DYDX exchange releases governance token, making its airdrop worth up to $100K

The DYDX governance token becomes the latest airdrop to surpass $100,000 for the most active users, and the DEX's transaction volumes highlight the rising popularity of layer-2 platforms.

Airdrops have been a fan-favorite in the cryptocurrency ecosystem for years because they offer projects a way to reward early adopters and increase token distribution.

The latest project to surprise its community of supporters with retroactive rewards for its newly minted token is dYdX, a non-custodial decentralized derivatives exchange that operates on a layer-2 version of the Ethereum (ETH) network.

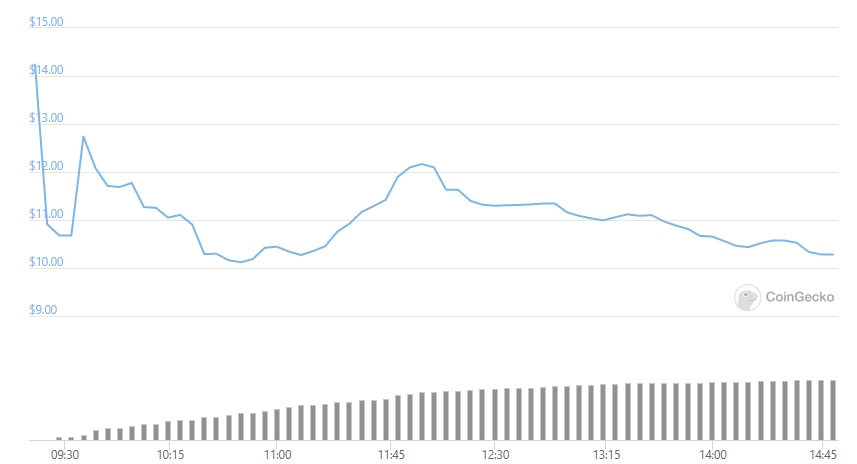

Data from CoinGecko shows that on its first day of trading live in the markets, DYDX is trading at a price of $10.28 at the time of writing after hitting an intra-day high at $14.24.

DYDX/USD 5-min chart. Source: CoinGecko

The number of tokens received by each user was determined by their previous trading actively on the platform, with the lowest tier user receiving 310 tokens for trading at least $1 on the exchange, and the highest tier user earning 9,529 tokens for trading volumes exceeding $1 million.

Airdrop token distribution. Source: dYdX Foundation

At the daily high of $14.24, the airdrop was worth between $4,414 and $135,692 with the average user who traded between $1,000 and $10,000 in value on the platform receiving 1,163 DYDX worth $16,561.

The ongoing shift to layer-two solutions

The retroactive 'release' of the DYDX governance token marks a big step for the protocol as it embarks on its path to becoming a fully decentralized, community-governed platform. It is and another sign of a larger shift by a growing number of projects shifting to layer-two solutions in order to operate in a lower fee environment.

Many blockchain projects are migrating to various cross-chain and layer-two solutions like Polygon and dYdX was actually one of the first decentralized exchanges to announce that it would launch on StarkWare, a layer-two solution it developed in conjunction with StarkEx.

According to data from dYdX, at the close of the first mining epoch, there were 32,700 DYDX holders and the platform had transacted $13.8 billion in monthly trading volume and $141 million in market-maker capital has been staked.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.