Dogecoin Price Prediction: DOGE set for 25% gains

- Dogecoin price sees rejection on the 55-day SMA at $0.16.

- DOGE bulls will see a short fade but will break through the 55-day SMA later this week.

- A break above $0.16 will open more room with 25% gains before the next resistance hits.

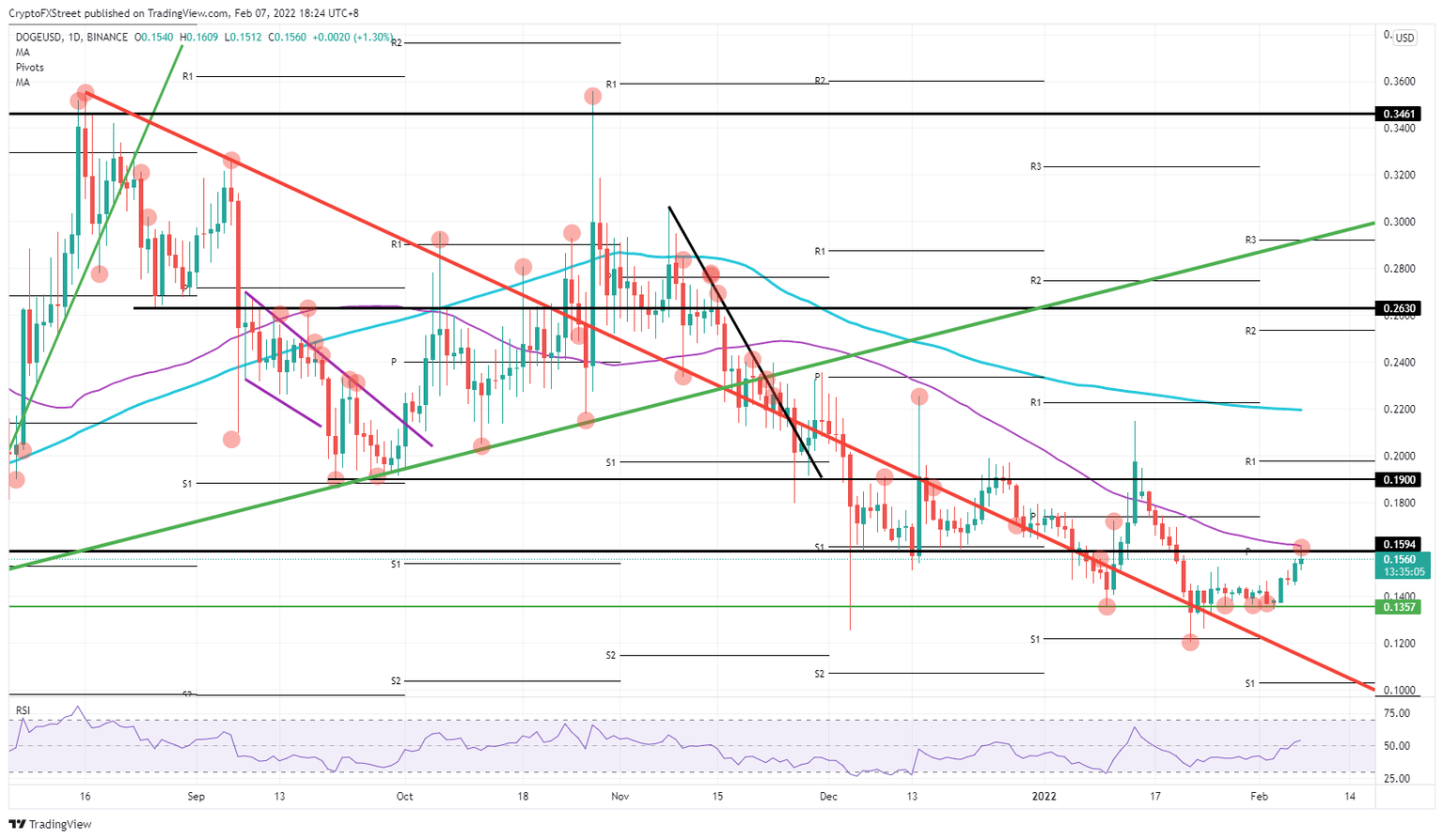

Dogecoin (DOGE) price is continuing its winning streak as bulls come storming out of the gate at the start of a new trading week. At the opening, bulls hit a curb at the 55-day Simple Moving Average (SMA) around $0.16. As the price fades slightly, the Relative Strength Index shows further weakness is unlikely and bulls will see a retest and break higher later today – or this week – opening the floor for more upside potential towards $0.19, and 25% gains.

DOGE price rewards faithful bulls with 25% gains

Dogecoin price saw strong demand at the market open in Asia on Monday, with a break above $0.1594 then hitting $0.16 at the 55-day SMA. After hitting this double resistance, DOGE price action saw a short fade as some bulls that entered at $0.14 booked some profits. This makes perfect sense from a trade management point of view and will see bulls still holding either half or more of their positioning in Dogecoin.

DOGE price will see more interest in the US opening as investors take note of the bullish uptick and breach above $0.1594. Expect this to attract more bulls and investors, seeing this as evidence of upside potential. With no actual resistances in the way, $0.19, which is a historical cap, will be the first level where bulls will start to book some partial profits again, resulting in 25% gains.

DOGE/USD daily chart

The Risk index, called the VIX, is seeing an uptick this morning as most US indices futures are in the red at the time of writing. Should this accelerate into a sell-off, expect investors to book bigger chunks of profit or close their positions in total. This would see a fall-back of DOGE price action towards $0.14 with multiple tests and a possible break. More downside could see a dip towards the red descending trend line around $0.10.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.