Dogecoin Price Forecast: DOGE eyes consolidation after its recent pullback

- Dogecoin price could undergo consolidation as it is stuck between two demand barriers.

- Transactional data shows underwater investors at $0.624 could hinder an upswing.

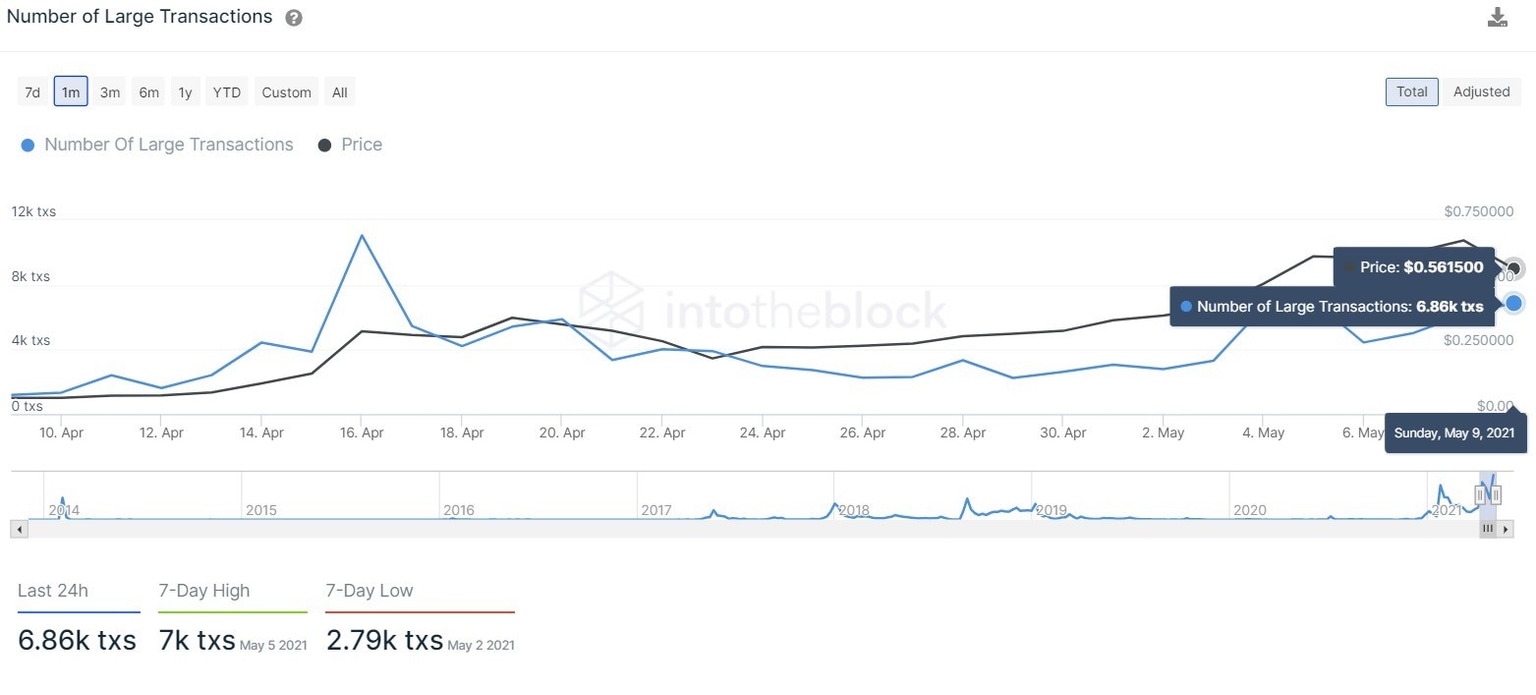

- A spike in large transactions worth more than $100,000 hints at a continuation of this downtrend.

Dogecoin price is facing a stiff resistance wall that could result in a minor correction. A confluence of on-chain indicators adds credibility to this potential bearish move.

Dogecoin price awaits a clear trend to establish

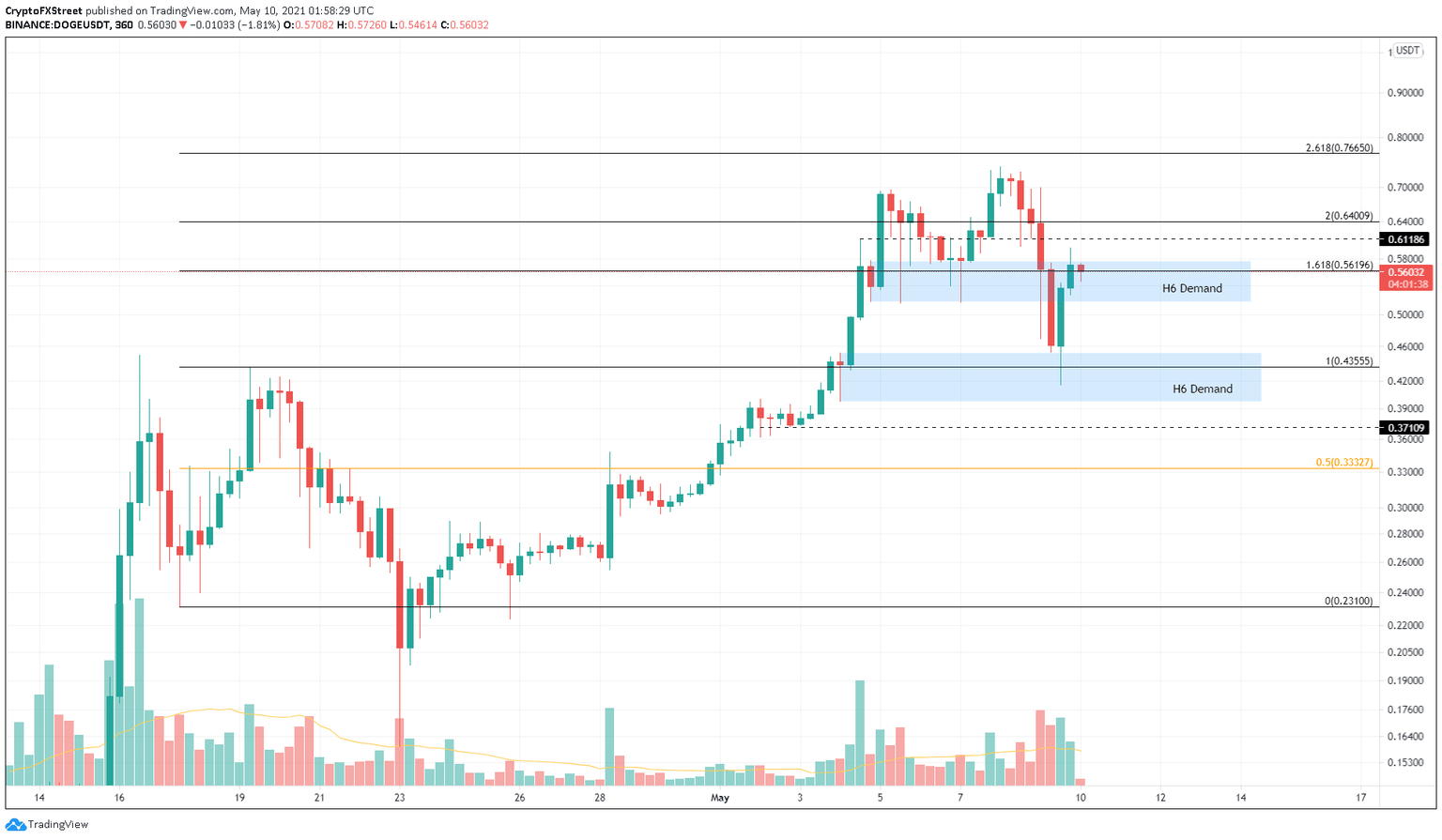

On the 4-hour chart, Dogecoin price shows a 47% downtrend after tagging an all-time high at $0.704 on May 8. The resulting pullback sliced through the immediate area of interest ranging from $0.518 to $0.576, flipping it into a resistance level. But the meme coin found support on the next barrier that extends from $0.397 to $0.451.

As a result, Dogecoin price rallied 43% higher only to face blockade at the former level. Now, investors can expect DOGE to consolidate between these levels before buyers/sellers take control and break out of the confinement.

Dogecoin price could likely tag the resistance level at $0.611 before it retraces 26%. Hence, investors must keep a close eye on this barrier.

DOGE/USDT 4-hour chart

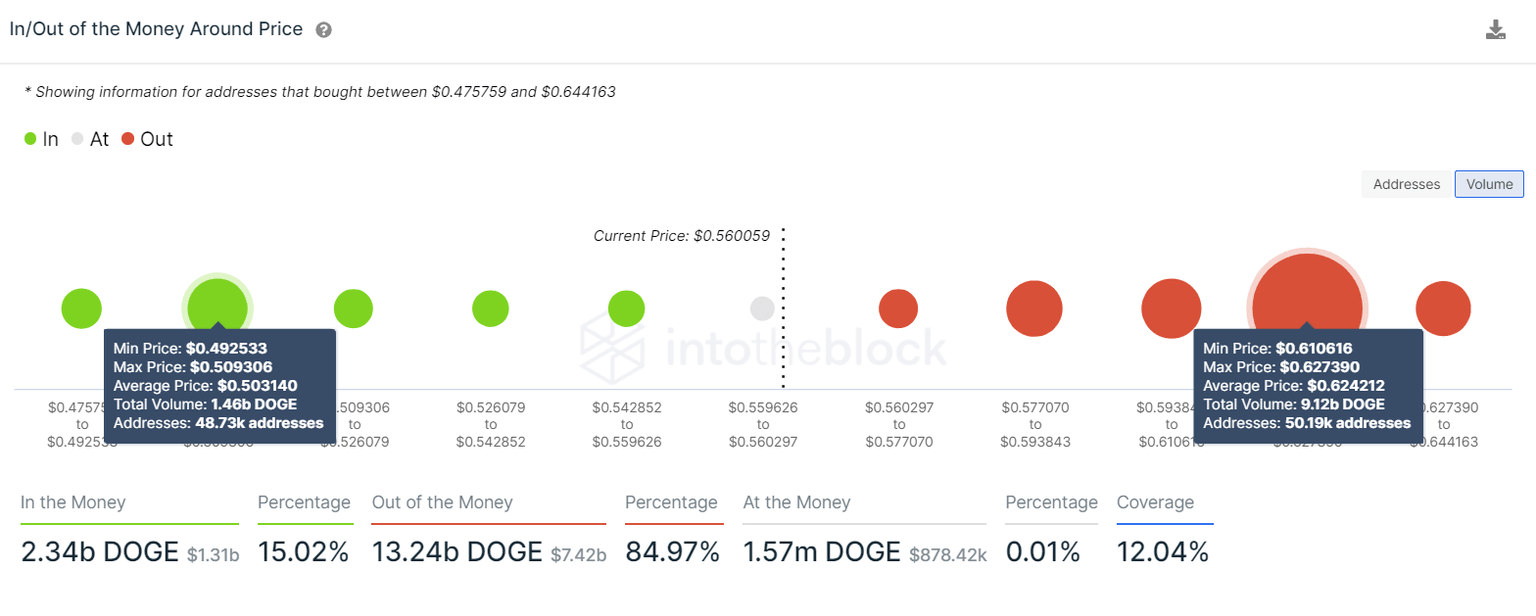

Adding credence to this downtrend is IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, which shows a cluster of underwater investors around $0.624. Here, roughly 50,000 addresses that purchased 9.12 billion DOGE are “Out of the Money.”

Therefore, a short-term spike in bullish momentum could be shut down as market participants who might want to break even might off-load their holdings, adding selling pressure.

Moreover, the lack of support levels below the current price shows that a bearish move is likely.

DOGE IOMAP chart

Moreover, transactions worth $100,000 or more have spiked from 1,120 to 6,860 over the past month. This 476% increase, which acts as a proxy to whale’s investment interests and often such a rapid increase, potentially aligns with a local top, further confirming the bearish narrative.

DOGE large transaction chart

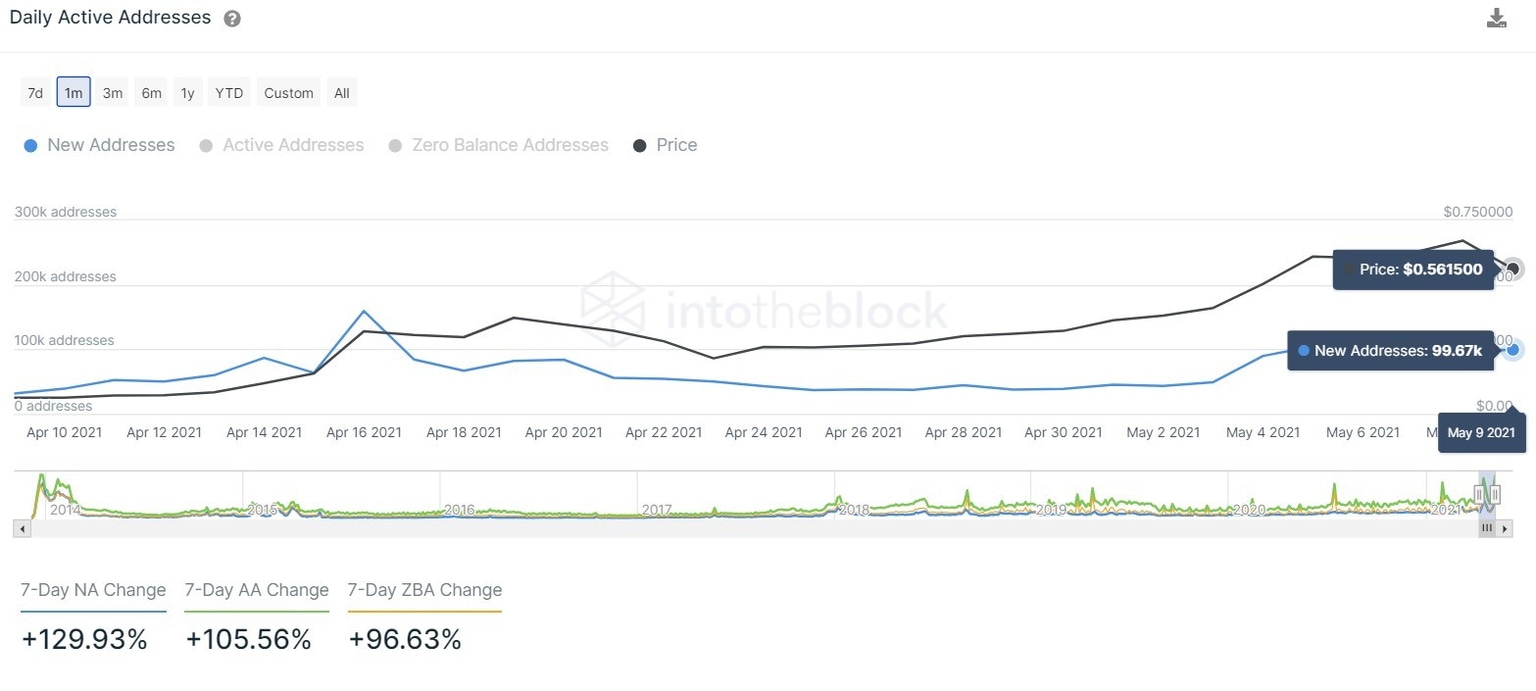

While things seem to be looking down for Dogecoin price, the number of new addresses joining the DOGE blockchain has increased from 33,000 to 99,0000 since April 9. This 217% growth in new users joining the network indicates that market participants are interested in the meme-themed cryptocurrency at the current price level.

DOGE new addresses chart

Therefore, a sudden spike in buying pressure that leads to a decisive close above $0.611 will signal an increase in short-term bullish momentum. However, a breach of $0.704 will invalidate the bearish scenario and kickstart an 8% upswing to new highs at $0.766, coinciding with the 216% Fibonacci extension level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.