakers can go with ETH2. Which is fair to each their own choice. Thanks and congrats @VitalikButerin et al.

— Ethereum Classic (@eth_classic) September 15, 2022

May both chains co exist in their own right providing options for stakers and miners. https://t.co/4x008OxaUL

However, it did not take them long to scale back. While some miners stuck to ETC, many others migrated to other networks, and the hash rate took a hit. Dropping by 47% in the span of 10 days, the hash rate could be seen lingering at 160.8 TH/s at the time of writing.

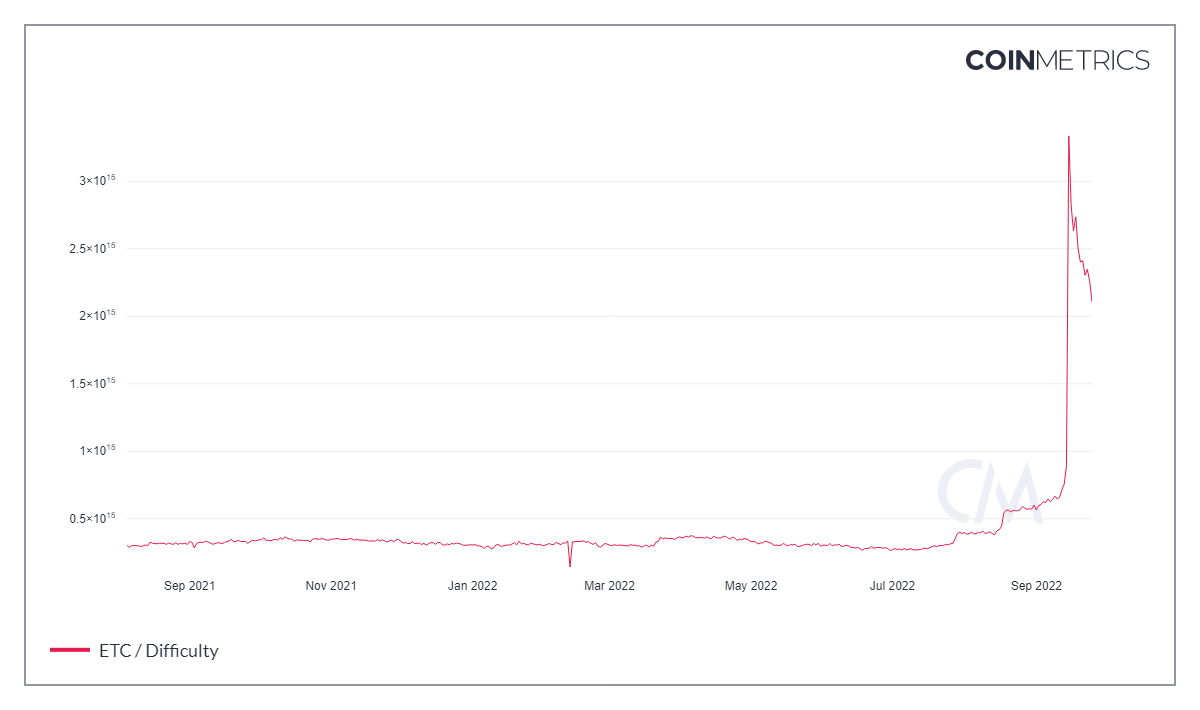

This also had an impact on the mining difficulty, which fluctuated in sync with the hash rate.

Ethereum Classic Difficulty

Only the network, not the price

This sudden migration of miners was not followed by investors as the buying pressure on ETC remained unchanged. In fact, following the broader market bearish trend, ETC’s price went down during this duration.

Trading at $28.1, ETC’s price fell by 28.18% following the Merge, inching closer to the $23.33 support level. This price level has been historically tested as a critical support level and would act as a buffer to prevent a further drawdown for ETC.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.