Dogecoin price crashing by 10% stumps investors awaiting profits worth $1.64 billion

- Dogecoin price followed Bitcoin’s cues as the meme coin failed to breach the multi-mont barrier at $0.0966.

- Investors that bought their holdings when DOGE fluctuated between $0.0868 and $0.0932 went underwater over the last 24 hours.

- The prospect of recovery is looking strong at the moment, given the rising rate of DOGE transfer among addresses.

Dogecoin price has been struggling to mark a new year-to-date high as it continues to fail in breaching the four-month-long barrier. This has left a specific group of DOGE holders perplexed as to whether their holdings will ever see the light of profits.

Dogecoin price dip brings losses

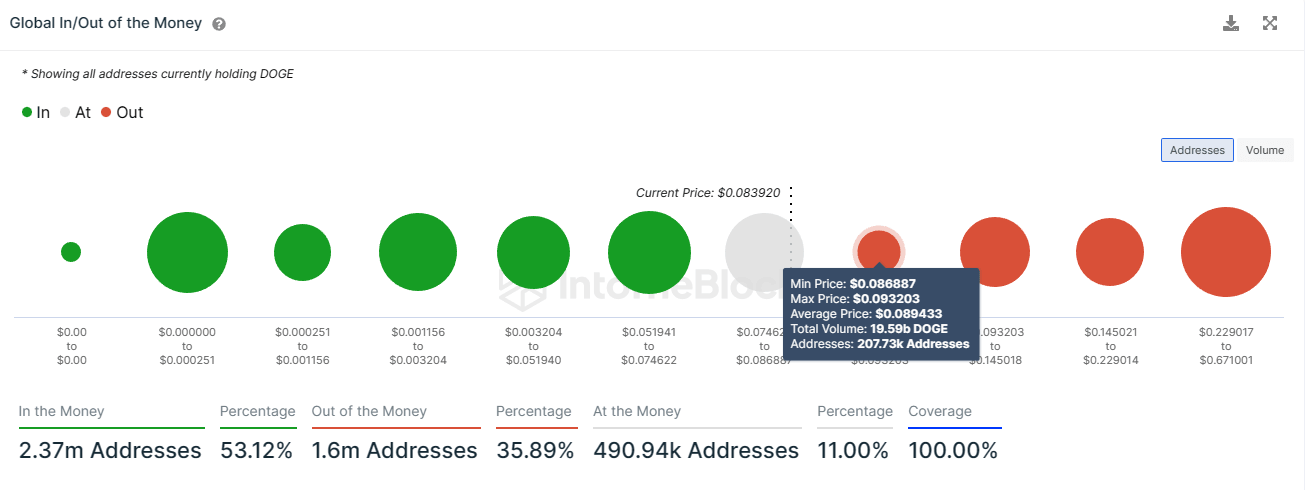

Dogecoin price in the last 24 hours charted a nearly 11% decline as the meme coin fell from $0.0942 to $0.0835 at the time of writing. As the altcoin declined on the charts, the group of investors that bought their supply when DOGE was worth between $0.0868 and $0.0932 witnessed losses again.

DOGE/USD 1-day chart

These investors amassed nearly 19.6 billion DOGE, which at current prices is worth close to $1.64 billion. For this supply to turn profitable, the Dogecoin price would need to recover beyond $0.0894, which is the average price of 19.6 billion DOGE.

Dogecoin GIOM

Furthermore, these tokens would turn truly profitable only when the altcoin can manage to sustain a rise beyond $0.0966. This level marks not only the multi-month resistance level that the cryptocurrency has not breached since December 2022 but also the point beyond which Dogecoin price would note new year-to-date highs.

The possibilities of profit currently rely on the broader market cues as DOGE investors are maintaining a bullish outlook. The velocity of the cryptocurrency, which highlights the rate at which supply has been changing hands, is indicating an uptick.

This translates to optimism among investors and has historically been accompanied by a positive turn in price action, as observed in December 2022 and March this year.

Dogecoin velocity

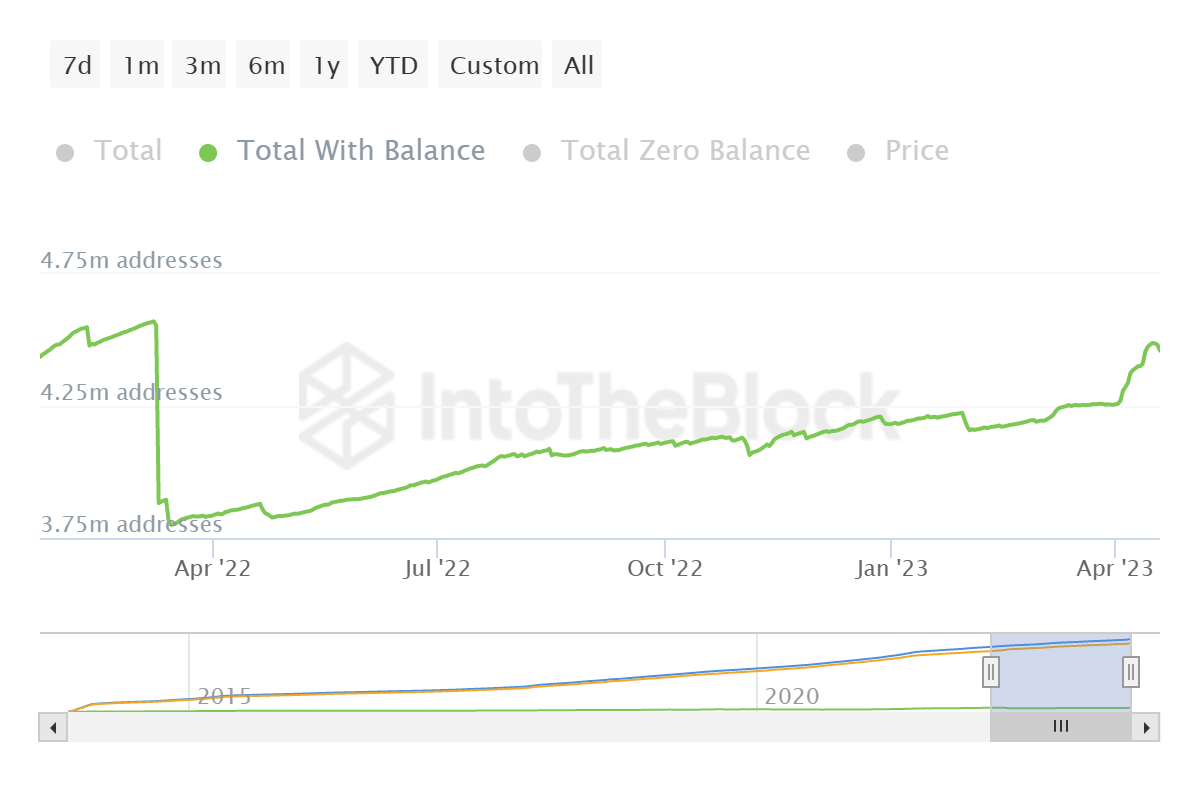

This bullishness is also visible in the rising demand for Dogecoin as the total addresses holding a balance have observed a sharp rise against the average rate at which investors join the network. While between November 2022 and March 2023, Dogecoin only added 170,000 new addresses, in the last 20 days alone, over 200,000 new addresses have joined the network.

Dogecoin total addresses

Not everything is lost for the addresses that hold the 19.6 billion DOGE, as several indicators support a recovery.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B23.34.52%2C%252020%2520Apr%2C%25202023%5D-638176135112279284.png&w=1536&q=95)