Dogecoin Elliott Wave technical analysis [Video]

![Dogecoin Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/DOGE-bearish-line_XtraLarge.png)

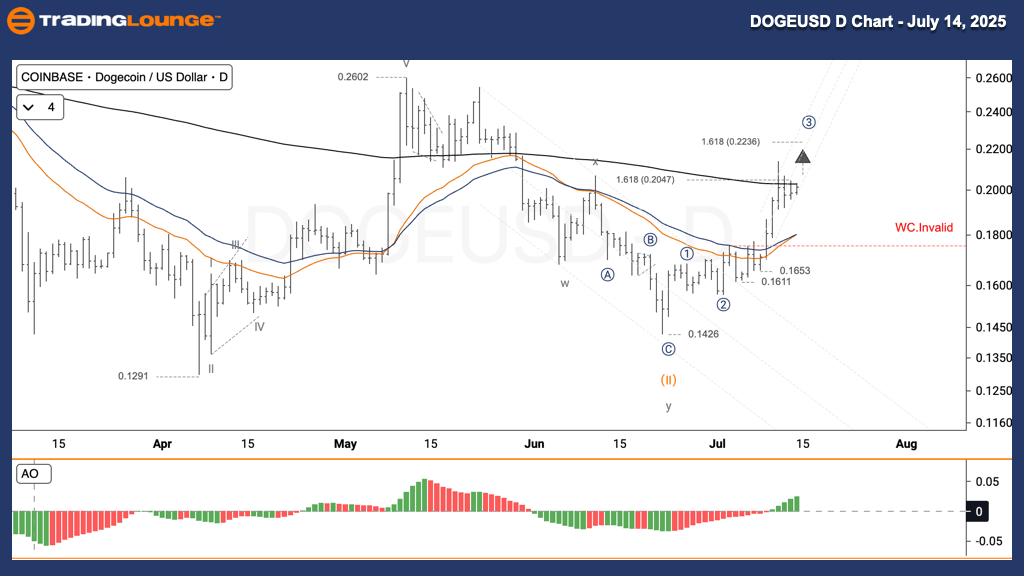

DOGE/USD – Elliott Wave technical analysis – Daily chart

-

Function: Follow Trend.

-

Mode: Motive.

-

Structure: Impulse.

-

Position: Wave 3.

-

Direction (next higher degrees): Pending.

-

Invalidation level: Pending.

DOGE/USD – Trading strategy

Overview

Wave (2) completed between 0.16113–0.16525 as a Zigzag correction. The price has now moved into the final phase of wave 3, which includes five sub-waves. A short-term retracement could occur, targeting 0.22363.

Trading strategies

-

Swing trade strategy (short-term traders):

-

Watch for the end of wave 5 near 0.2236 and consider booking partial profits.

-

Monitor for signs of divergence or weakening momentum near this level to prepare for wave (4) correction.

-

-

Invalidation point:

-

The uptrend structure is invalidated if the price falls below 0.18000.

-

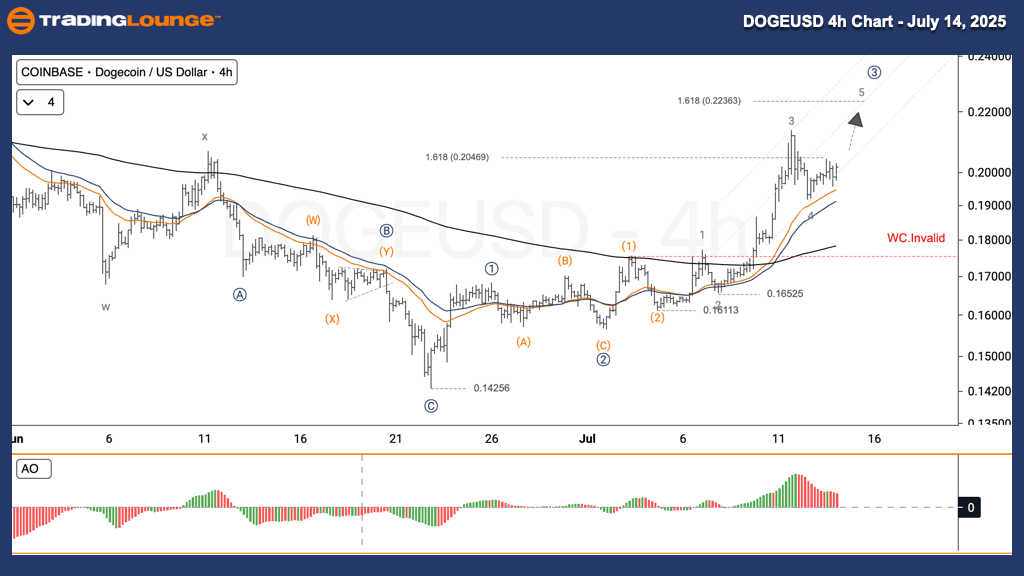

DOGE/USD Elliott Wave technical analysis – Four-hour chart

-

Function: Follow Trend

-

Mode: Motive

-

Structure: Impulse

-

Position: Wave 3

-

Direction (Next Higher Degrees): Pending

-

Invalidation Level: Pending

DOGE/USD – Trading strategy recap

Overview

Wave (2) ended between 0.16113–0.16525, following a Zigzag structure. Price is in the latter part of wave 3, expected to peak around 0.22363.

Trading strategies

-

Swing trade strategy (short-term):

-

Consider profit-taking as wave 5 concludes near 0.2236.

-

Watch for divergence or slowing momentum as possible signals to prepare for a correction wave.

-

-

Invalidation level:

-

The structure becomes invalid if the price dips below 0.18000.

-

Dogecoin Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.