DOGE beats the blue chips as D.O.G.E calls it quits

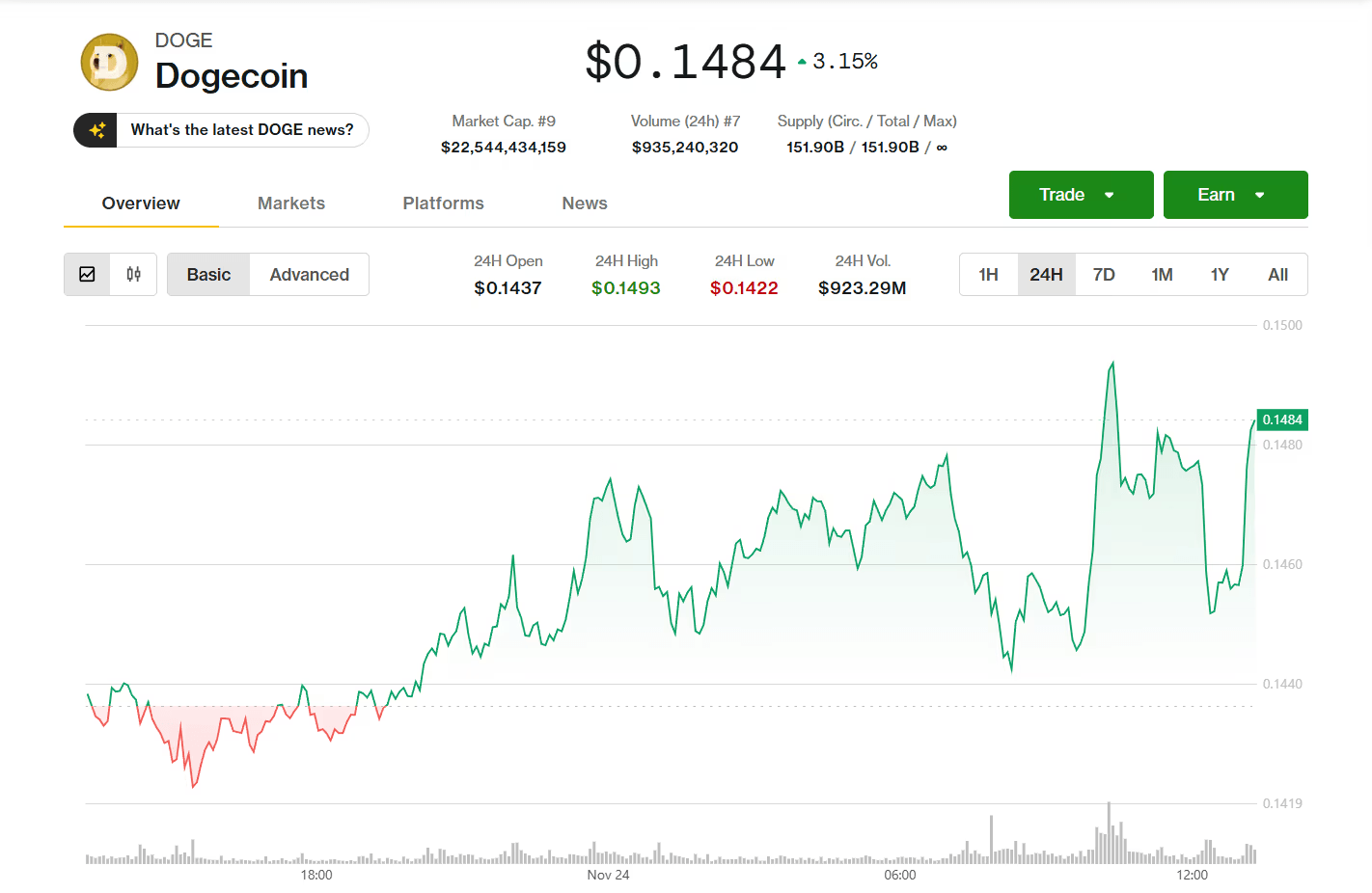

- Dogecoin rose over 3% as traders anticipated the launch of Grayscale's DOGE coin ETF.

- Grayscale's DOGE ETF, trading under the ticker $GDOG, is set to begin trading on NYSE Arca.

- Cat-themed memecoins outperformed dog-themed coins, with a 4.2% market cap increase compared to 4% for dog-themed coins.

DOGE $0.1458 looked past the demise of Elon Musk's D.O.G.E. department, as it climbed Monday in Asian markets, driven by renewed optimism sparked by Grayscale’s forthcoming introduction of a DOGE coin ETF.

CoinDesk market data shows that DOGE was trading around $0.145 on Monday, with a daily gain of over 3%, outpacing the roughly 0.6% rise in the CoinDesk 20 Index (CD20) and the CoinDesk Memecoin Index.

DOGE is rallying into a wave of newly approved spot ETFs, with Grayscale’s GDOG set to begin trading and Bitwise’s rival DOGE product potentially going live under the 20-day 8(a) window, creating a rare bullish catalyst even as whale selling and weak technicals keep near-term price action fragile.

At the same time, BTC and ETH remain sharply lower on a weekly basis with declines of about 9% and 10% while most large cap tokens continue to lag.

While DOGE’s gains are easily attributable to the upcoming ETF launch, typically the token also moves when it finds itself in the headlines – usually from an Elon Musk mention.

The White House confirmed that the Department of Government Efficiency has effectively dissolved eight months ahead of schedule after Elon Musk’s split with President Trump triggered infighting and a quiet transfer of its functions to traditional agencies.

But, despite the usual D.O.G.E-mention, DOGE gain flywheel effect, it's actually cat-themed tokens that have edged ahead.

CoinGecko data shows felines were the actual winner, with the category of cat-themed memecoins growing its market cap by 4.2%, while dog-themed coins are up by 4%.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.