Dog-themed coins SHIB show bullish signs, DOGE faces resistance

- Dogecoin and Shiba Inu consolidate at crucial support levels after Friday’s pullback.

- Derivatives market traders show a bullish bias for SHIB, but sentiment declines for DOGE.

- Technical outlook signals a post-retest reversal chance for SHIB, while DOGE struggles with a long-standing trendline.

Dogecoin (DOGE) and Shiba Inu (SHIB) are down roughly 1% at press time on Tuesday. While the dog-themed meme coins have consolidated for almost a week, Shiba Inu shows recovery signs in the derivatives market and technical charts as Dogecoin faces headwinds.

Shiba Inu eyes bullish reversal, DOGE faces bearish trendline

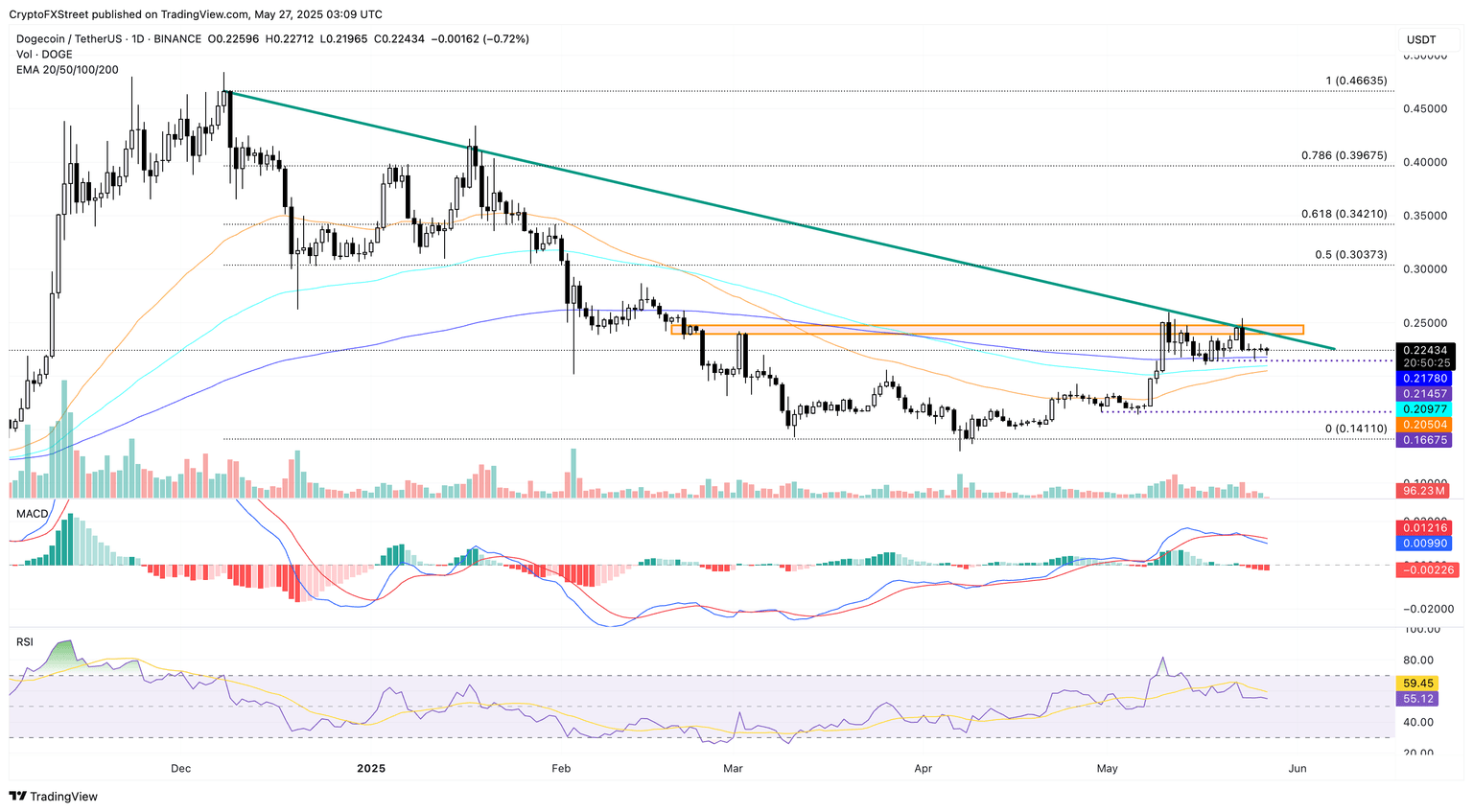

Dogecoin trades at $0.2243 with a streak of Doji candles for the last four days, holding above the $0.20 support. The 200-day Exponential Moving Average (EMA) at $0.2178 provides dynamic support to the consolidation.

DOGE reveals a double top, a bearish reversal pattern, at the junction of the $0.25 supply zone and a long-standing resistance trendline since December. The pattern’s neckline is at $0.2145; a close below this could extend Dogecoin’s correction.

The Moving Average Convergence/Divergence (MACD) indicator triggers a sell signal as it crosses below its signal line alongside a fresh wave of bearish histograms. Additionally, the Relative Strength Index (RSI) is at 55, down from the overbought region to almost midline, reflecting a loss in bullish momentum.

DOGE/USDT daily price chart. Source: Tradingview

Overall, the technical outlook shares multiple bearish elements on the Dogecoin price chart, signaling downside risk. A closing price below the $0.2145 neckline could test the $0.1667 low formed in early May.

However, a potential trendline breakout could put the $0.30 level, a crucial support turned resistance for DOGE, on bullish radars.

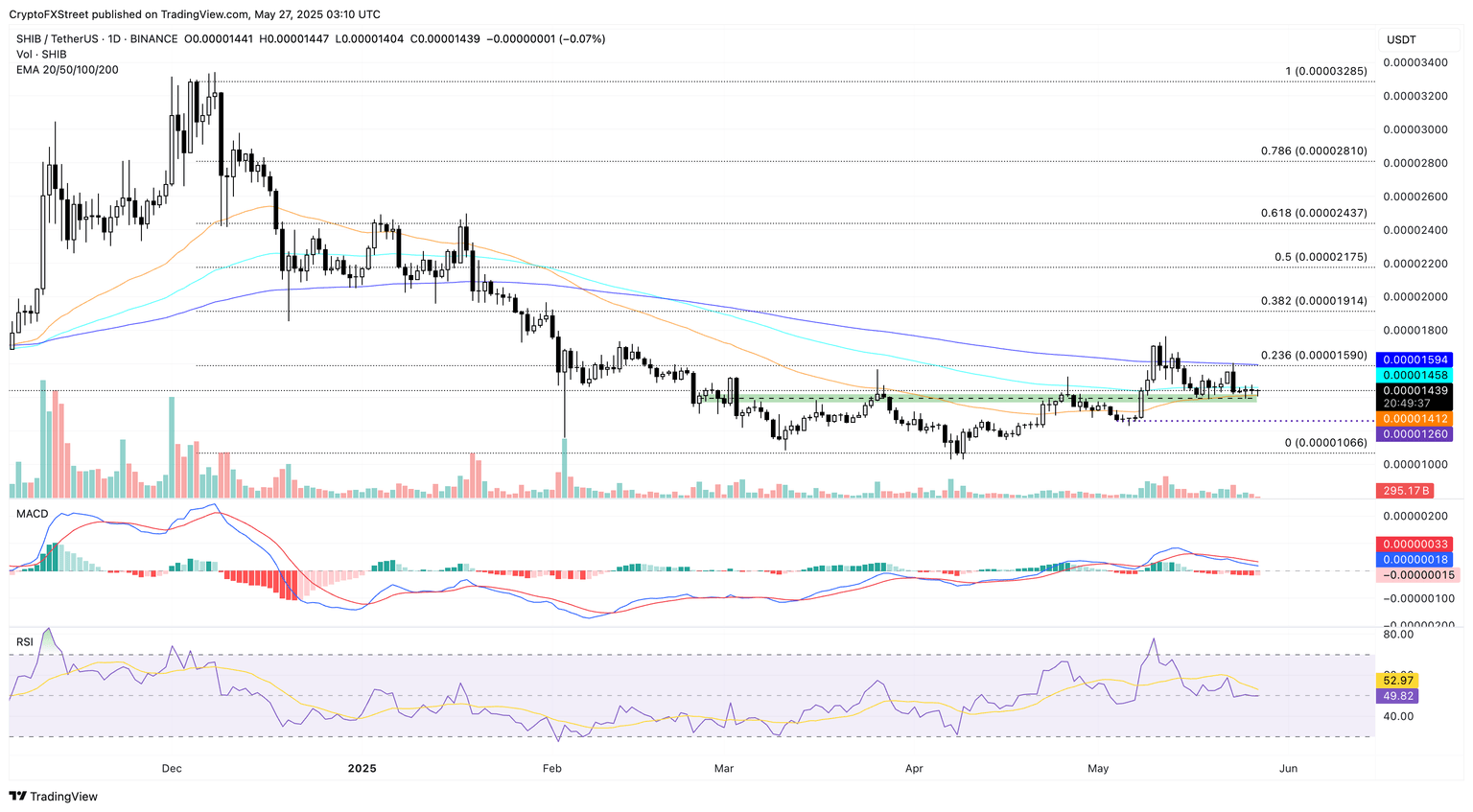

On the other hand, Shiba Inu trades at $0.00001439, playing out a similar consolidation phase above the 50-day EMA at $0.00001412 and the $0.000014 support zone. Furthermore, the lack of a bearish trendline reduces SHIB's headwinds.

The $0.000014 zone breakout marked a trend reversal for Shiba Inu but failed to cross above $0.000017. A steep correction due to market volatility has led to a bearish bias in technical indicators similar to Dogecoin. However, the pullback holds above the broken zone, signaling post-retest reversal chances.

SHIB/USDT daily price chart. Source: Tradingview

The Fibonacci retracement from $0.00003285 to $0.00001066 between December 5 and April 8 shows the immediate resistance at $0.00001590, overlapping with the 23.6% Fibonacci level and the 200-day EMA. Fibonacci levels extend the price targets to $0.00001914 (38.2% level) and $0.00002175 (50% level).

Bullish bias in SHIB derivatives

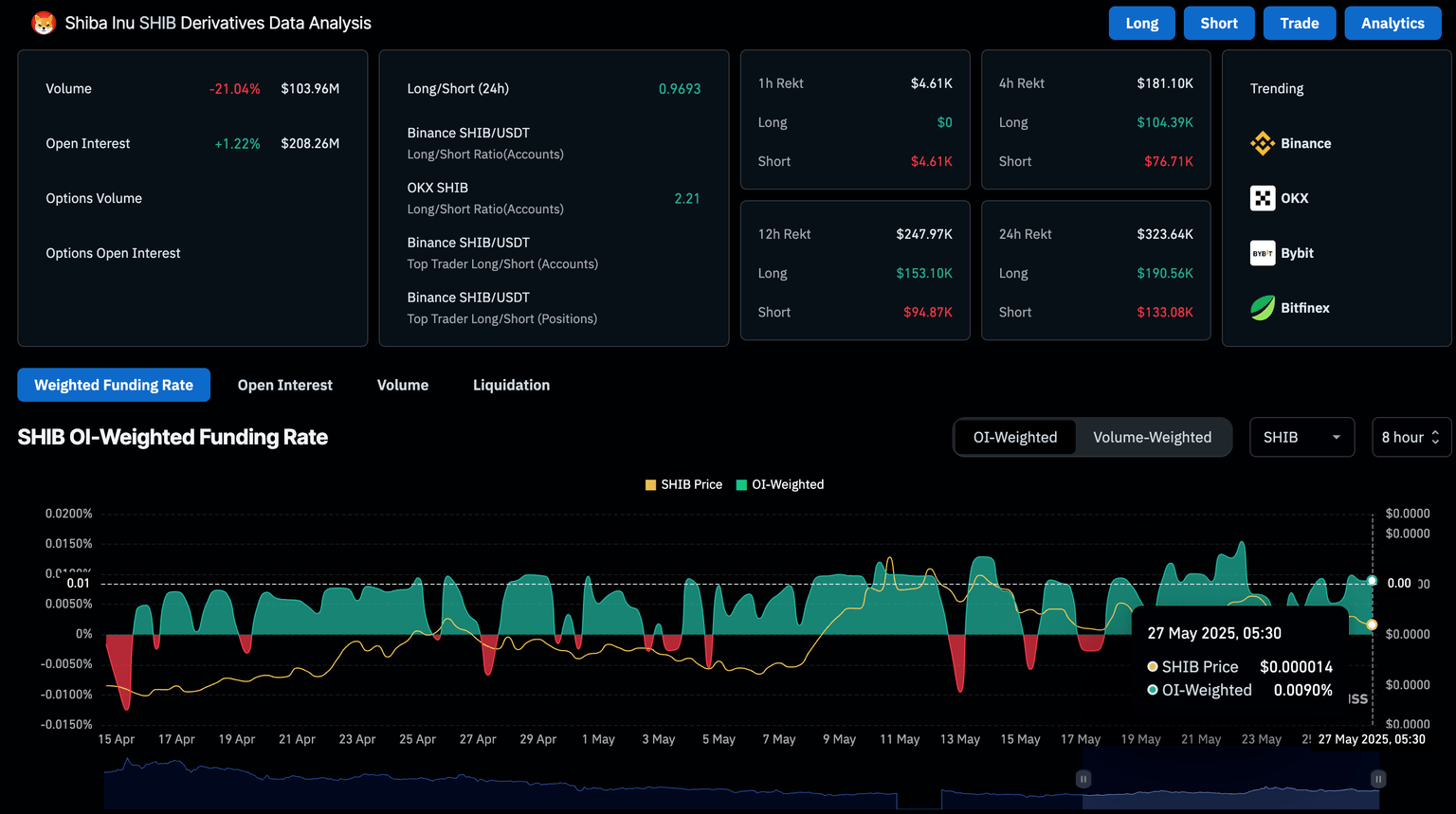

As the technical outlook suggests a potential bullish recovery for Shiba Inu, the derivatives market witnesses a surge in bullish anticipation. The SHIB open interest (OI) has surged by 1.22%, reaching $208 million, reflecting increased activity. The heightened bullish intent is reflected by the OI-weighted funding rate rising to 0.0090%.

Shiba Inu derivatives data. Source: Coinglass

However, DOGE's open interest is down by 0.14% to $2.64 billion, with the OI-weighted funding rate remaining stable at 0.0095%.

Dogecoin derivatives data. Source: Coinglass

The liquidation data over the past 24 hours reflects an increased wipeout of bullish positions in Dogecoin compared to SHIB. Over the past 24 hours, the long liquidation in Dogecoin accounted for $3.36 million compared to $1.39 million in short liquidations, while the long liquidation in Shiba Inu accounted for $190K with $133K in short liquidations.

SHIB long-to-short ratio chart. Source: Coinglass

The Shiba Inu long/short ratio chart based on taker buy/sell volume reflects increased long positions in Shiba Inu for three consecutive days, accounting for 49.82%, neutralizing the playing field with a long to short ratio of 0.9928.

DOGE long-to-short ratio chart. Source: Coinglass

However, the ratio for Dogecoin has dropped to 0.885 over the past 24 hours as short positions spike up to 53.05%. Hence, the bearish bias in the Dogecoin derivatives is clear, increasing the chances of Shiba Inu outperforming Doge this week.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.