Cryptocurrencies Price Prediction: Pepe, Terra Luna Classic & Bitcoin — Asian Wrap 26 March

Pepe price coils up for next leg higher as meme coins awaken

Pepe (PEPE) price has joined the broader cryptocurrency community, awakening after a show of strength in the Bitcoin (BTC) price. Alongside the frog-themed crypto’s value surge, meme coins are also rallying, which is an unexpected turnout considering how the sector has reacted to BTC price rallying over the past few months.

LUNC price in recovery mode after opening statements from SEC and Do Kwon’s defense team

As broader markets awaken on Monday, Terra Classic (LUNC) and Terra Luna (LUNA) prices have not been left behind. The two altcoins, sprouting from the Terraform Labs ecosystem, are also showing some strength, coming on the same day as Terraform Labs executive Do Kwon’s trial with the US Securities & Exchange Commission (SEC) commences.

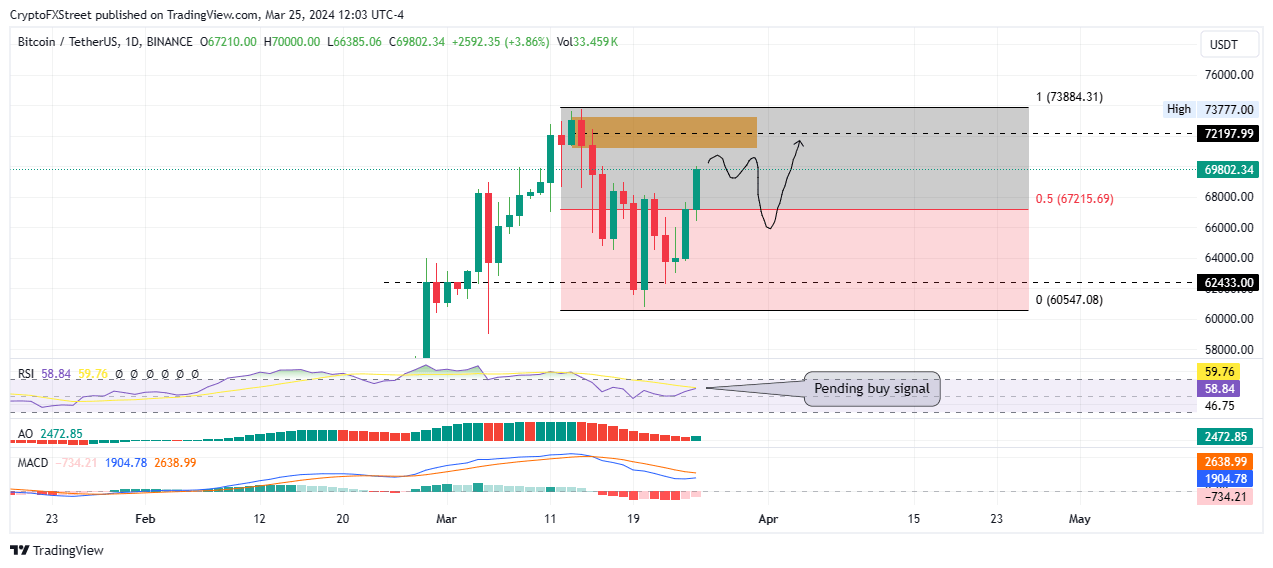

Bitcoin price tags $70K as BlackRock and Fidelity inflows contend against Grayscale outflows

Bitcoin (BTC) price soared to levels above $69,000, after giving the bulls an opportunity to buy BTC at lower prices last week. A rally that was only budding over the weekend has put the week off to a good start, with the potential for more gains.

Author

FXStreet Team

FXStreet