Dogecoin Price Prediction: DOGE’s bullish potential appears limited amid overbought conditions

- DOGE/USD eyes $0.80 amid a descending triangle breakout on the 4H chart.

- Overbought RSI remains a cause for concern for the DOGE bulls.

- Elon Musk’s Saturday Night Live appearance waited for fresh impetus.

Dogecoin (DOGE/USD) has entered a phase of bullish consolidation after recording fresh all-time highs at $0.7558 on Friday

The Shiba Inu-represented cryptocurrency, Dogecoin, staged a 23% rebound from Thursday’s low of $0.5339, as traders overlooked Tesla Inc’s founder Elon Musk warning, “Cryptocurrency is promising, but please invest with caution!”

The optimists rather cheered Musk’s tweet referring to DOGE, “Fate loves irony. Like, what would be the most ironic outcome? That the currency that was invented as a joke in fact becomes the real currency.”

The coin has risen a staggering 20000% so far this year, benefiting from the celebrity endorsements while being Musk’s all-time favorite.

Looking ahead, DOGE bulls brace for Musk’s Saturday Night Live appearance for fresh trading impulse.

DOGE/USD: How is it positioned on the technical graph?

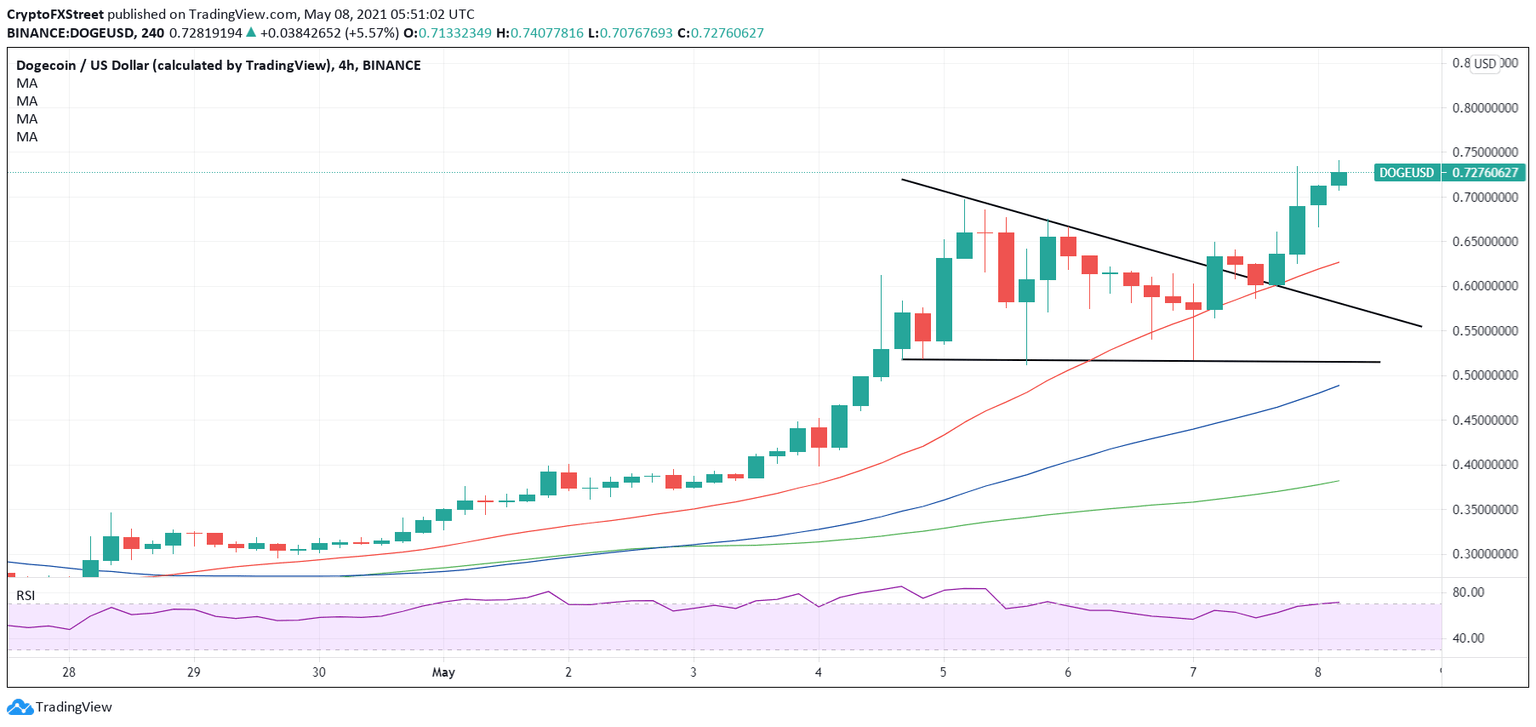

DOGE/USD: Four-hour chart

Having confirmed a descending triangle breakout on the four-hour chart in Friday’s Asian trading, DOGE/USD built onto the upside, looking to retest the record highs.

The next stop for the DOGE bulls is seen at $0.7915, the pattern target. Further up, the $0.80 round figure could come into play.

However, the relative strength index (RSI) is edging higher within the overbought region, warranting caution for the buyers.

Therefore, the DOGE price could likely face rejection near the $0.80 region, which could trigger a corrective pullback towards the upward-sloping 21-simple moving average (SMA) at $0.6260.

If the downside pressure intensifies, the sellers could aim for the psychological $0.60 level.

The next relevant support is aligned at the triangle resistance now support at $0.5831.

Further south, Friday’s low of $0.5093 could challenge the bearish commitments.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.