Curve Dao price managed to weather the storm while the rest of the cryptocurrency market plummets

- Curve Dao gives a blind eye to the bleeding crypto market, soars by 14% to $2.

- CRV/USD has encountered a hurdle at $2, leaving a gap to be explored by sellers toward the IOMAP support.

Curve Dao Token, a $340 million altcoin, edged above other cryptocurrencies to post double-digit gains despite widespread corrections. CRV/USD is up 14% and trading at $1.78. The 24-hour trading volume holds at $664 million following a 77% increase.

Curve Dao uptrend hits a wall as correction lingers

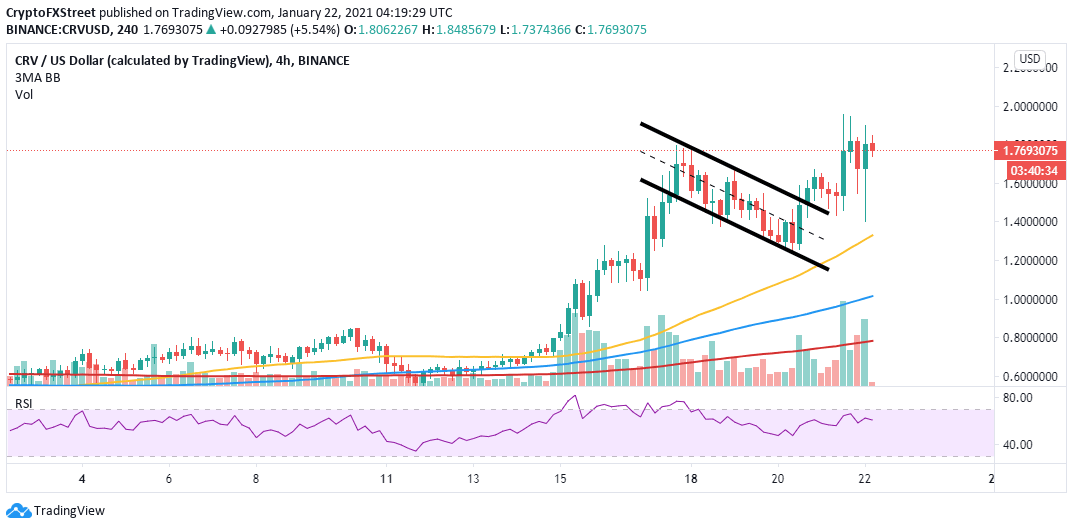

A bull flag pattern came into the picture after CRV hit highs around $1.8. The consolidation allowed buyers to take positions and regain control over the price. The breakout from the pattern became strong enough to cancel the bearish wave across the market.

Meanwhile, the bullish leg shot above the recent barrier at $1.8 but failed to break the next resistance at $2. At the time of writing, overhead pressure is building under $1.8 and likely to push decentralized finance token toward the tentative critical support at the 50 Simple Moving Average.

CRV/USD 4-hour chart

IntoTheBlock’s IOMAP reveals the presence of a medium-strong resistance ahead of Curve Dao. The resistance runs from $1.81 to $1.86 and hosts 649 addresses that previously purchased approximately 8 million CRV. If the seller congestion in this area is overcome, the price could rally to levels above $2.

Curve Dao IOMAP chart

On the flipside, Curve Dao has room to explore downstream before it encounters the most robust support between $1.56 and $1.62. Here, 561 addresses had previously bought roughly 13.4 million CRV. It is improbable that the decline will penetrate this area, suggesting that a reversal may take place, pulling CRV back to $2.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637468873546978902.png&w=1536&q=95)