Dogecoin Price Prediction: How to trade DOGE as crypto markets coil up after recent crash?

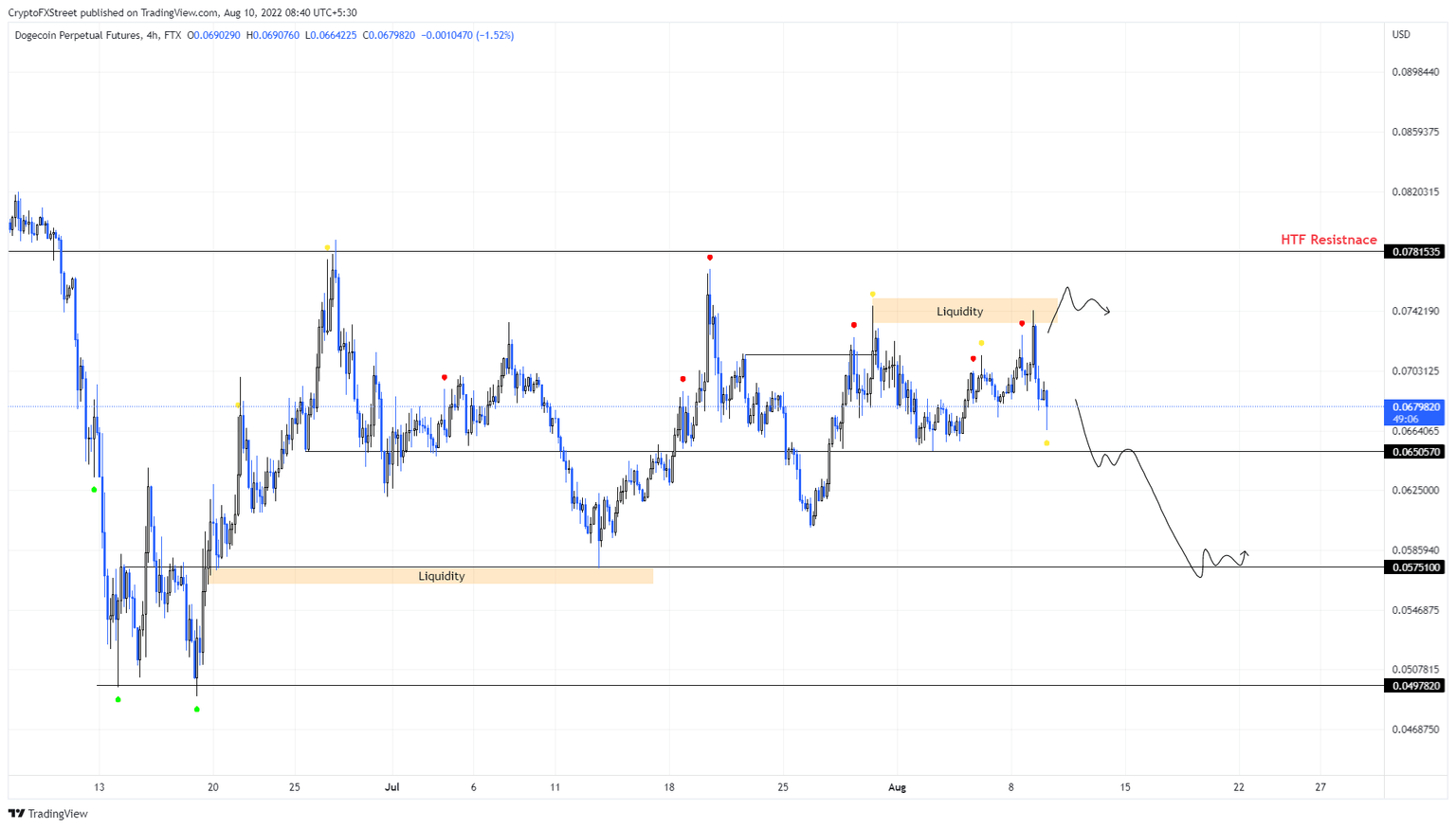

- Dogecoin price trades between the $0.078 resistance and $0.057 support levels.

- DOGE could either sweep the $0.074 level first before crashing to $0.057 or directly do it from its current position.

- A daily candlestick close above $0.078 will invalidate the bearish outlook for the meme coin.

Dogecoin price shows signs of consolidation as it produces a potential top formation. While the direction of DOGE is decided, there might be a minor detour before reaching its target.

Dogecoin price prepares for its next leg

Dogecoin price is trading around $0.067 after producing multiple higher lows. However, the $0.078 resistance level seems to be a hindrance preventing DOGE from going higher, as a result, the meme coin has produced lower highs since June 27.

Going forward, investors can expect one of two things to happen:

- Dogecoin price sweeps the buy-stop liquidity resting above $0.074 and reverses its trend to crash 21% to $0.057 to collect the sell-stop liquidity.

- DOGE heads lower to sweep the $0.057 level and ignores the liquidity present at the topside.

Therefore, investors can be prepared to short DOGE if one of these events is triggered. A four-hour candlestick close below the $0.065 support level will be the confirmation for the 2nd scenario.

Market participants should note that the position is likely to yield high returns and be more effective if the buy-stop liquidity is collected first. Moreover, investors need to pay close attention to Bitcoin price before taking a jab at Dogecoin price

DOGE/USDT 4-hour chart

On the other hand, if Dogecoin price produces a daily candlestick close above the $0.078 resistance level and flips it, the bearish thesis will face invalidation. In such a case, DOGE is likely to continue its ascent to $0.10.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.