Dogecoin presents buy opportunity before DOGE hits $0.34

- Dogecoin price shows signs of a bottom developing.

- Point and Figure charts await confirmation of a new bull market.

- The early entry zone could trigger a 75% gain for Dogecoin.

Dogecoin price has frayed the nerves of both bulls and bears alike. Bears especially have been on the more painful end of the Dogecoin trade due to their inability or lack of desire to push Dogecoin into a flash-crash towards single digits.

Dogecoin price action shows a new bull market has already started

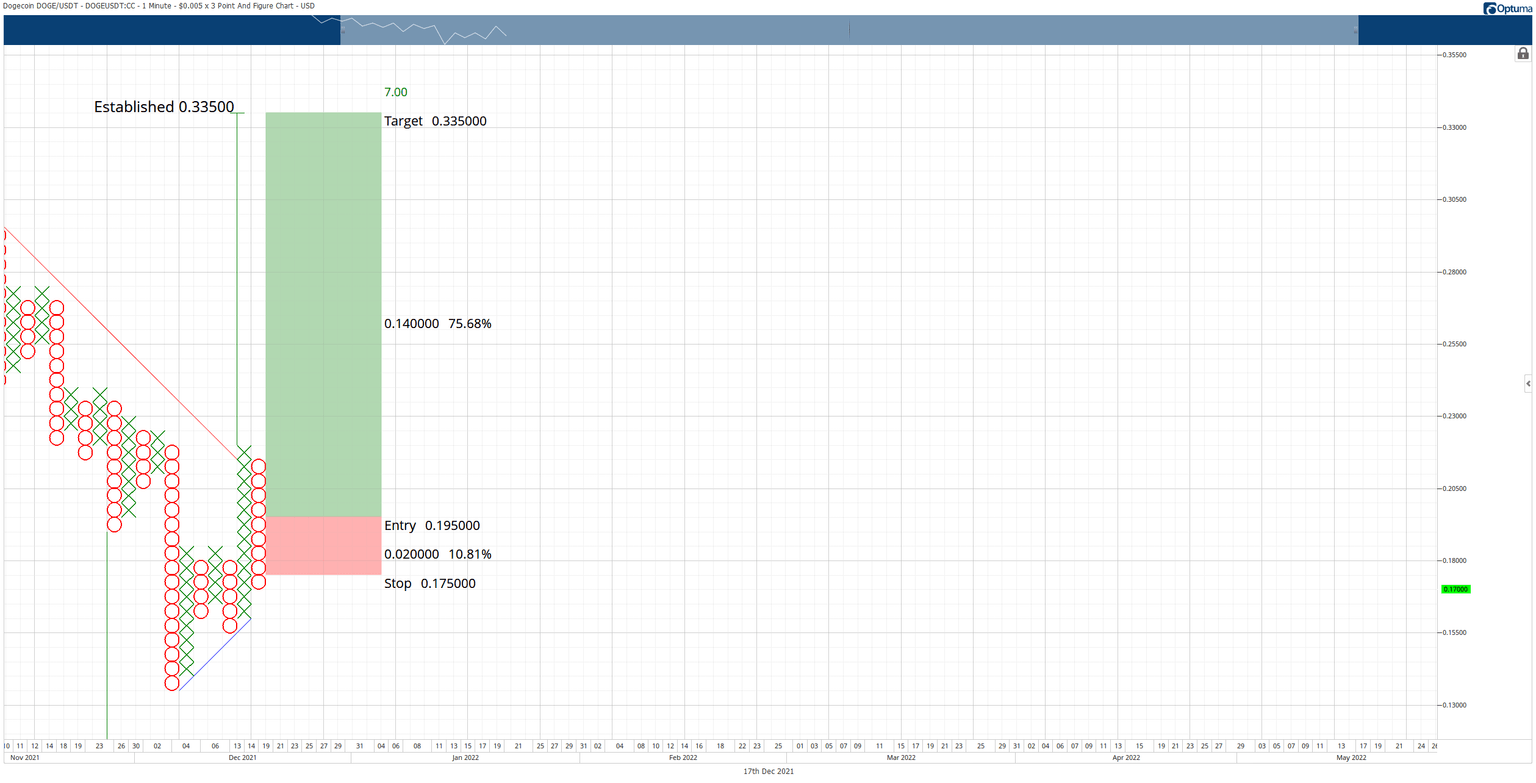

Dogecoin price action on the $0.005/3-bx Point and Figure chart shows the prior bear market angle was broken when Dogecoin moved to $0.215. After breaking that bear market angle (red diagonal line), the Point and Figure chart converted into a bull market. Ever since the bearish trendline was broken, however, DOGE has pushed lower.

The current retracement has undoubtedly shaken the resolve of many hodlers and buyers who are still on the sidelines. One interesting facet of Point and Figure analysis is interpreting the change of a market from bull-to-bear or bear-to-bull. The initial corrective move (throwback or pullback) is not viewed as a weakness but a sign of strength. And that is where trading opportunities occur.

There is a phenomenal early entry opportunity now on the Dogecoin price Point and Figure chart. The theoretical long opportunity is a buy stop order at the 3-box reversal off the current column of Os, currently at $0.1950. A 4-box stop loss (currently at $0.175) and profit target at $0.335 complete the long setup. A 3-box trailing stop would help protect any implied profits post entry.

DOGE/USDT $0.005/3-box Reversal Point and Figure Chart

The long setup remains valid as long as Dogecoin price remains above the bull market trendline (blue diagonal line). If it prints a box that breaks that angle, the long idea is no longer valid.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.