Dogecoin price reaches key support, suggesting a 40% rebound for DOGE

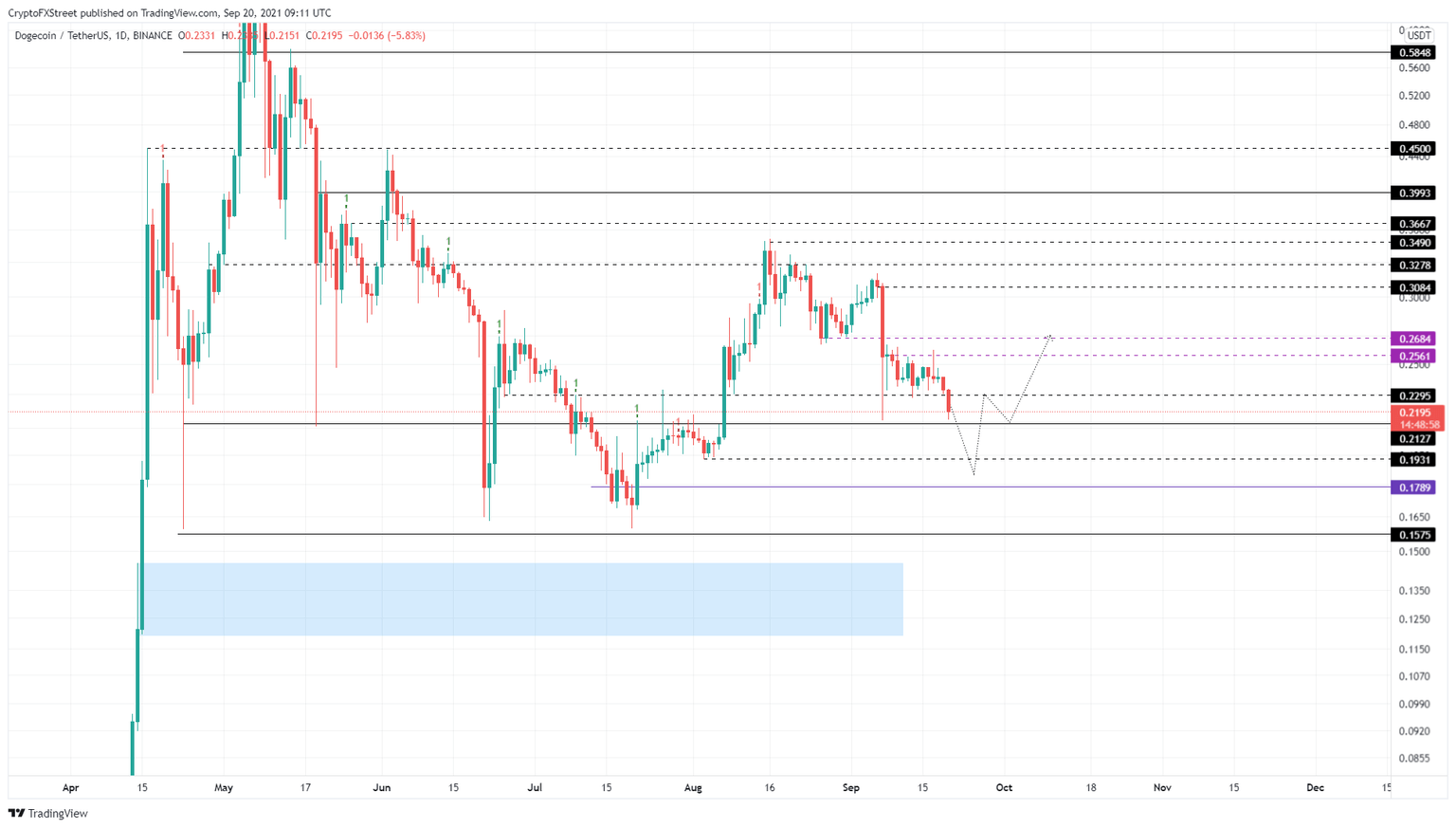

- Dogecoin price is currently hovering above the $0.213 support barrier.

- A retest of $0.193 is plausible before DOGE sparks an ascent to $0.268.

- A decisive close below $0.179 will invalidate the bullish thesis.

Dogecoin price has been lacking volatility for the past 11 days, but the recent sell-off seems to have reintroduced it, leading to a breakdown of the immediate support floor. While a bounce from the current position is likely, investors should be wary of another downswing.

Dogecoin price waits for buyers’ comeback

Dogecoin price has been on a downward sloping consolidation since September 8 but broke out to the downside as of September 20, slicing through the $0.230 support floor. Currently, DOGE is hovering above the $0.213 demand barrier and shows signs of recovery.

If BTC shows strength, DOGE may kick-start a new uptrend from this platform. In case of a no-go, market participants can expect the meme-themed cryptocurrency to slice through $0.213 and make its way toward $0.193. In some cases, the market makers might briefly dip below this floor to collect liquidity, signaling the possible start of a new uptrend.

The resulting uptrend is likely to smash through the incoming resistance barriers and make a run at the $0.268 ceiling. This climb would represent a 40% ascent.

DOGE/USDT 1-day chart

Regardless of the support floors, if Bitcoin price fails to muster the strength and face the bulls, Dogecoin price will continue to remain weak, especially if DOGE breaks below the $0.193 support platform. This move will indicate an increased selling activity among holders and panic.

Such a move might push Dogecoin price to retest the $0.179 barrier, a breakdown of which will invalidate the bullish thesis and potentially trigger further descent to $0.158.

Like this article? Help us with some feedback by answering this survey:

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.