Cryptocurrencies Price Prediction: Ripple, Render & Dogecoin – European Wrap 5 March

XRP price rallies alongside Bitcoin, sustaining above key psychological barrier

XRP price climbed to a high of $0.6685 on Tuesday, before correcting to $0.6410. XRP price appears to be on an uptrend following the recent rally in Bitcoin, sustaining above the psychologically important level of $0.60.

The recent XRP rally seems to be sustained by large wallets, which have accumulated XRP since the beginning of March, according to on-chain data. Meanwhile, while retail traders appear to be taking profits from the recent price increase.

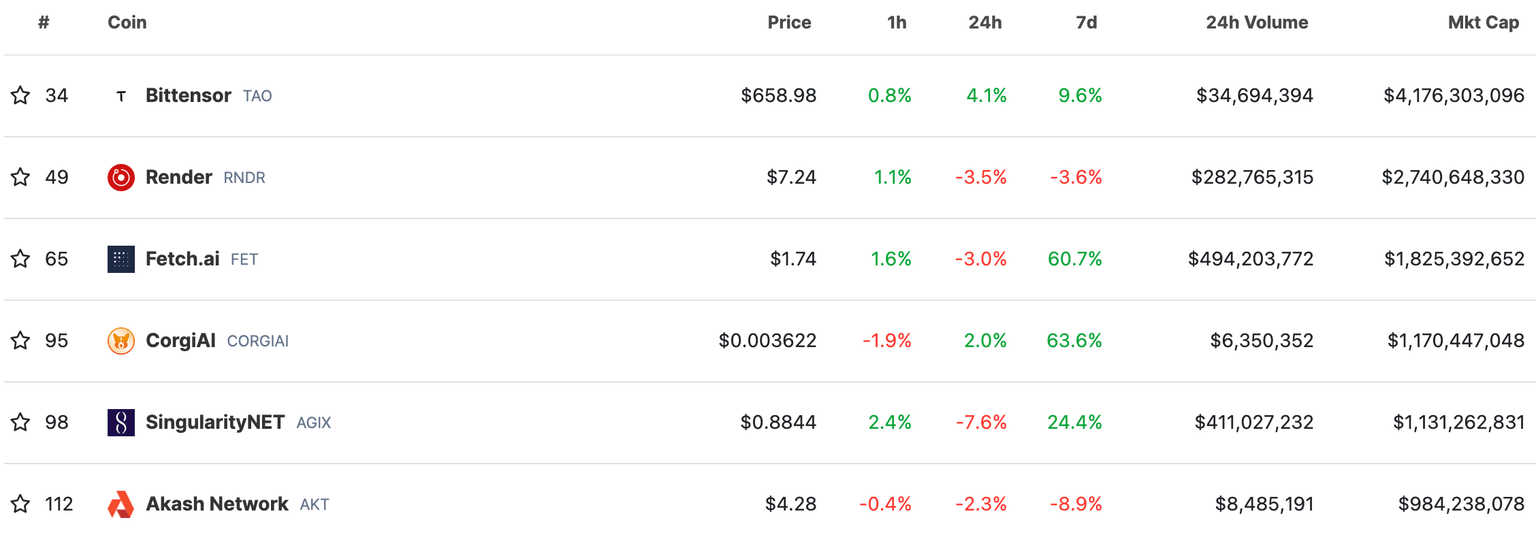

AI tokens dip before NVIDIA 2024 GTC AI conference: RNDR, FET, AGIX, AKT

The Artificial Intelligence (AI) narrative is likely to make a comeback with NVIDIA’s AI conference, which will be held in mid-March. The event will feature over 900 sessions and 300 exhibits, and has the potential to fuel the current AI-led narrative among crypto market participants.

AI tokens Render (RNDR), Fetch.AI (FET), SingularityNET (AGIX) and Akash Network (AKT) have noted a decline in their prices on Tuesday. The recent correction, which goes from 2.3% to 7.6% depending on the token, could offer sidelined traders a “buy the dip” opportunity ahead of a key event in the ecosystem, the upcoming NVIDIA 2024 GTC conference in Silicon Valley. This is an important event since it is the largest AI conference hosted by NVIDIA, which is benefiting the most from the recent AI frenzy.

Dogecoin more than doubles as DOGE joins WIF, PEPE, FLOKI and others in meme coin rally

Dogecoin price has shown incredible momentum and continues to climb after the previous week’s 78% rally. Considering the massive volatility surrounding meme coins, this DOGE move is not surprising.

Dogecoin (DOGE) price cleared the multi-month declining trend line in October 2023, but the parabolic rally began in February 2024. So far, DOGE has soared by 130% in the past eight days. This massive upswing has shattered the $0.116 and $0.181 weekly resistance levels.

Author

FXStreet Team

FXStreet