Elrond Price Prediction: EGLD wants to head higher, but bulls lack conviction

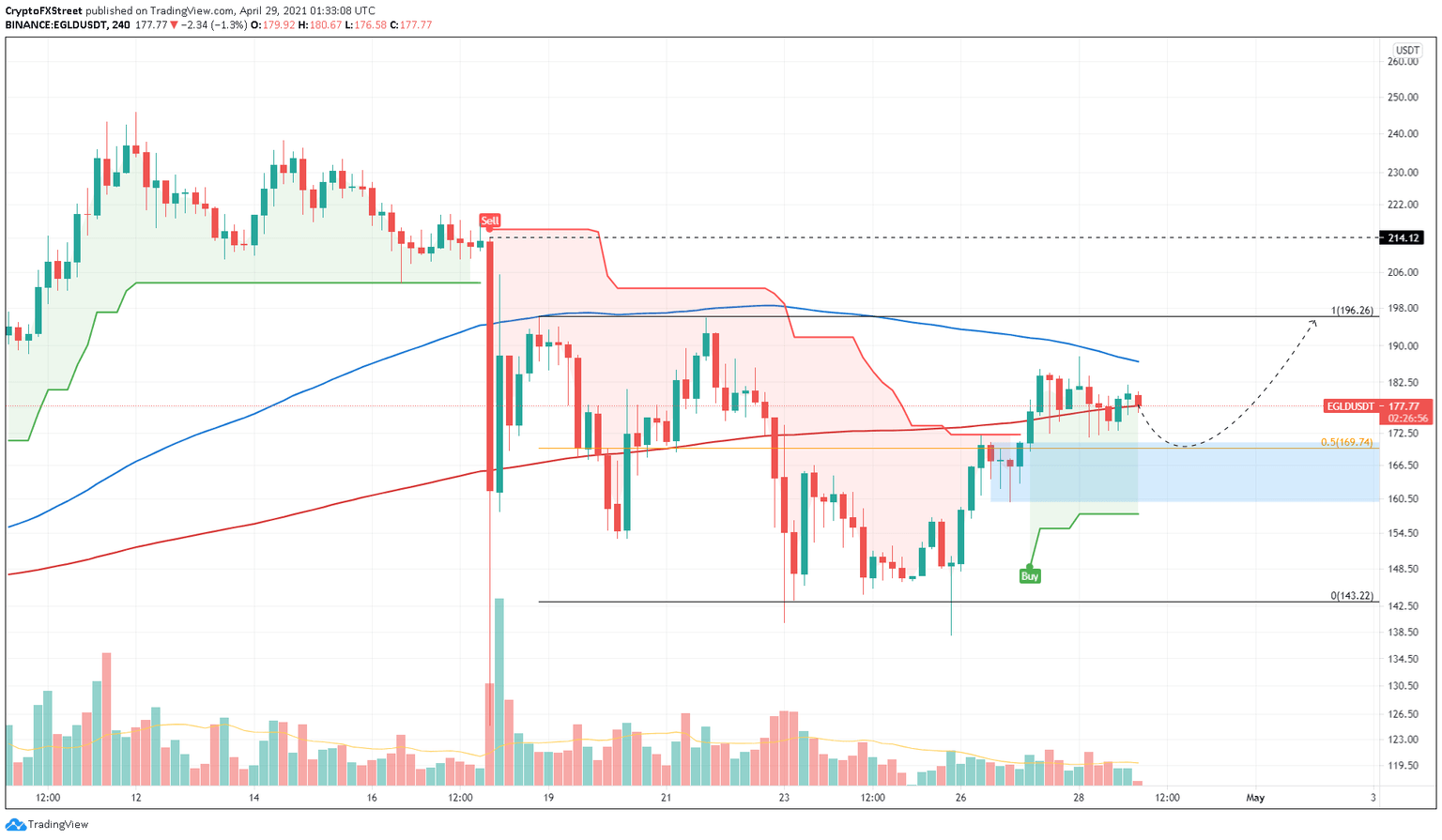

- Elrond price shows consolidation between the 100 and 200 SMA on the 4-hour chart.

- EGLD might retest the upper boundary of a demand barrier ranging from $160 to $170.

- Such a move might allow the bulls to propel the altcoin by 15% to $196.26.

Elrond price shows a lack of momentum that has caused it to move sideways. A minor retracement is plausible before EGLD breaks the market structure and turns bullish.

Elrond price eyes higher high

On the 4-hour chart, Elrond price seems to have climbed above the 200 Simple Moving Average (SMA) at $177.75, but the lack of buying pressure has prevented it from flying higher. If the sellers topple the bulls, a retest of the demand zone that extends from $160 to $170 seems likely.

Investors can expect a resurgence of buyers here, preventing Elrond price from forming a lower low and kick-starting a 15% upswing to $196.26. A confirmation of this bullish spike will arrive after EGLD produces a decisive close above the 100 SMA at $186.50.

Adding a tailwind to this scenario is the SuperTrend indicator’s buy signal flashed on April 27.

EGLD/USDT 4-hour chart

On the flip side, a successful breach of the support barrier’s lower trend line at $160 will signal increasing sell-side pressure. If the Elrond price closes below $157 on the 4-hour chart, it will create a lower low, signaling the start of a new downtrend.

In such a case, EGLD could slide 6% to $150.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.