Dogecoin Price Prediction: DOGE liftoff to $0.065 in the cards

- Dogecoin bulls set eyes on $0.065 after breaking above a crucial technical pattern.

- The IOMAP model reveals reducing resistance, thus, confirming the uptrend.

- Failing to hold above the 200 SMA may increase from selling orders.

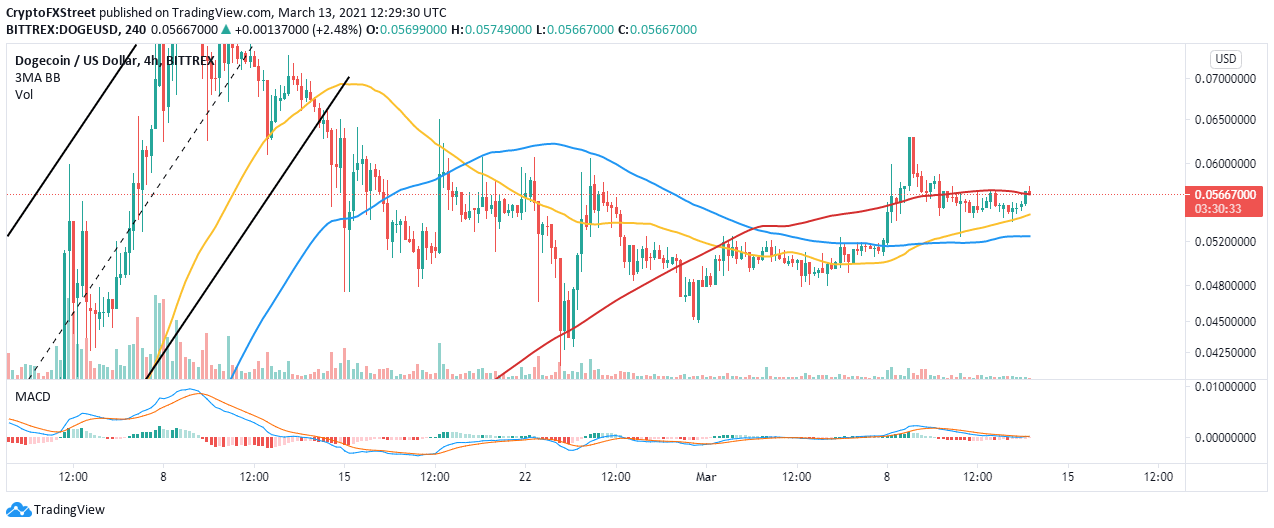

Dogecoin is doddering at $0.056 after bouncing off key short-term support. Price action above the 200 Simple Moving Average (SMA) on the 4-hour chart would pave the way for gains eying $0.065. Meanwhile, bulls are focused on nurturing the uptrend by aggressively defending support at the 200 SMA.

Dogecoin comes out of consolidation

The MemeCoin has been in consolidation for the past few days and after the rejection from $0.62. After finding support at the 50 SMA, bulls pushed the cryptoasset to higher levels while eyeing gains past $0.065. Dogecoin sliced through the 200 SMA but faced an intensifying hurdle at $0.058.

The Moving Average Convergence Divergence (MACD) confirmed the consolidation. Besides, it has a bullish impulse that is likely to result in the price rolling upwards. However, the MACD line (blue) must cross and sustain the position above the signal line.

DOGE/USD 4-hour chart

The IOMAP model by IntoTheBlock confirms the uptrend with robust support, running from $0.055 to $0.057. Here, nearly 112,600 addressed had previously bought roughly 11 billion DOGE.

Dogecoin IOMAP chart

The observed resistance is not immense on the upside, and Dogecoin could slice through as investors anticipate the roll up to $0.065. However, the model directs our attention to the region between $0.58 and $0.06. Here, around 56,000 addresses had previously purchased nearly 7.1 billion DOGE. Trading above this would pave the way for significant price action beyond $0.065.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637512365951462583.png&w=1536&q=95)