Elliott wave view: Bitcoin within wave (5) of a parabolic move [Video]

![Elliott wave view: Bitcoin within wave (5) of a parabolic move [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Digital Currencies/Bitcoin/Bitcoin_2_XtraLarge.jpg)

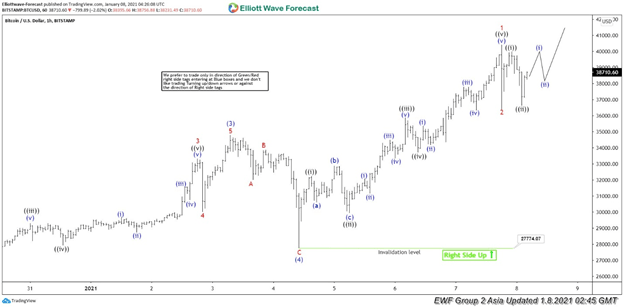

Bitcoin (BTCUSD) has rallied parabolically since forming the low in March of last year. The rally from 8 September low is unfolding as a 5 waves impulsive Elliott Wave structure. In the 1 hour chart below, we can see wave (3) of this impulsive rally ended at 34800, while pullback in wave (4) ended at 27704. The crypto currency has since resumed higher within the last wave (5).

Internal of wave (5) is unfolding also as another 5 waves in lesser degree. Up from wave (4) low at 27774, wave ((i)) ended at $32246.97, and wave ((ii)) ended at 29936.26. The crypto currency resumed higher in wave ((iii)) towards 35879.35 and wave ((iv)) pullback ended at 33710.16. Final leg wave ((v)) ended at 40402.46. This ended wave 1 in higher degree. Pullback in wave 2 is also proposed complete at 36388. Expect Bitcoin to continue higher in wave 3 of (5). However, it still needs to break above wave 1 at 40402.46 to rule out a double correction in wave 2. As far as Jan 4 pivot low at 27774.07 remains intact, expect the crypto currency to extend higher.

Bitcoin (BTC/USD) 60 Minutes Elliott Wave Chart

Bitcoin (BTC/USD) Elliott Wave Video

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com