Enjin Coin Price Prediction: ENJ remains range-bound despite recent sell-off

- Enjin Coin price crashed 13% over the past 12 hours but found support around $2.37.

- On-chain metrics reveal opposing views for ENJ, hinting at a continuation of consolidation.

- The bullish thesis will face invalidation upon the breakdown of the demand barrier at $2.19.

Enjin Coin price experienced a brief dip earlier today as it came close to breaching its consolidation.

Enjin Coin price continues sideways

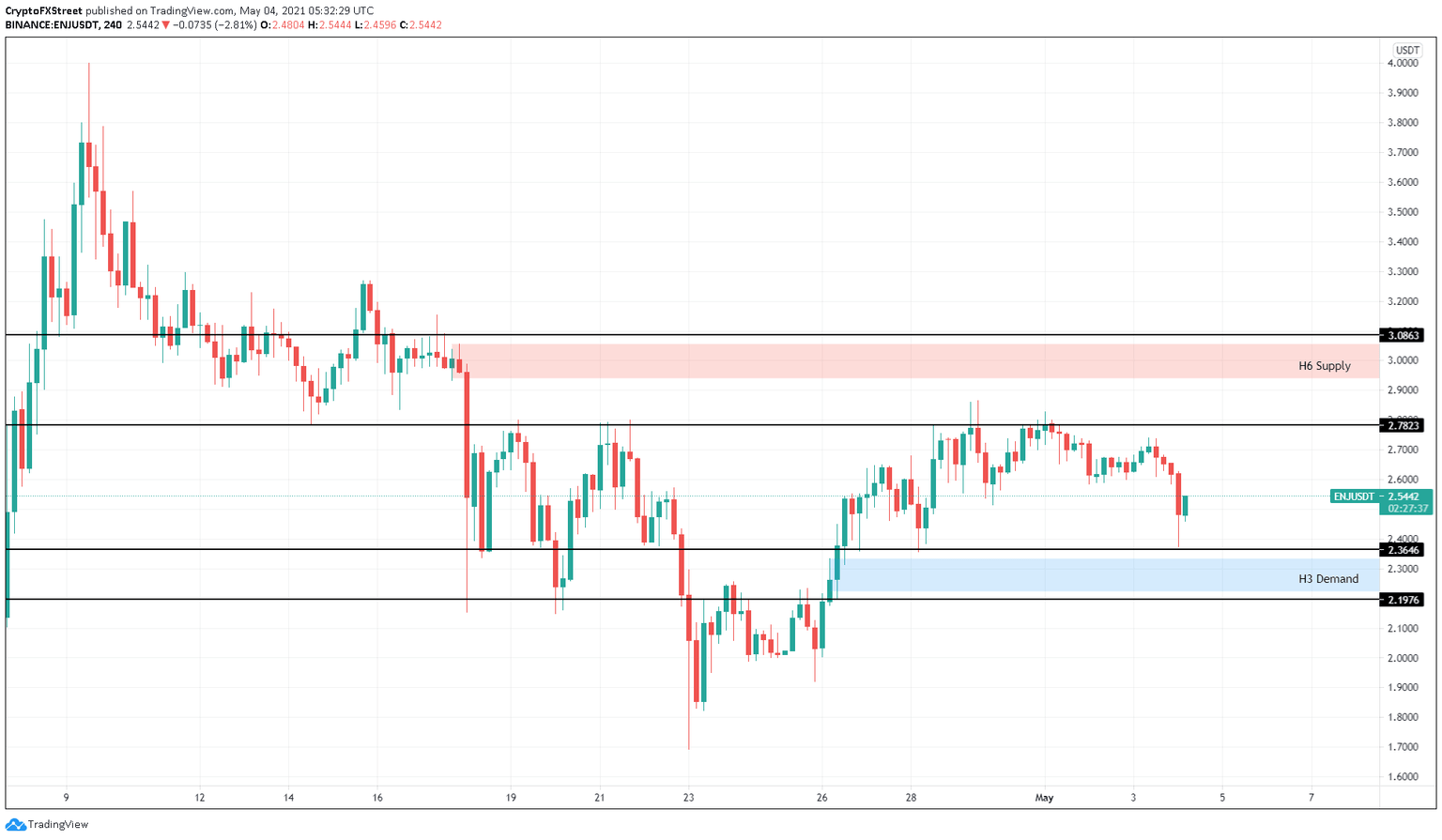

The 4-hour chart shows Enjin Coin price is stuck in a tight range that extends from $2.36 to $2.78. After tagging the lower trend line, ENJ buyers have stepped in and have pushed its market value up by 7%.

While this move is bullish in the short term, it is uncertain if it will be enough to slice through the upper boundary. Failing to shatter the resistance level at $2.78 will result in a repetition of its descent toward the support at $2.36.

For this reason, buyers need to overwhelm the sellers and produce a decisive 4-hour candlestick close above $2.75 to establish the start of a new uptrend. Breaching it will allow Enjin Coin price to surge 5% before approaching a supply zone that extends from $2.94 to $3.08.

ENJ/USDT 4-hour chart

According to IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, the resistance levels are stacked and could prevent swift upward moves for Enjin Coin price.

The immediate supply level at $2.57 harbors nearly 7,000 addresses that purchased 32.39 million ENJ and are “Out of the Money.” Similarly, such underwater market participants stretch until $2.88, which overlaps with the supply zone outlined from a technical perspective.

ENJ IOMAP chart

While an upside move for this altcoin will face headwinds, the stacked support barriers present below the current price indicate that a sell-off will not be easy since 3,200 addresses that purchased 42.85 million ENJ at an average price of $2.49 will act as a cushion and dampen the selling pressure. Therefore, this combination of stable demand and supply barriers encapsulating Enjin Coin might promote sideways movement.

Hovering in the buy zone with little to no buyers

Santiment’s 30-day Market Value to Realized Value ratio (MVRV) model, which tracks the profit/loss of all Enjin Coin’s network participants over the past months, shows that it is in the opportunity zone at -13.9%.

A sudden drop in MVRV indicates that short-term traders are booking profit, creating an opportunity for long-term holders to accumulate.

The last time, MVRV dipped below -11%, Enjin Coin price surged nearly 67% in the next three weeks. Hence, this index suggests that ENJ is undervalued at the current levels and might see a surge in its market value shortly.

ENJ 30-day MVRV chart

Even though Enjin Coin's MVRV model suggests the current price levels present an excellent buy opportunity, market participants seem disinterested in acquiring ENJ based on the 73% decline in new addresses joining the Enjin Coin network.

This reduction from 4,400 to 900 addresses being created per day indicates that investors are not interested in Enjin Coin at the current price, or they might be reallocating their funds.

Either way, from a network perspective, Enjin Coin price paints a pessimistic picture.

ENJ new addresses chart

While the short-term outlook shows buyers propping up ENJ price, the long-term scenario is much more ambiguous, as presented by the technical and on-chain indicators.

Hence, investors need to wait for a clear trend to establish. A sudden burst in buying pressure that slices through the resistance level at $3.08 will signal the start of a new uptrend and could see ENJ rise 6% to tag $3.27. However, if Enjin Coin price breaks through the support barrier at $2.19 in a convincing fashion, an 8% downswing to $2.01 seems likely.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.