Cryptocurrencies Price Prediction: Luna Classic, Fantom & Uniswap — Asian Wrap 16 February

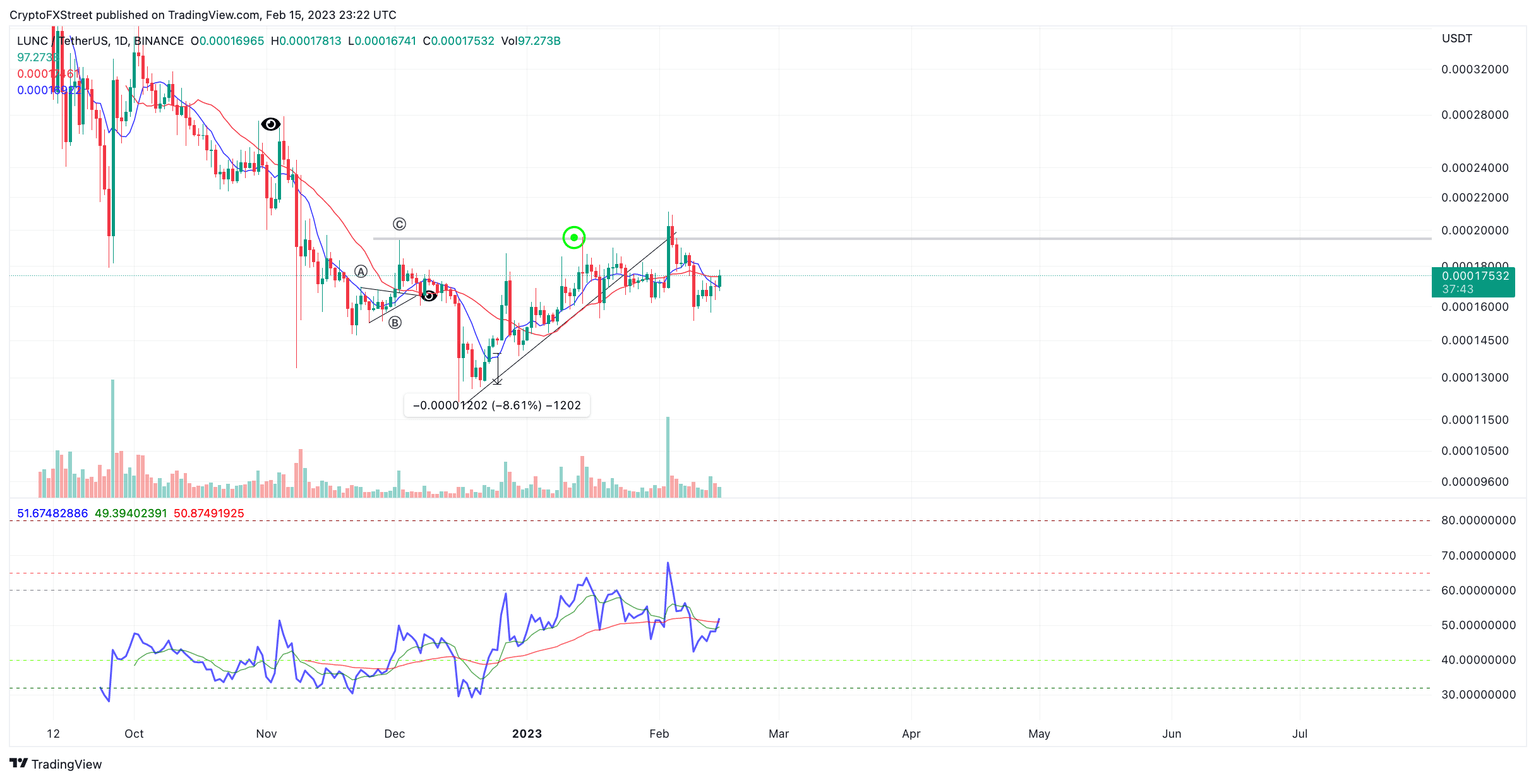

Luna Classic Price Prediction: Bulls setting up for another leg up

Luna classic price displays applaudable retaliation signals following last week's 10% decline. Traders should keep a close eye on LUNC as a potential swing trade could present itself in the coming days.

Fantom Price Prediction: Newfound momentum suggests FTM is on its way to $1

Fantom price displays strong bullish-retaliation signals. Traders should keep their eye on the smart contract token as it seems poised to rally considerably.

Uniswap Price Prediction: Bullish divergences to catalyze the next rally

Uniswap price shows bullish cues after experiencing the largest sell-off in 2023 last week. Traders should watch the UNI price closely to participate in the next volatile price movement.

Author

FXStreet Team

FXStreet