ETH ecosystem users 9X since 2020 as VanEck tips $22K by 2030

There are almost nine times as many daily active users in the Ethereum ecosystem as there were just four years ago — and analysts say the increasing demand is set to propel Ether (ETH $3,852) to new heights.

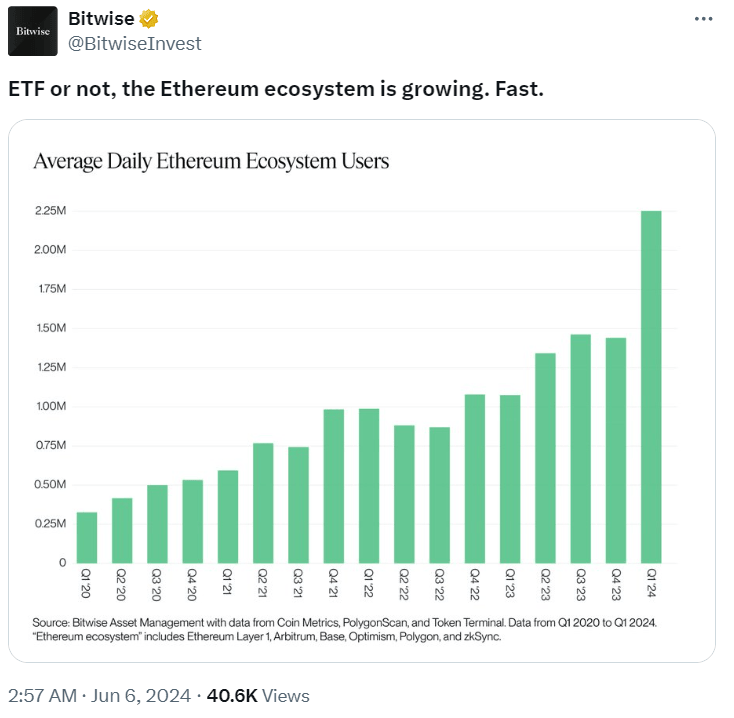

According to data compiled from crypto ETF issuer Bitwise, there was an average of more than 250,000 daily active users of Ethereum and its scaling solutions Arbitrum and Polygon in Q1 2020, with the lion’s share coming from the Ethereum layer-1 mainnet.

As of the first quarter of 2024, this daily user number — which now also includes the since-launched layer-2 networks Optimism, Base and zkSync — hit around 2.25 million, nearly nine times greater.

Source: Bitwise

As a result of pushing transactions to L2s, Ethereum now makes up a far smaller portion of active daily users.

On June 4, Ethereum mainnet had 378,000 active users, Polygon had 1.3 million while the other four L2s posted around 1.5 million active users in total.

Optimism was launched in late 2021, while zkSync mainnet and Base launched for public access in 2023.

The user numbers for Ethereum don’t look too great, but they are part of the roadmap, with Ethereum co-founder Vitalik Buterin focused on using L2s as a means of scaling the main blockchain.

He recently argued that L2s are similar to the sharding concept of the old Eth 2 plan, and that the layer may also help foster growth in various “subcultures” within the Ethereum ecosystem.

VanEck tips growth in the Ethereum network

Meanwhile, crypto ETF issuer VanEck has raised its price target for Ethereum — expecting the cryptocurrency to hit $22,000 by 2030.

In a June 5 blog published by VanEck’s head of digital assets research, Matthew Sigel and two colleagues, the analysts raised their 2030 expectations for Ether — up from just $11,800 last year — noting its revenue per user exceeds most Web2 businesses and is set to grow in popularity among traditional financial market participants as well as with Big Tech.

“We anticipate that spot ether ETFs are nearing approval to trade on U.S. stock exchanges. This development would allow financial advisors and institutional investors to hold this unique asset [...] and benefit from the pricing and liquidity advantages characteristic of ETFs,” said the analysts.

“We project ETH’s 2030 valuation based upon a forecast of $66B in free cashflows generated by Ethereum and accruing to the ETH token,” the analysts added.

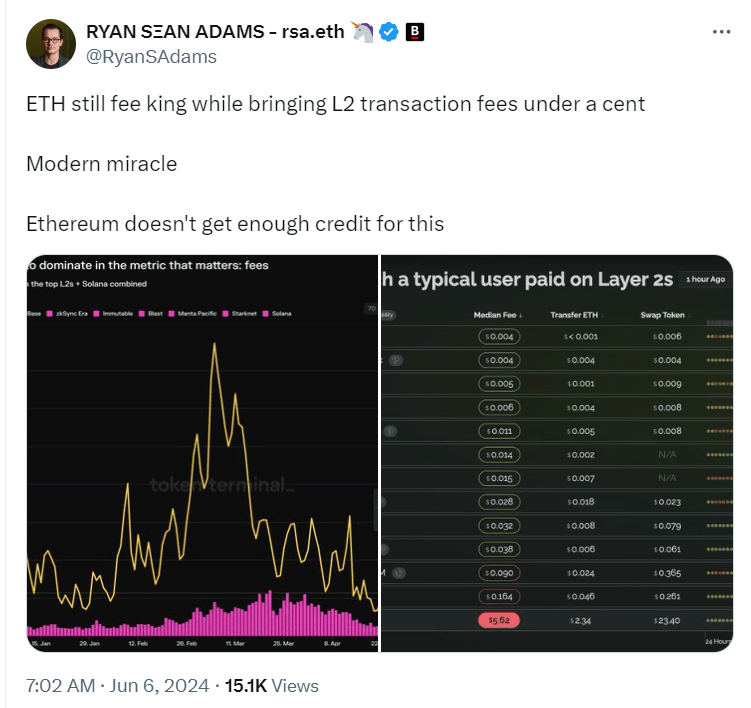

Bankless co-founder Ryan Sean Adams noted that despite lower user numbers, the Ethereum blockchain still generates three times more in fees than the top layer 2 networks and Solana combined, referring to it as a “modern miracle.”

The L2s pay Ethereum fees to settle transactions on the main chain and benefit from its security.

Source: Ryan Sean Adams

According to CoinGecko, Ether is currently priced at $3,862, rising 1.3% over the last 24 hours.

Many expect the launch of spot Ether ETFs to eventually push the price of Ether to a new all-time high, though some warn that inflows into the new crypto ETFs will be significantly lower than the Bitcoin ETFs.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.