Ethereum 2.0 deposit contract breaches $1 billion staked while ETH price aims for $1,200

- Ethereum price jumped to $665 as the crypto market turns bullish.

- The Eth2 deposit contract has over 1.528 million ETH inside, worth $1,016,450,390 at current prices.

The interest in Ethereum staking continues growing as more than 1.52 million ETH have been locked inside the Eth2 deposit contract in just one month. At current prices, this represents over $1 billion.

Ethereum price reacts positively and aims for $1,000

Although most of the recent price action is due to Bitcoin reaching new all-time highs above $23,000, the amount of Ethereum deposited inside the Eth2 deposit contract remains a notably bullish factor.

Although users can directly deposit their Ethereum coins inside the contract themselves, many popular exchanges have already announced their support for ETH staking. Coinbase, for instance, plans to roll out Eth2 staking in early 2021.

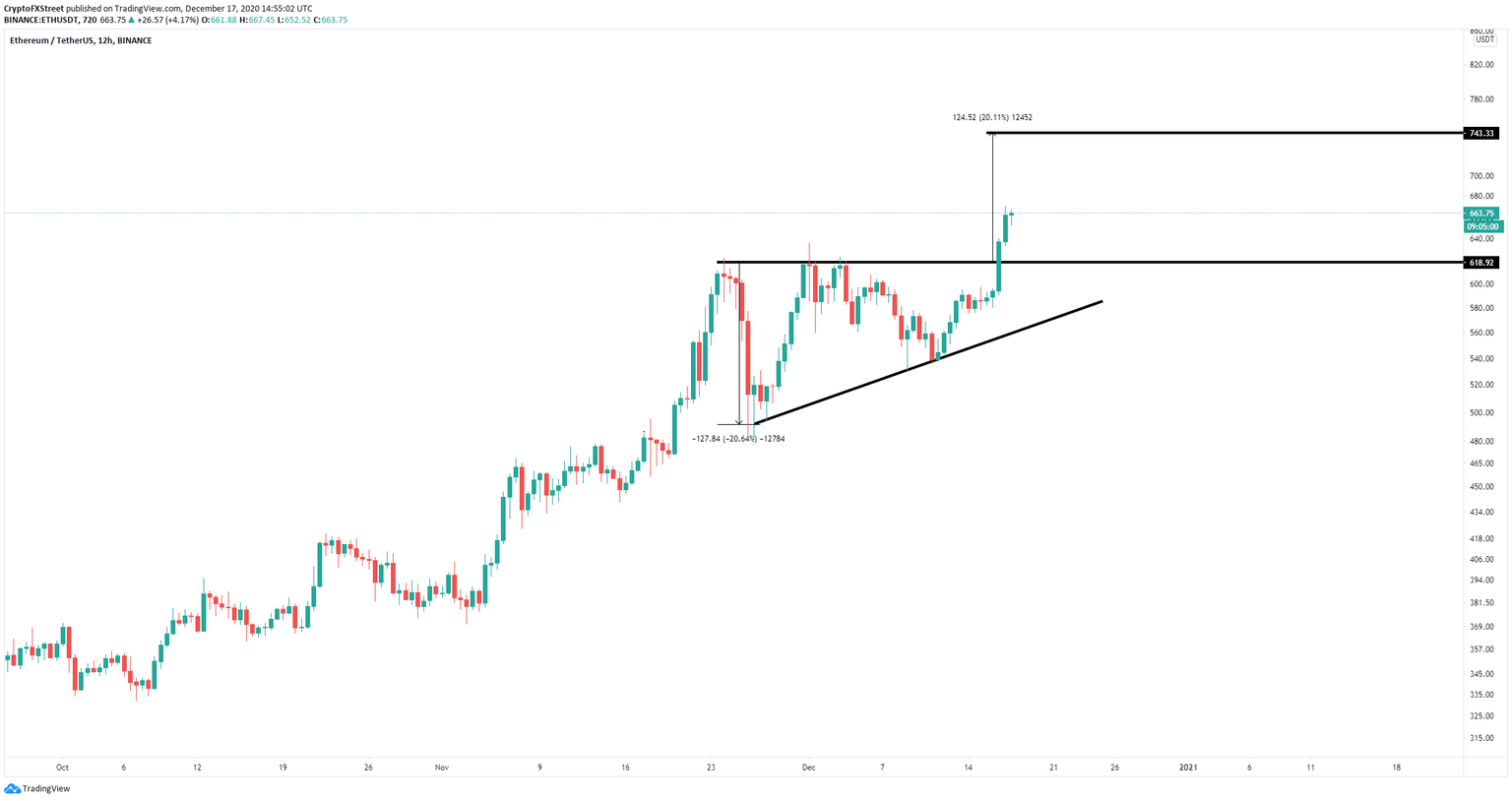

ETH/USD 12-hour chart

On December 16, Ethereum price broke out of an ascending triangle pattern on the 12-hour chart with an initial price target of $740. However, as we have stated in our last analysis article, a move above $780 would open the doors for $1,000.

Additionally, CME Group has recently announced a new product for Ethereum futures set to launch in February 2021. Furthermore, the number of addresses with a balance exceeds 50 million for the first time ever, indicating that there is a lot of interest in the digital asset.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.