Dogecoin Price Prediction: Defending 21-DMA is critical for DOGE after Musk calls it a ‘hustle’

- Elon Musk's appearance on 'SNL' throws DOGE under the bus.

- DOGE/USD extends sell-off into Sunday, hitting five-day lows.

- DOGE bulls remain hopeful as 21-DMA support holds, with RSI still bullish.

The selling pressure in the Dogecoin (DOGE/USD) remains unabated for the second straight day on Sunday, as the corrective mode from all-time highs of $0.7605 remains intact.

The crash in the Shiba Inu-inspired cryptocurrency kicked off during Elon Musk, Tesla Inc’s founder, much-awaited Saturday Night Live (SNL) appearance. Musk referred to it as "a hustle” when asked if Dogecoin was a hustle while playing a character of a financial expert.

The DOGE price hit the lowest levels in five days $0.4168 on Sunday in Musk’s aftermath, having clocked daily highs of $0.7079.

Dogecoin has jumped over 800% in the last month and is now the fourth-largest digital currency, with a market capitalization of $73 billion.

DOGE/USD: What’s in store for the canine-themed meme coin?

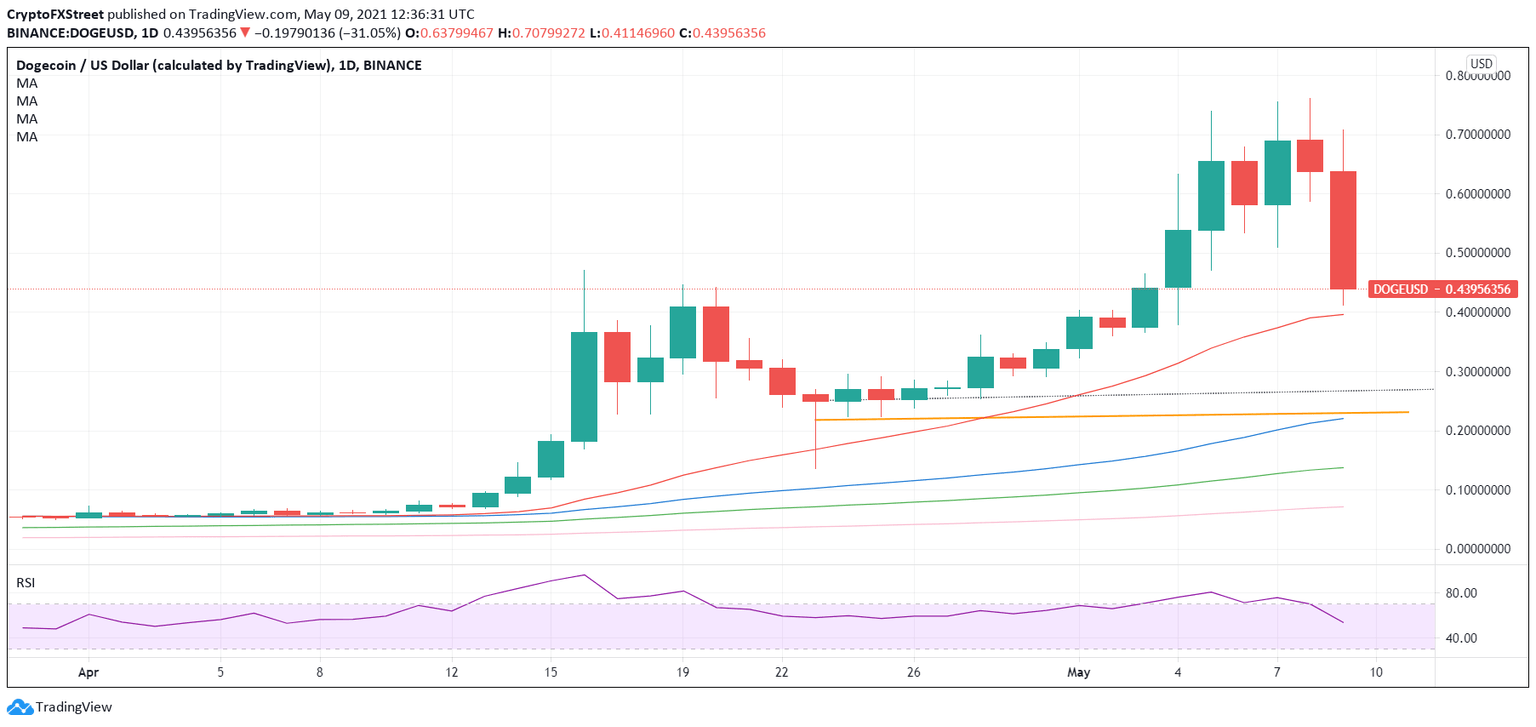

DOGE/USD: Daily chart

Dogecoin’s daily chart shows that the sell-off has stalled just above the critical short-term 21-moving average (DMA) at $0.3964.

A daily closing below the latter could expose the next downside target near the $0.2250-90 region, which is the confluence of the upward-sloping 50-DMA and horizontal trendline (orange) support.

On the flip side, the DOGE buyers need to recapture $0.50 for a convincing recovery to kick in.

The bargain hunters could look for entry around the abovementioned level, given that the relative strength index (RSI) continues to hold above the midline, despite the sharp retreat.

A run towards the $1 mark will resume only when the price delivers a daily closing above the $0.70 round figure.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.