Dogecoin price to dodge a sell-off and target $0.250

- Dogecoin price hits a new three-week high.

- Rally halted against two primary resistance levels.

- Some profit-taking after a big rally expected, downside risks limited.

Dogecoin price is coming off of some intense buying pressure that capped off prices levels not seen since January 17, 2022. As a result, a slight pause here should be expected as bulls and bears digest the recent rally.

Dogecoin to return to $0.250 after pullback to $0.155

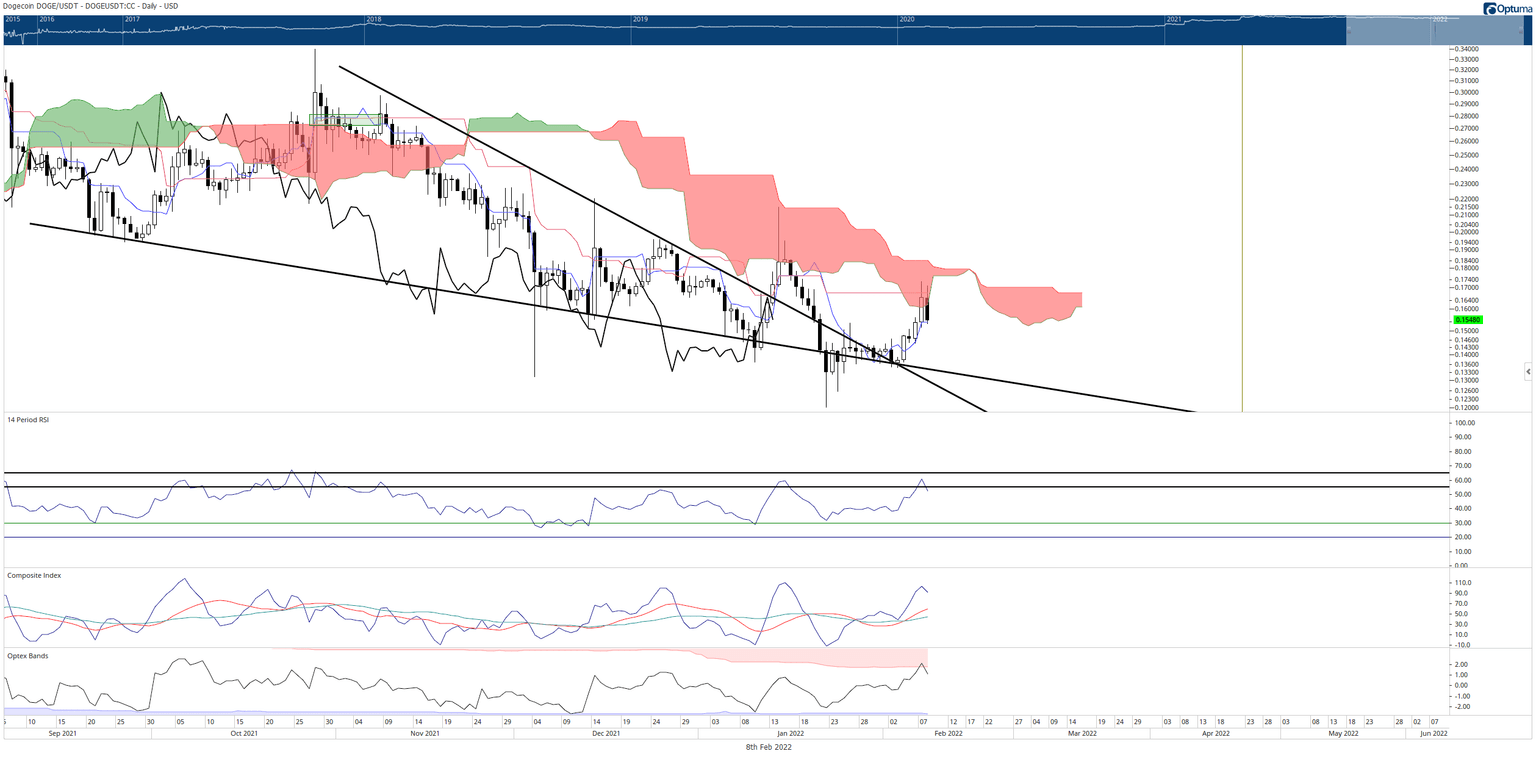

Dogecoin price hit its primary resistance level on the daily Ichimoku chart against the Kijun-Sen and bottom of the Ichimoku Cloud (Senkou Span A) at $0.170. A pullback to the $0.155 level at the daily Tenkan-Sen will be critical for the future upcoming trend.

If the Tenkan-Sen holds as support, then it is very likely that a new bullish expansion phase will begin for Dogecoin. Therefore, a future breakout on the daily chart should not be overly complicated. From today (February 8, 2022) until February 16, the Ichimoku Cloud gets thinner. Thin clouds represent weakness and are generally easy for prices to move through.

However, the top of the Cloud (Senkou Span B) at $0.180 will likely halt Dogecoin price again. Senkou Span B is the strongest support and resistance level within the Ichimoku system. Therefore, it is the most challenging place for price to close above or below.

If Dogecoin price can close above Senkou Span B at or above $0.180, then the daily Chikou span would also be above the bodies of the candlesticks and in open space. In other words, Dogecoin will fulfill all the requirements needed for an Ideal Bullish Ichimoku Breakout. In addition, it would be the first time that Ichimoku entry has occurred since October 18, 2021.

DOGE/USDT Daily Ichimoku Kinko Hyo Chart

A swift move to the $0.250 price level would be the next test for Dogecoin price bulls. The level at $0.250 is where the weekly Kijun-Sen exists.

Downside risks should be limited to the Tenkan-Sen at $0.155. Below that, bulls will need to be cautious. A daily close at or below $0.130 would initiate an Ideal Bearish Ichimoku Breakout and could see Dogecoin price enter into capitulation territory with a move down to the $0.080 - $0.090 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.