Ethereum 2.0 staking continues to gain momentum while ETH price looks poised for V-shaped recovery

- Ethereum price slipped below the support level at $550 but managed to recover quickly within 24 hours.

- The Ethereum 2.0 deposit contract continues to receive more ETH, currently at 1.2 million.

The upcoming launch of Ethereum 2.0 has been one of the most anticipated upgrades in the cryptocurrency market. Initially, the contract needed around 500,000 ETH to launch, however, there are more than 1.2 million ETH deposited to date and the number continues growing.

Ethereum price remains stable despite positive on-chain metrics

On December 8, the cryptocurrency market suffered a mild pullback and Ethereum dropped from $595 towards $549 and $530 in the past 24 hours. However, the digital asset has managed to recover and it’s currently trading at $567.

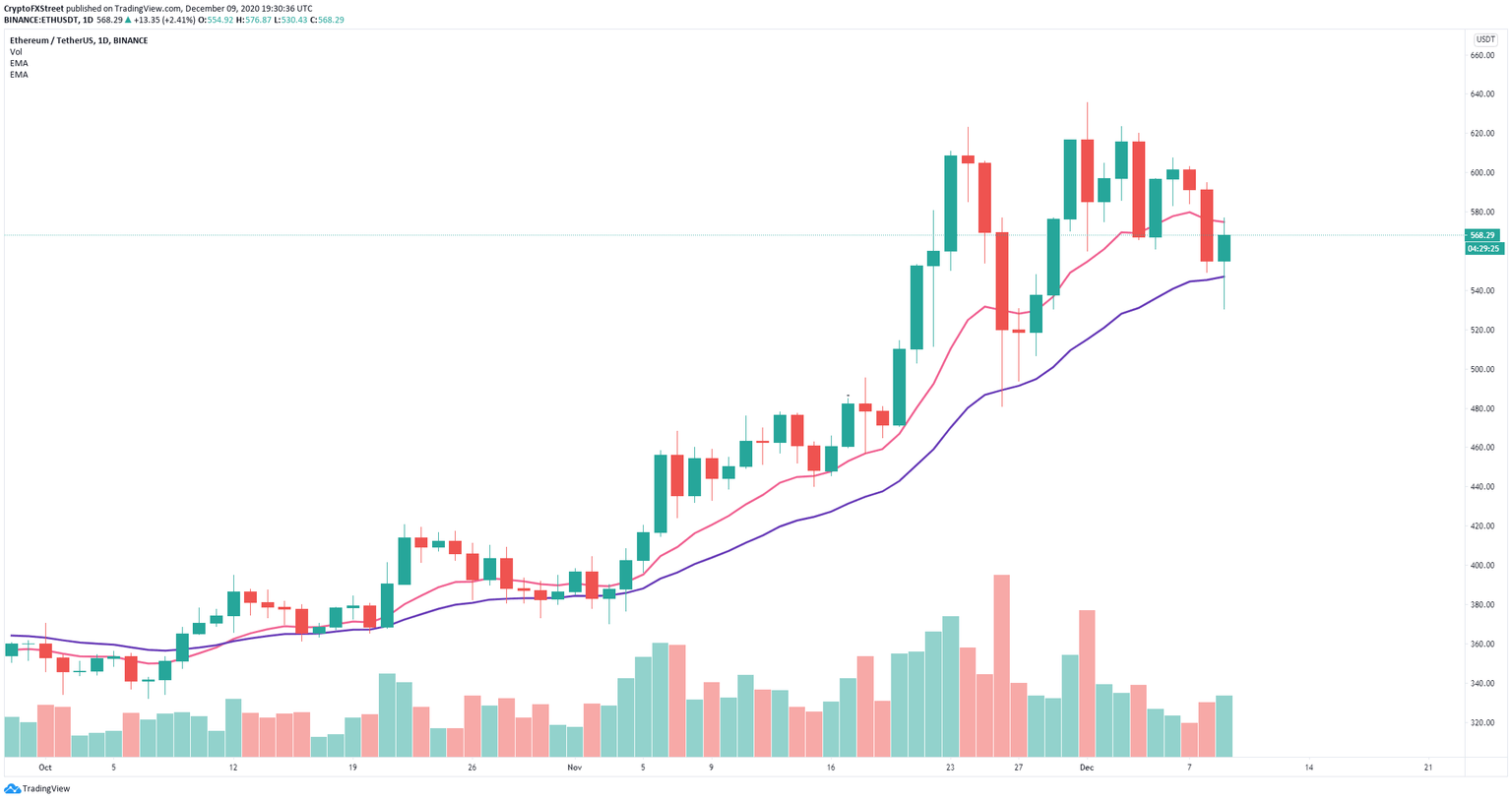

ETH/USD daily chart

On the daily chart, Ethereum price slipped below the 12-EMA but managed to defend the 26-EMA like it has been doing since October 15. One of the most bullish on-chain metrics in favor of Ethereum is the significant increase in the number of coins deposited into the ETH2 contract.

After a slow start in November, deposits quickly took off on November 20 jumping from 116,448 to 730,176 only five days later. The total number is currently at 1,229,000 which represents over $660,000,000.

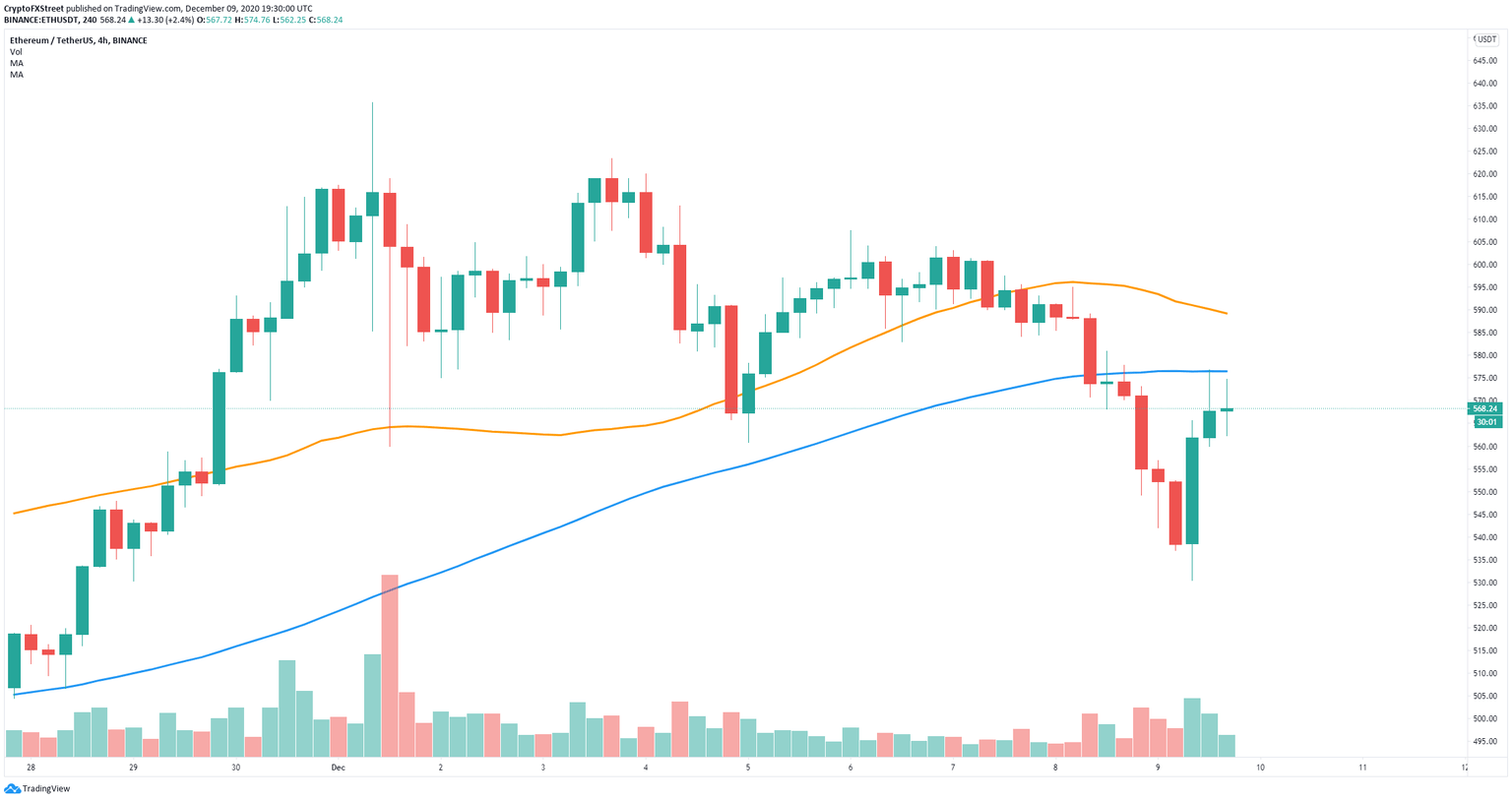

ETH/USD 4-hour chart

It seems that bulls were able to strongly defend the support level at $530 and Ethereum price is rebounding forming a potential V-recovery. A breakout above the 100-SMA resistance level at $575 can quickly push ETH towards the 50-SMA at $590.

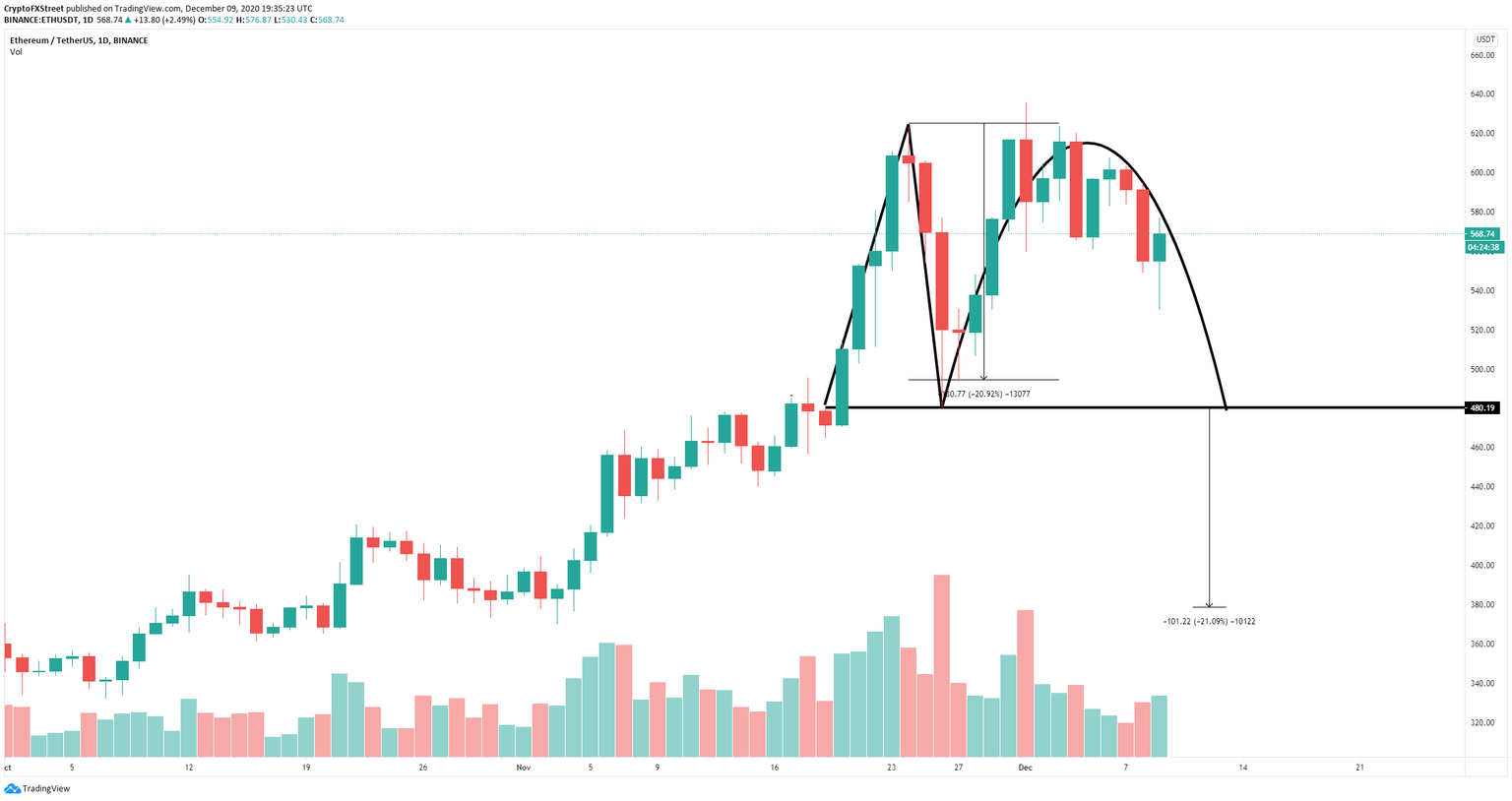

ETH/USD daily chart

However, it seems that Ethereum might be forming what’s known as an Adam and Eve pattern on the daily chart with the support level established at $480. A breakdown below this level would quickly drive Ethereum price towards $380.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.