Elrond Price Prediction: EGLD locks in on 30% gains

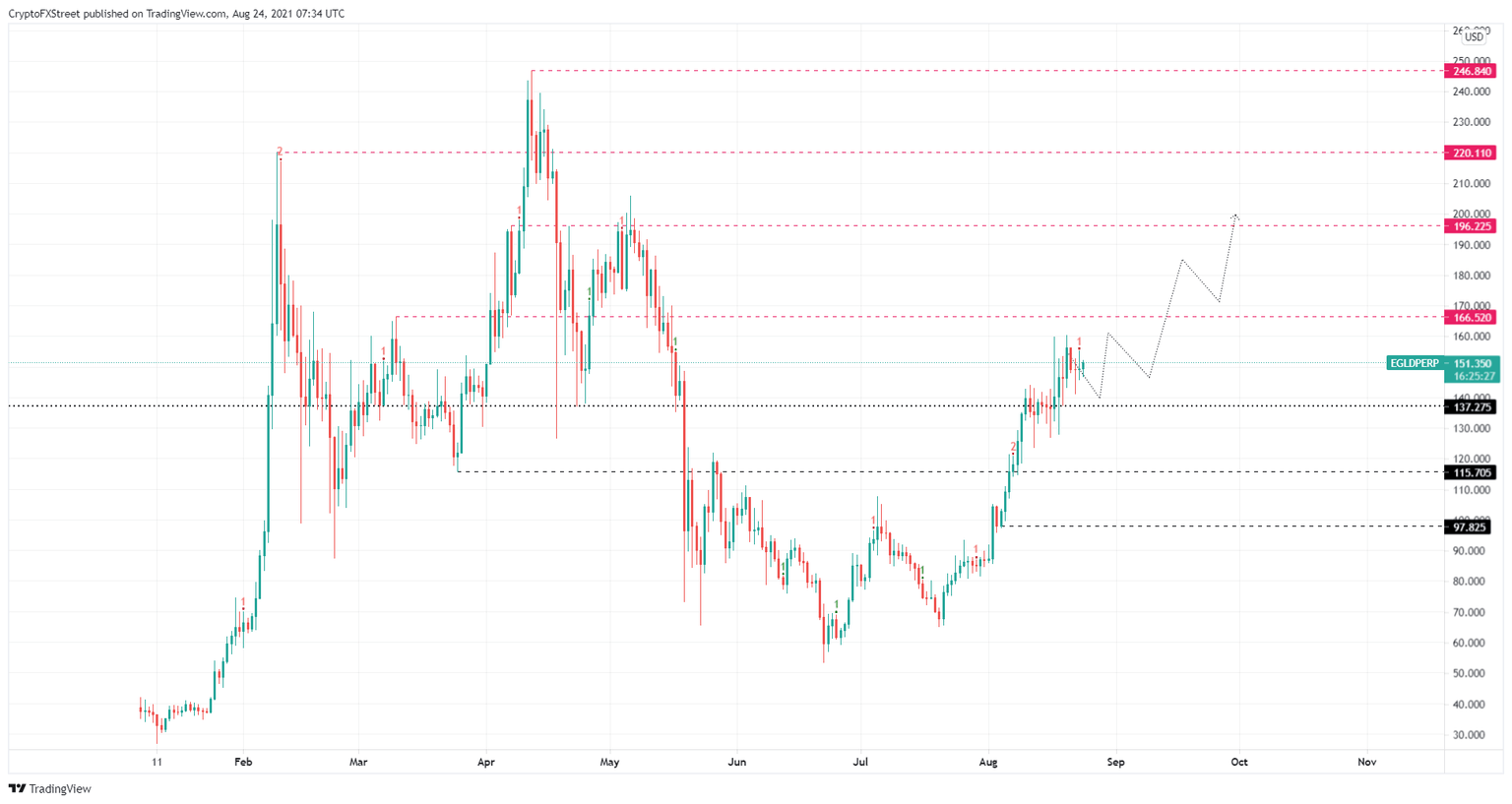

- Elrond price is stuck in limbo between the $166.52 and $137.28 barriers.

- A decisive close above $166.52 will confirm the start of an uptrend.

- If EGLD breaks below the $123.65 support level, it will invalidate the bullish thesis.

Elrond price is currently bouncing off a critical demand barrier, hoping for an uptrend. However, there might be a retest of the said support floor before an uptrend originates.

Elrond price consolidates before a breakout

Elrond price has been on a slow uptrend over the past two weeks. This steady move has kept EGLD close to the demand barrier at $137.28. Considering the short-term bearish outlook on the big crypto, investors can expect Elrond price to retrace once more to the foothold at $137.28 as it heads higher.

The uptrend will face serious hindrance around $166.52, but a decisive 12-hour candlestick close above this point will confirm an uptrend’s start. This move will also put a $196.23 ceiling at a reaching distance for the bulls.

Assuming the bullish momentum continues, Elrond price will likely continue to rally toward $196.23, roughly a 30% advance from its current position – $151.35. In a highly bullish case, the buyers might stay put until $220.11 before booking profits.

EGLD/USDT 12-hour chart

While things seem to be heading in favor of the bulls, a breakdown of the $137.23 support level will invalidate the bull thesis and indicate weakness among buyers, opening the path for further downswings.

However, if Elrond price sets up a lower low below $123.65, it will invalidate the bullish thesis and shift the trend to favor the bears.

Such a move might trigger a sell-off to $115.71 or $97.83 in a highly bearish case.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.