Cryptocurrency Market Update: Bitcoin, Ethereum and Ripple have positive starts as the bulls rush in

- ETH/BTC bears remained in control for the second straight day.

- The ETH/USD daily chart has charted the highly bullish golden cross pattern.

ETH/BTC daily chart

ETH/BTC bears tool control for the second straight day as the price fell from 0.02155 to 0.0213. The RSI is trending horizontally around 36, right next to the oversold zone. If the bulls were to take back control, they must push the price above the SMA 200, 0.0217 and 0.022. For the bears to continue their domination, they must aim for the 0.0211 and 0.02055 levels.

BTC/USD daily chart

Buyers take control for the second consecutive day as the price went up from $8,572 to $8,918, having found reliable support at the SMA 20 and the upward trending line. The 20-day Bollinger jaw has narrowed, which indicates decreasing price volatility.

The MACD indicates increasing bearish momentum, while the Elliott Oscillator has had three straight red sessions. The bulls must conquer resistance levels at $9,172.88 and $9,605. On the downside, good support lies at $8,606.12 and $&,963.80, along with the SMA 200.

ETH/USD daily chart

ETH/USD bulls have taken the price up from $185.82 to $190.55, entering the red Ichimoku cloud in the process. The SMA 50 has crossed over the SMA 200 to chart the golden cross pattern. The William %R is trending around -70, moving along the edge of the oversold zone.

On the upside, there is a strong resistance level at $199.85. Following that, the buyers must overcome the resistance at the SMA 20 and then cross above the $214.60-level. Healthy support levels lie at $190.70 and $174.

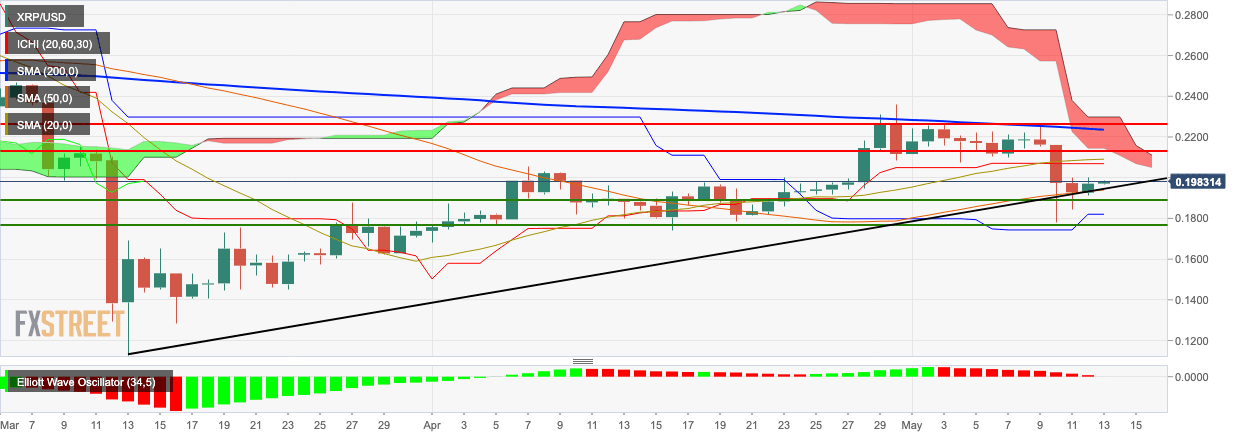

XRP/USD daily chart

XRP/USD found support at the SMA 50 curve and jumped. The price has gone up from $0.1926 to $0.198 in the early hours of Wednesday. The bulls must jump above the SMA 20 curve and the $0.213 level to enter the red Ichimoku cloud. Following that. The buyers can attempt to climb above the cloud by conquering the $0.2263 level. On the downside, the price has found healthy support at $0.189 and $0.177.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637249318174868237.png&w=1536&q=95)

-637249317151586645.png&w=1536&q=95)

-637249315825804668.png&w=1536&q=95)