Cryptocurrency Market News: Bitcoin attacks $12,000 as selected altcoins roar

Here is what you need to know on Monday, August 10, 2020.

Markets:

Bitcoin price breaks out past $12,000 before quickly retreating to the current market level at $11,960. The bulls extended the price action to $12,083 (intraday) but lost momentum before attacking the seller congestion at $12,000. As reported in the price prediction article earlier, BTC remains in the hands of the bulls in spite of the retreat. However, to be on the safer side, Bitcoin bulls must focus on establishing support above $12,000.

Ethereum commenced the new week trading at $390 before spiking to $400. After a minor retreat, the second-largest cryptocurrency is dancing at $395. A bearish trend has already come into the picture. However, the low volatility means that gains are unlikely to continue in the near term. Support is also expected at $390.

The fourth-largest cryptocurrency, Ripple, on the other hand, is trading 2.18% higher on the day. XRP/USD did not, however, make it above $0.30 with $0.2959 temporarily marking the end of the bullish action on the day. Ripple has retreated to $0.2943 at the time of writing amid a growing bearish momentum coupled with increased volatility.

While Bitcoin, Ethereum and Ripple are recording considerable gains on the day, some selected top 100 digital assets are posting impressive gains such as Chainlink (8.16), Cosmos (23.55%), Ontology (12.24%), Compound (17.43%), Band Protocol (45.99%), Ren (31.95%) and Ampleforth (29.94).

Chart of the day: BTC/USD daily

%20(17)-637326400574336893.png&w=1536&q=95)

Market:

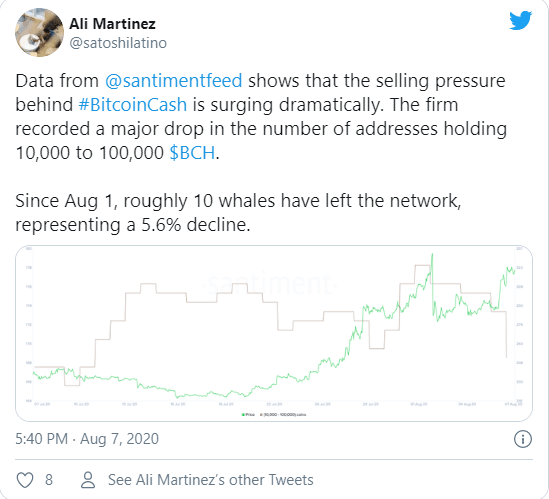

Bitcoin Cash price surged by about 40% towards the end of July. However, there are reports that at least ten whales have left the network unbothered by the rally. Data from Santiment, a cryptoanalysis platform highlights that investors holding between 10,000 BCH and 100,000 BCH (approximately $3.3 million) have transferred their holdings in the token. The fall in the number of investors happened despite the surge in the price to highs of $306 (market value).

Industry:

A new project is launching in South Korea that will see cryptocurrency payments trialed. The pilot program is being piloted by CIC Enterprise (an affiliate of Bitbeat). The company will be operating in a couple of tourist destinations and will seek to establish reliability, transparency and convenience for electronic payments. Tourists will be able to pay for watersports in cryptocurrencies such as Bitcoin, Ethereum, MCI and WAY ERC20.

Regulation:

The New York State Department of Financial Services has given a greenlight to eight virtual currencies for safekeeping by licensed entities. These tokens include Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), Binance USD (BUSD), Gemini Dollar (GUSD), Pax Gold (PAXG), and the Paxos Standard Token (PAX). According to the NYDFS “, any entity licensed by DFS to conduct virtual currency business activity in New York may use coins on the Greenlist for their approved purpose.”

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren