Cryptocurrencies Price Prediction: Polygon, Bitcoin & Litecoin – European Wrap 3 August

MATIC, ENS, ARB look ready to plummet as traders lose interest on CEX tokens

As Bitcoin (BTC) price continues to hover around the $30,000 psychological level, investors are looking elsewhere to pour their capital. These days, it is on-chain altcoins on Decentralized Exchanges (DEX) that allow investors with some risk appetite to make big profits. With big returns elsewhere, why would crypto participants want to invest in Centralized Exchange (CEX) altcoins that are hardly moving?

Polygon (MATIC) price has shed 25% over the last 20 days and the bottom is not close yet. After slipping below the $0.760-to-$0.714 bearish breaker area, MATIC holders could suffer more losses. Short-sellers, however, are likely to get a good entry if Polygon price manages to sweep the $0.704 level for buy-side liquidity.

Bitcoin’s continued slide down

The crypto market cap fell 1.6% in 24 hours to $1.166 trillion. Risk assets in traditional markets came under pressure as the accumulated overheating in equities (especially in techs) accompanied a trigger – Fitch’s cut of the US rating.

The initial flight of speculators into Bitcoin proved to be short-lived. Bitcoin closed Wednesday down 0.5%, losing over 3.1% from its peak at the start of the day, and failed to get back above the 50-day average. This is another bearish signal in addition to the sequence of downward daily candles. So far, Bitcoin has managed to avoid accelerating the sell-off, but it looks like it's only a matter of time before it does.

Litecoin price hits August low after halving event, reaction differs from Bitcoin

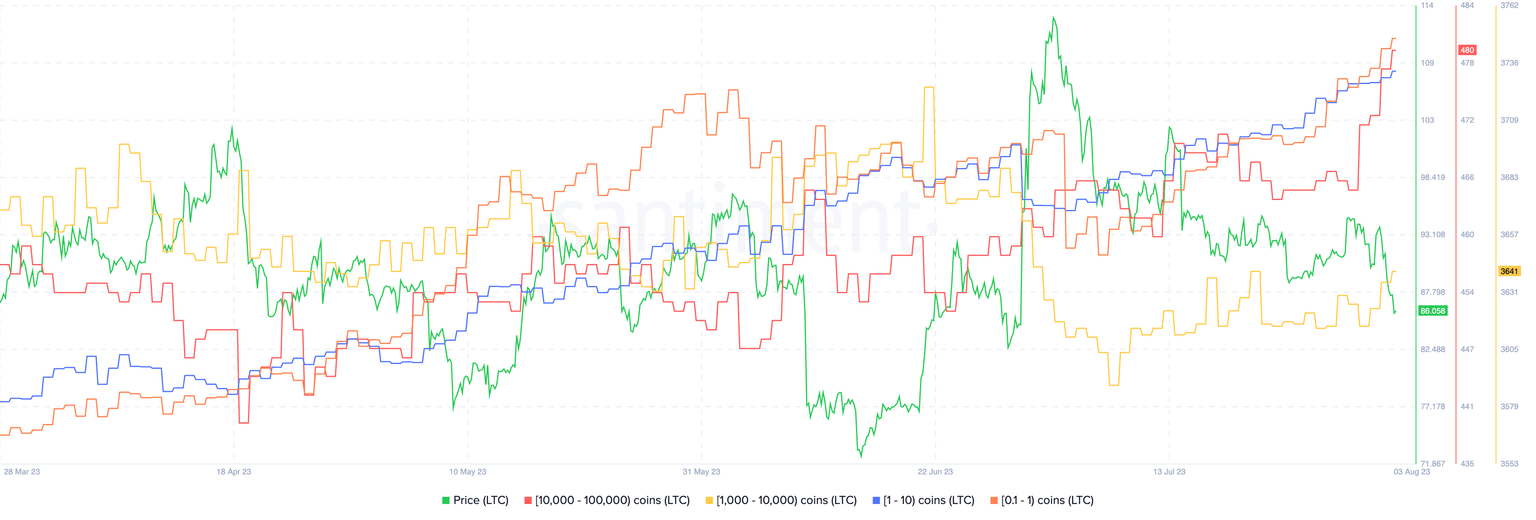

Litecoin (LTC), one of the largest altcoins in the crypto ecosystem, went through a halving event on August 2 in which the mining reward per block was slashed in half. Contrary to popular expectation, Litecoin price plummeted in response to the event, dropping to a fresh monthly low of $85.61.

The Litecoin halving event was followed by a steep decline in LTC price on Binance. Litecoin dropped from its Wednesday high of $94.50 to its August low of $85.61. In the days leading up to the halving, there was a significant accumulation of LTC tokens by large wallet investors.

Author

FXStreet Team

FXStreet