Dogecoin recovers as House of Doge targets public listing via Brag House merger

- House of Doge announces plans to go public through a merger with Brag House Inc.

- Following the merger, Brag House is expected to issue approximately 594 million shares of its common stock.

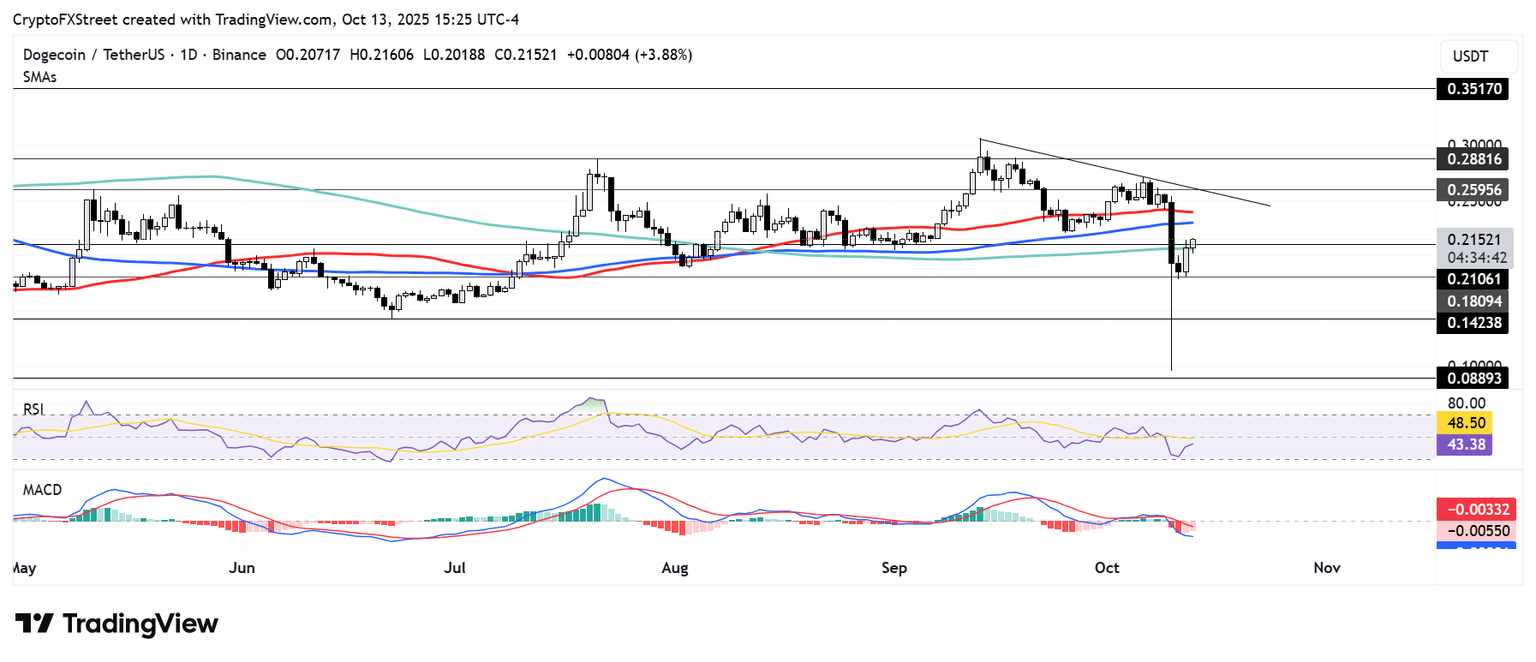

- DOGE has recovered the $0.210 support but faces resistance near the 50 and 100-day SMAs.

Dogecoin (DOGE) is up 3% on Monday as House of Doge revealed it plans to go public on the Nasdaq through a merger with Brag House Holdings (TBH).

House of Doge set to go public through merger with Brag House

House of Doge, the corporate arm of the Dogecoin Foundation, has entered into a definitive merger agreement with Nasdaq-listed Brag House Holdings, a Gen Z-focused gaming and digital media platform, according to a statement on Monday.

The deal, unanimously approved by the boards of both companies, aims to advance mainstream Dogecoin adoption and strengthen its institutional use cases.

"What started as a community-led ambition has matured into an infrastructure engine for Dogecoin," said Marco Margiotta, House of Doge's CEO. "By going public through this merger, we're opening access and unleashing the next wave of innovation, institutional participation, and mainstream utility for Dogecoin."

The merger, expected to close in early 2026, remains subject to standard conditions and approval from Brag House shareholders. Upon completion, Brag House will issue about 594 million new shares, mostly allocated to existing House of Doge shareholders, while current Brag House investors will retain the remaining equity. Brag House also holds a stake in Dogecoin treasury CleanCore Solutions (ZONE).

"Brag House is now well-positioned as the public company vehicle for the next generation of global finance, a widely accepted, culturally integrated, and institutionally supported currency," said Lavell Juan Malloy II, CEO and co-founder of Brag House.

Earlier in the year, House of Doge partnered with 21Shares and the Dogecoin Foundation to launch Europe's first Dogecoin exchange-traded product (ETP). The Dogecoin ETP currently holds about $26 million in assets and roughly 107 million DOGE, the firm stated.

Several issuers in the US have also filed for a spot Dogecoin ETF.

Brag House stock plunged nearly 50% on Monday following the merger announcement.

Dogecoin Price Prediction: DOGE targets trendline resistance after recovery above $0.210

After the crypto market flash crash on Friday, DOGE found support at $0.180 before staging a recovery above the $0.210 level, which is strengthened by the 200-day Simple Moving Average (SMA).

DOGE/USDT daily chart

A firm reclaim of $0.210 could see the top memecoin tackle the descending trendline resistance extending from September 13. On the upside, DOGE faces a potential hurdle at the 50-day and 100-day SMAs.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) histogram bars are trending upward but below their neutral levels, indicating a weakening bearish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi