Cryptocurrencies Price Prediction: Ripple, Bitcoin & Monero – European Wrap 17 December

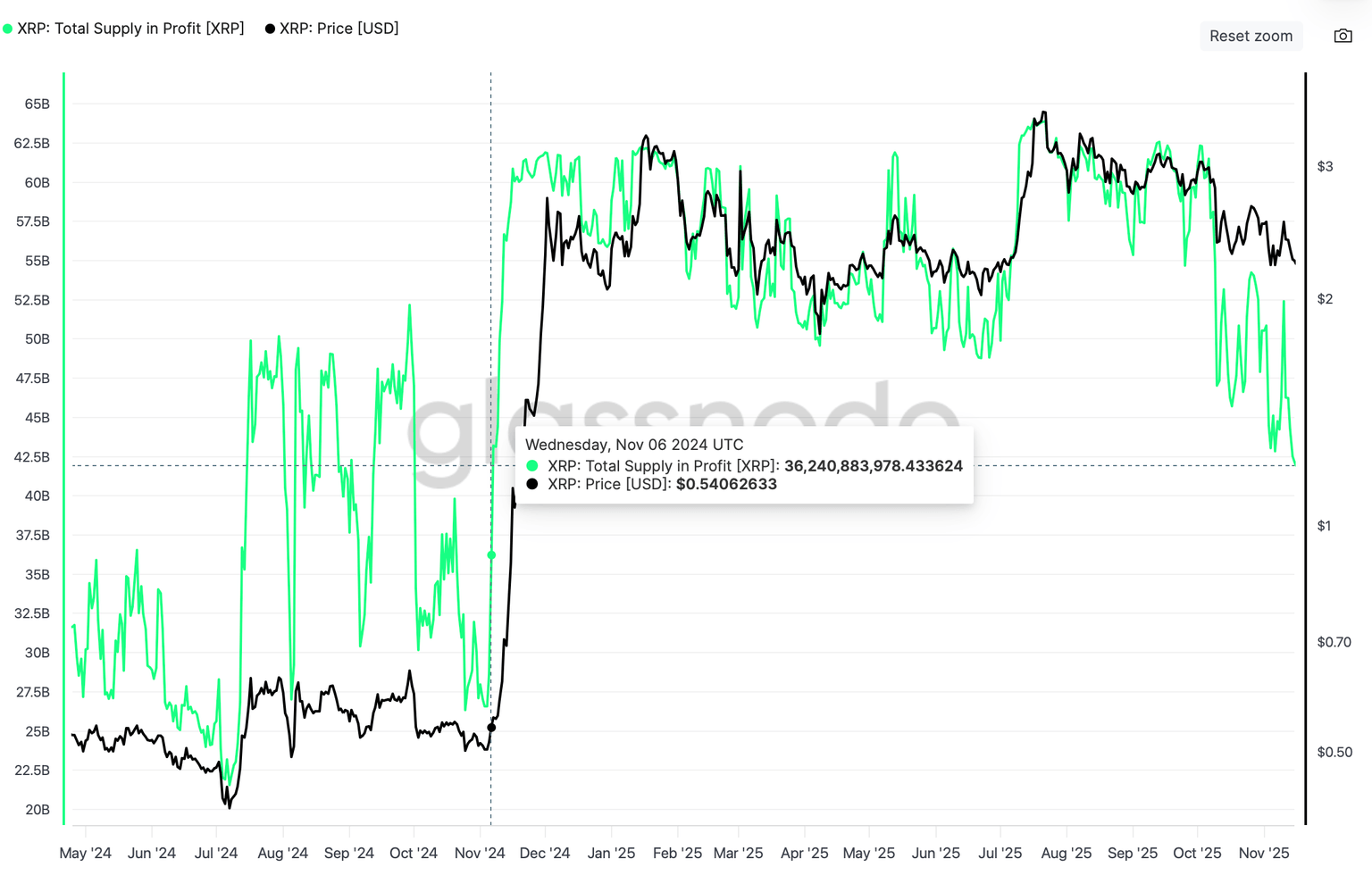

Ripple Price Annual Forecast: XRP eyes record high breakout in 2026 as Ripple scales infrastructure

Ripple (XRP) is trading near $2.00 ahead of the New Year after a volatile 2025 that saw the cross-border remittance token swing to a new record high of $3.66 in July.

The resolution of the lawsuit against Ripple filed by the United States (US) Securities and Exchange Commission (SEC) in July paved the way for the adoption of XRP as an institutional-grade digital asset, with active corporate treasuries.

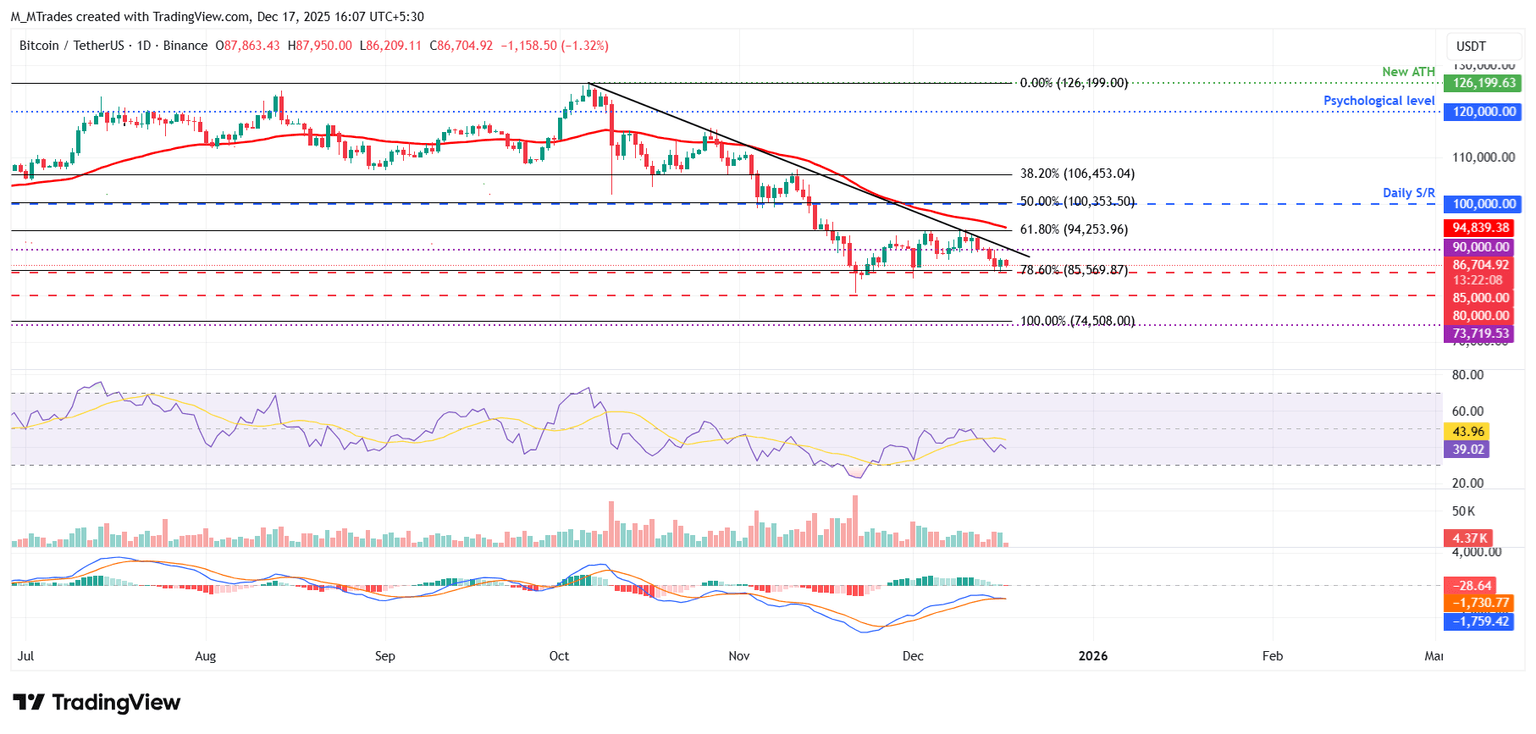

Bitcoin Price Forecast: BTC risks deeper correction as ETF outflows mount, derivative traders stay on the sidelines

Bitcoin (BTC) remains under pressure, trading below $87,000 on Wednesday, nearing a key support level. A decisive daily close below this zone could open the door to a deeper correction. Meanwhile, the bearish outlook strengthens as spot Bitcoin Exchange Traded Funds (ETFs) record a second consecutive day of outflows, while wallets linked to Matrixport move 4,000 BTC onto exchanges. In addition, derivatives traders largely sit on the sidelines with BTC lacking a clear catalyst to spark a near-term recovery, keeping downside risks firmly in focus.

Institutional demand started the week on a negative note. SoSoValue data show that Spot Bitcoin ETFs recorded an outflow of $277.09 million on Tuesday, marking the second consecutive day of withdrawals so far this week. If these outflows continue and intensify, the Bitcoin price could see further correction.

Monero Price Forecast: XMR builds momentum amid bullish bets and looming resistance

Monero (XMR) trades close to $430 at press time on Wednesday, after a 5% jump on the previous day. The privacy coin regains retail interest, evidenced by heightened Open Interest and long positions. Still, the technical outlook remains mixed as Monero approaches a key resistance level at $439.

CoinGlass data shows the XMR futures Open Interest (OI) stands at $78.61 million, up from $68.15 million on Tuesday. This rise in OI reflects traders increasing their risk exposure in XMR derivatives, including both long and short positions.

Author

FXStreet Team

FXStreet