Decentralized v. Centralized finance: Who’s to blame for FTX exchange collapse

- Decentralized exchange dYdX’s founder Antony Juliano believes the solution to the collapse of centralized exchanges is DeFi.

- Juliano stresses that decentralized exchanges can be audited much quicker than centralized entities and there is higher transparency.

- FTX exchange crash triggered a bloodbath in cryptocurrencies and dYdX founder argues this could have been avoided using DeFi.

/business-man-hands-signing-on-document-at-his-desk-16721898_XtraLarge.jpg)

The debate between decentralized and centralized exchanges turned serious with the recent collapse of Samuel Bankman-Fried’s FTX exchange. Antony Juliano, founder of decentralized exchange dYdX believes the FTX crash could have been avoided if traders used DeFi instead of centralized entities.

Also read: Crypto lender BlockFi prepares for potential bankruptcy in the aftermath of FTX collapse

Are decentralized exchanges the answer to crypto traders’ woes?

Crypto traders suffered losses from the collapse of Samuel Bankman-Fried’s (SBF) FTX exchange collapse. Antony Juliano, the CEO and founder of decentralized exchange dYdX believes that the problem is the failure of centralized exchanges.

FTX’s collapse started with a lack of transparency and guard rails. In DeFi, platforms are built on top of smart contracts. A smart contract is simply a program stored on a blockchain that runs when predetermined conditions are met. Juliano explained that dYdX offers similar products as centralized exchange FTX, the only difference is the ease of use and accessibility.

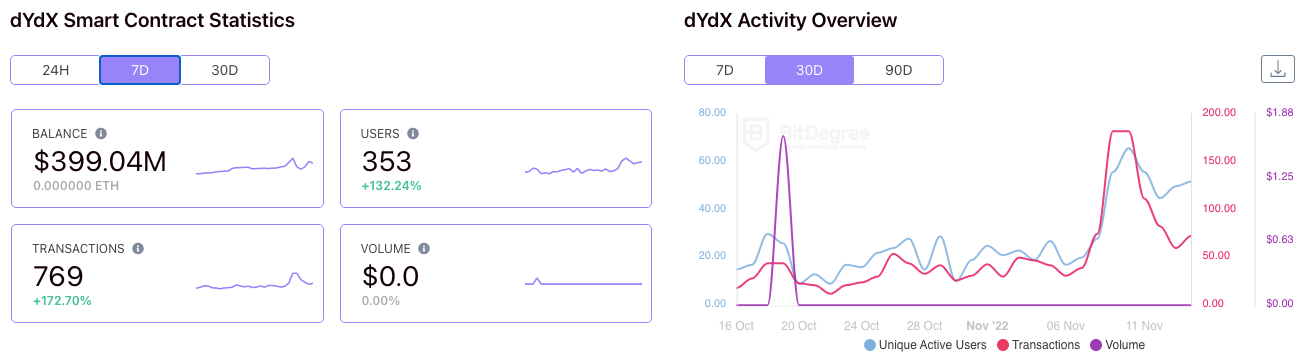

dYdX smart contract statistics

Centralized exchanges offer better accessibility to users while their decentralized counterparts provide better security. The safety of user funds has emerged as a leading cause of concern among traders. dYdX witnessed an increase in inflow of new users and funds following the FTX collapse.

Juliano was quoted on Bloomberg crypto show, saying:

The initial knee-jerk reaction is to regulate and potentially over regulate the [DeFi] industry, but for a lot of regulators, not only can it be positive but it can be ten times better than the existing financial system.

Turf wars between US regulators need to end

US financial regulators, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), are competing to regulate cryptocurrencies. Experts argue that crypto regulation is the purview of the CFTC. However, the SEC has continued its regulation of crypto projects and firms using enforcement throughout 2022.

Janet Yellen, US Treasury Secretary, believes that the FTX exchange collapse has exposed the “weaknesses” in crypto. At the same time, there was no regulation to tackle the liquidity crisis of FTX or prevent the collapse from wiping out billions in digital assets. This event stresses the need to regulate cryptocurrencies and crypto-related centralized and decentralized entities.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.