EOS Price Analysis: Block.One to launch a suite of services, EOS unaffected

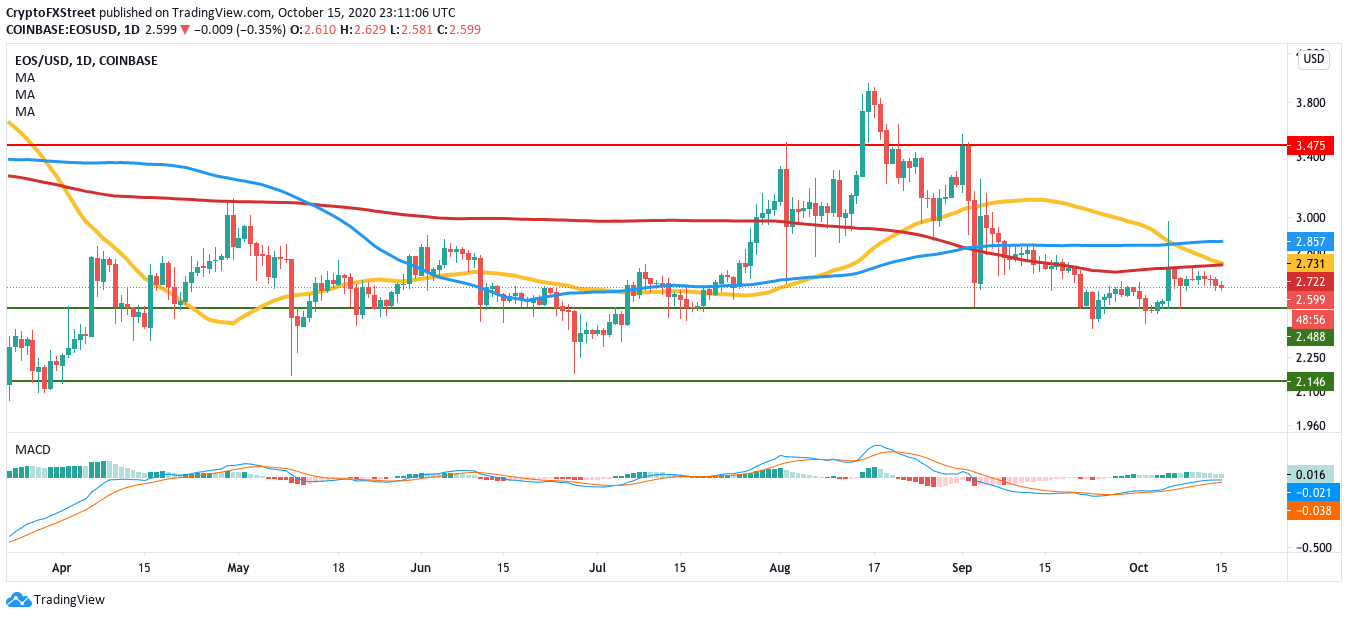

- EOS has charted the death cross pattern in its daily chart.

- The Ethereum killer has faced repeated rejections at the 200-day SMA.

Block.One, the company behind EOSIO, are launching a suite of services, namely:

- EOSIO Premier Technical Support: Provides several support tiers for troubleshooting issues and delivering technical assistance.

- EOSIO Blockchain-as-a-Service (BaaS): An automated blockchain platform fully managed by a dedicated BaaS team. Clients can choose a BaaS model that best suits the needs of their business.

- EOSIO Consulting: Get direct access to EOSIO engineers. Discover, identify, and implement solutions that best suit your business needs.

The main idea here is to make EOSIO more accessible and adaptable for enterprises. Along with that, they will also be launching EOSIO Training and Certification, a virtual campus of learning, to help enterprises remain at the forefront of their industry.

The technical outlook

On October 4, EOS bounced up from the $2.48 support line and reached $2.70, where it faced rejection from the 200-day SMA and dipped slightly to $2.60. The 200-day SMA has crossed over the 50-day SMA to chart the death cross pattern, a heavily bearish sign. To add further credence to our bearish outlook, the MACD also shows decreasing bullish momentum.

EOS/USD daily chart

Repeated rejections will drop the price down to the $2.48 support level. A further break below this zone will drop the “Ethereum killer” to the $2.15 support line. The EOS RAM chart also shows decreasing demand, which adds more meat to our bearish outlook. RAM is critical in EOS since it is used for dApp creation. Plus, a new EOS account also requires 4kb RAM.

EOS RAM

In June 2019, RAM spiked to nearly 0.20 EOS/KB after Block.One bought US$25 million worth of RAM for the launch of Voice, their social media network. Since July 2019, RAM costs have continued to drop below 0.1 EOS/KB.

The Flipside: Can the bulls take over?

For the bulls to take over, they will need to push EOS above $2.72 to cross above the 50-day and 200-day SMAs. However, even if they manage to do so, the upside is further limited by the 100-day SMA ($2.85). If the buyers somehow manage to break above the 100-day SMA, they should push the price to the $3.50 resistance line.

Key price levels to watch

Repeated rejections at the 200-day SMA will drop EOS to the $2.48 support wall. A break below this level will drop EOS to $2.15.

The bulls can take back control by pushing the price above the 200-day and 50-day SMAs to $2.75. The upside is limited by the 100-day SMA ($2.85).

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.