Dogecoin Price Forecast: Selling pressure drops 95% as DOGE traders target $0.50 breakout

- Dogecoin price reclaimed the $0.40 level on Monday after a 15% pullback from its three-year peak recorded on November 12.

- Dogecoin Age Consumed metric declines 95% from last week’s peak, signaling a decline in selling pressure among long-term holders.

- DOGE Volume Weighted Average Price (VWAP) has moved below the market price, displaying growing short-term demand.

The Dogecoin price breached the $0.40 resistance on Monday, rebounding from a 15% pullback. On-chain transaction flows observed this week suggest DOGE could be on the verge of another leg-up toward $0.50.

Dogecoin reclaims $0.40 as selling pressure drops 95%

On November 14, Dogecoin price rose to a three-year peak of $0.44 amid bullish tailwinds from Trump’s confirmation of Elon Musk’s involvement in the proposed Department of Government Efficiency (DOGE).

As markets peaked with 185% monthly gains on November 12, traders began locking in profits, which saw DOGE price succumb to a 15% correction before opening trading at $0.37 on Tuesday.

However, Dogecoin on-chain transaction flows observed this week suggests the selling pressure has dropped considerably, a move that could potentially trigger another price uptrend.

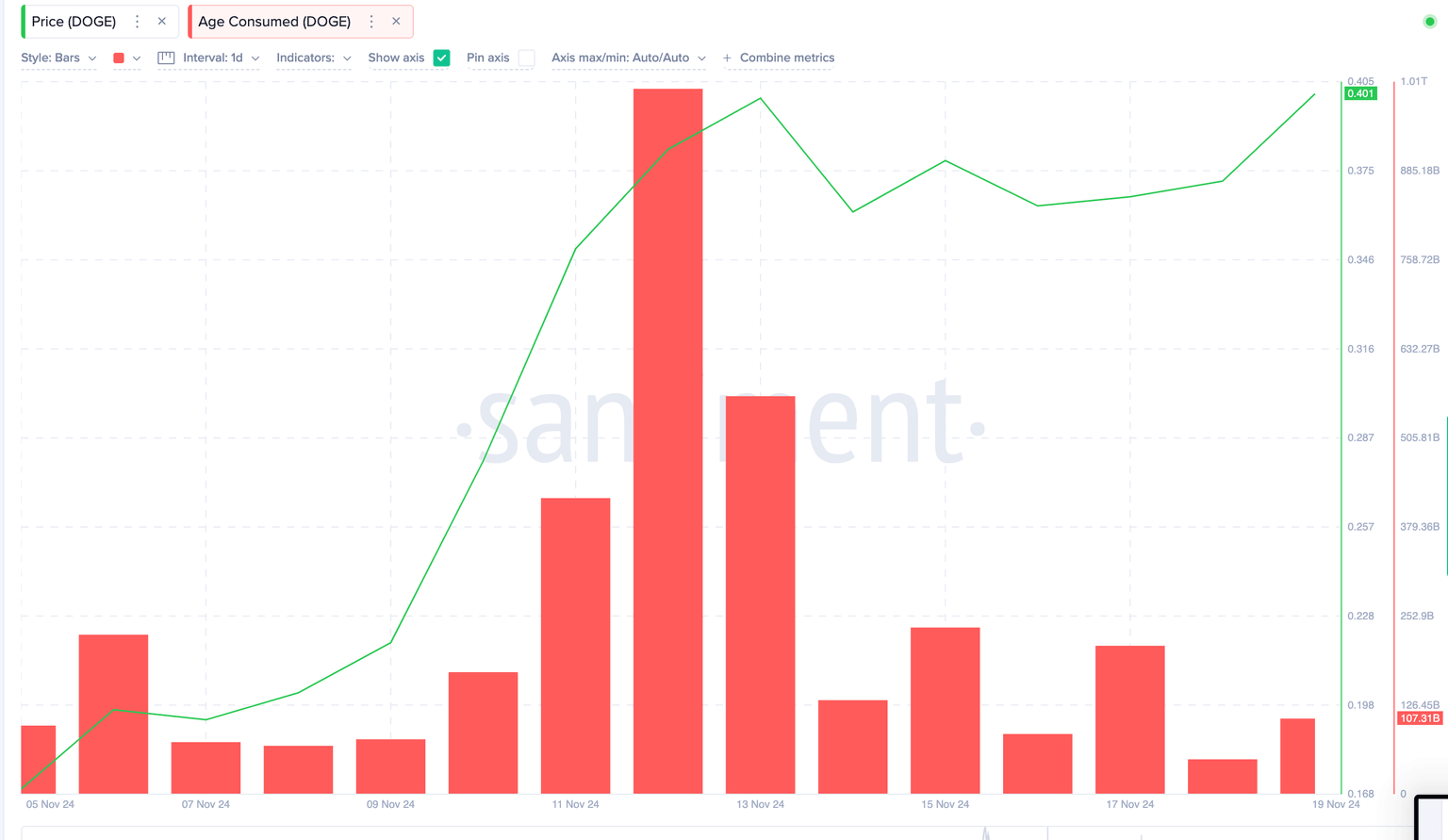

Santiment’s Age Consumed metric multiplies tokens traded by the number of days since they were last moved.

This serves as a proxy for monitoring spikes and dips in selling activity among long-term holders.

Dogecoin price vs. Age consumed | Santiment

As traders began booking profits on November 12, Age Consumed rose as high as 1 trillion DOGE.

Within 24 hours of the spike, the Dogecoin price rally stalled as the long-held coins flooding the markets overshadowed short-term demand.

However, the selling pressure has now subsided this week as the Age Consumed value fell to 49 billion DOGE at close of Monday, reflecting a 95% drop.

In simple terms, as decline in the Age Consumed metric implies that a fewer number of long-held tokens are currently being traded.

This could be bullish for Dogecoin price action for two key reasons.

First, with fewer dormant coins entering circulation, spikes in DOGE demand could trigger rapid price upswings.

Also long-term traders' reluctance to sell despite triple-digit gains in November could reinforce bullish sentiment among prospective new entrants.

These dynamics suggest that Dogecoin could recover its upward momentum, particularly if new demand outpaces the dwindling short-term supply.

Dogecoin price forecast: All eyes on $0.44 resistance

Dogecoin's price shows promising bullish momentum with the Volume-Weighted Average Price (VWAP) at $0.395, below the current market price of $0.399. This reflects rising short-term demand as the majority of buyers are now bidding higher prices to get their orders filled rather than wait on market orders.

In terms of short-term price projection, the Donchian Channel indicator shows DOGE faces initial resistance at the $0.44 level, which coincides with last week’s peak.

A breakout above the $0.44 resistance would affirm a continuation of the upward trend, possibly targeting $0.50 as the next milestone.

This scenario aligns with the evident accumulation phase as DOGE's sustained position above the VWAP signifies bullish sentiment dominating the market.

On the downside, Donchian Channels also underline that the midline of the channel at $0.29 now serves as critical support.

Any breach below this level could invalidate the bullish narrative and lead to a correction toward $0.20, the lower channel boundary.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.