Cryptocurrencies Price Prediction: Hedera, Ethereum & Dogecoin — Asian Wrap 18 July

Top Crypto Gainers: Hedera, Flare, Ripple – HBAR, FLR, XRP make waves with double-digit gains

Hedera (HBAR), Flare (FLR), and Ripple (XRP) continue to extend their double-digit gains from Thursday, outperforming the broader market over the last 24 hours. The surge in altcoins aligns with Bitcoin (BTC) reclaiming the $120,000 level and an improvement in broader market sentiment. The technical outlook suggests a bullish inclination, as rising buying pressure fuels trend momentum.

Ethereum Price Forecast: ETH eyes $4,000 as SharpLink Gaming expands ATM facility to $6 billion

Ethereum (ETH) briefly surged to $3,500 on Thursday after SharpLink Gaming (SBET) filed an amendment to increase its At-The-Market (ATM) facility by $5 billion. The amendment follows asset manager BlackRock's filing to integrate staking into its iShares Ethereum Trust (ETHA), which pulled in a record $500 million in net inflows on Wednesday.

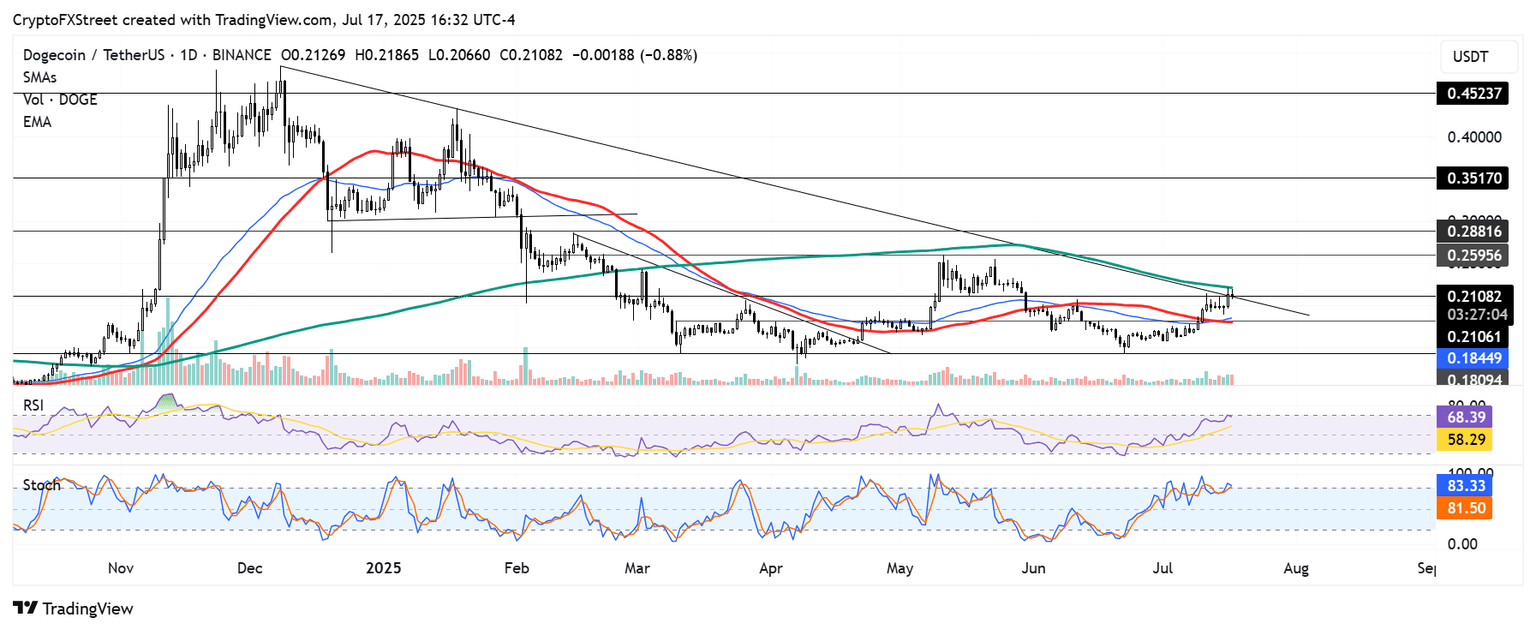

Dogecoin Price Prediction: DOGE rises 3% as Bit Origin unveils $500 million Dogecoin treasury

Dogecoin (DOGE) gained 3% on Thursday following Nasdaq-listed Bit Origin's (BTOG) announcement that it plans to raise up to $500 million from the sale of its shares and convertible debt to launch a DOGE treasury. The number one memecoin is battling the convergence of several resistance levels comprising a descending trendline, the $0.210 level, and the 200-day Simple Moving Average (SMA). A firm move above these levels could see DOGE stretch its rally to test the $0.259 resistance.

Author

FXStreet Team

FXStreet