Cryptocurrencies Price Prediction: Ethereum, Polkadot & Vechain – American Wrap 3 February

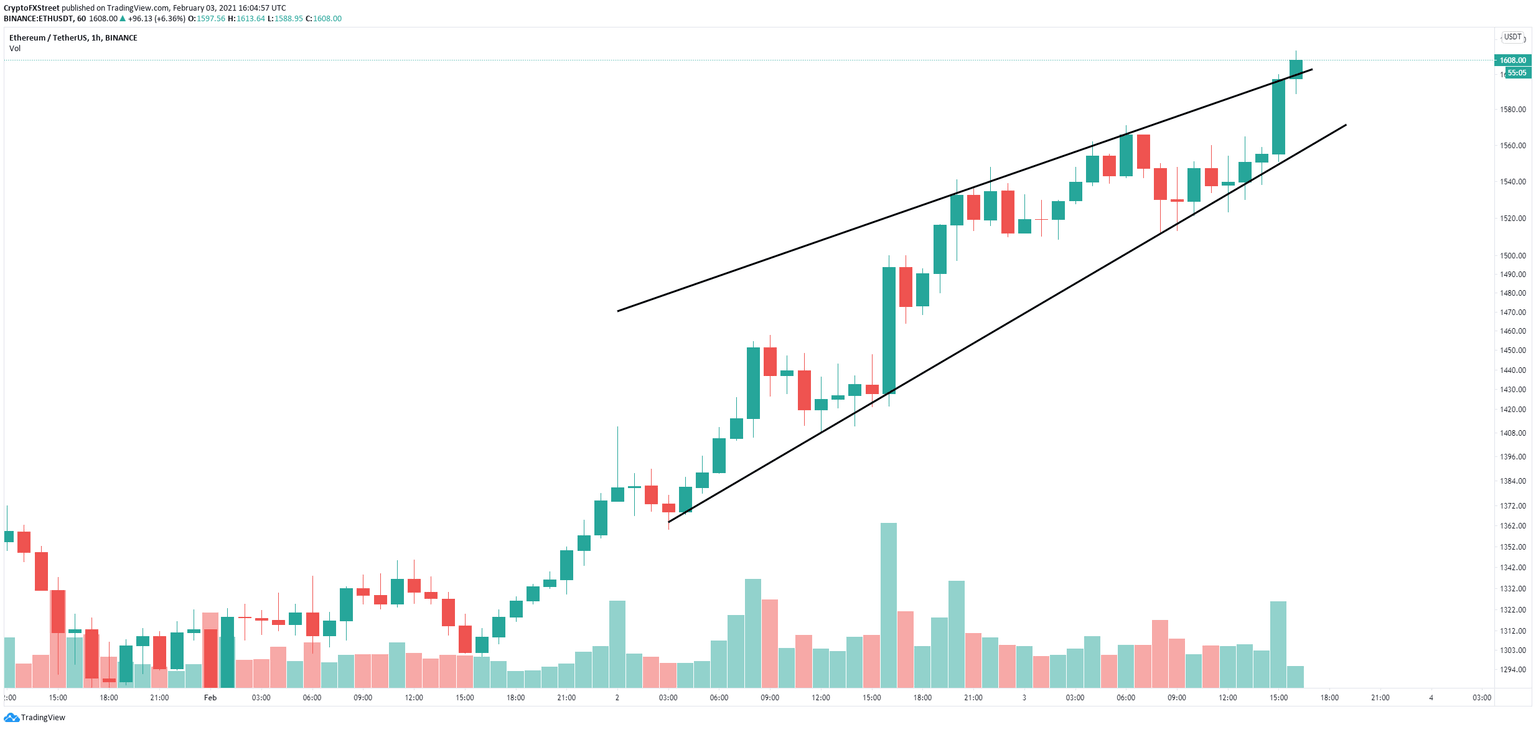

Ethereum price breaks $1,600 in unstoppable rally targeting $2,000

Ethereum has just reached a market capitalization of $183 billion for the first time ever after surpassing $1,600 across all major exchanges. ETH bulls aim for at least $2,000 in the short-term and up to $3,123 which is the 261.8% Fibonacci Level that Bitcoin touched after its last rally.

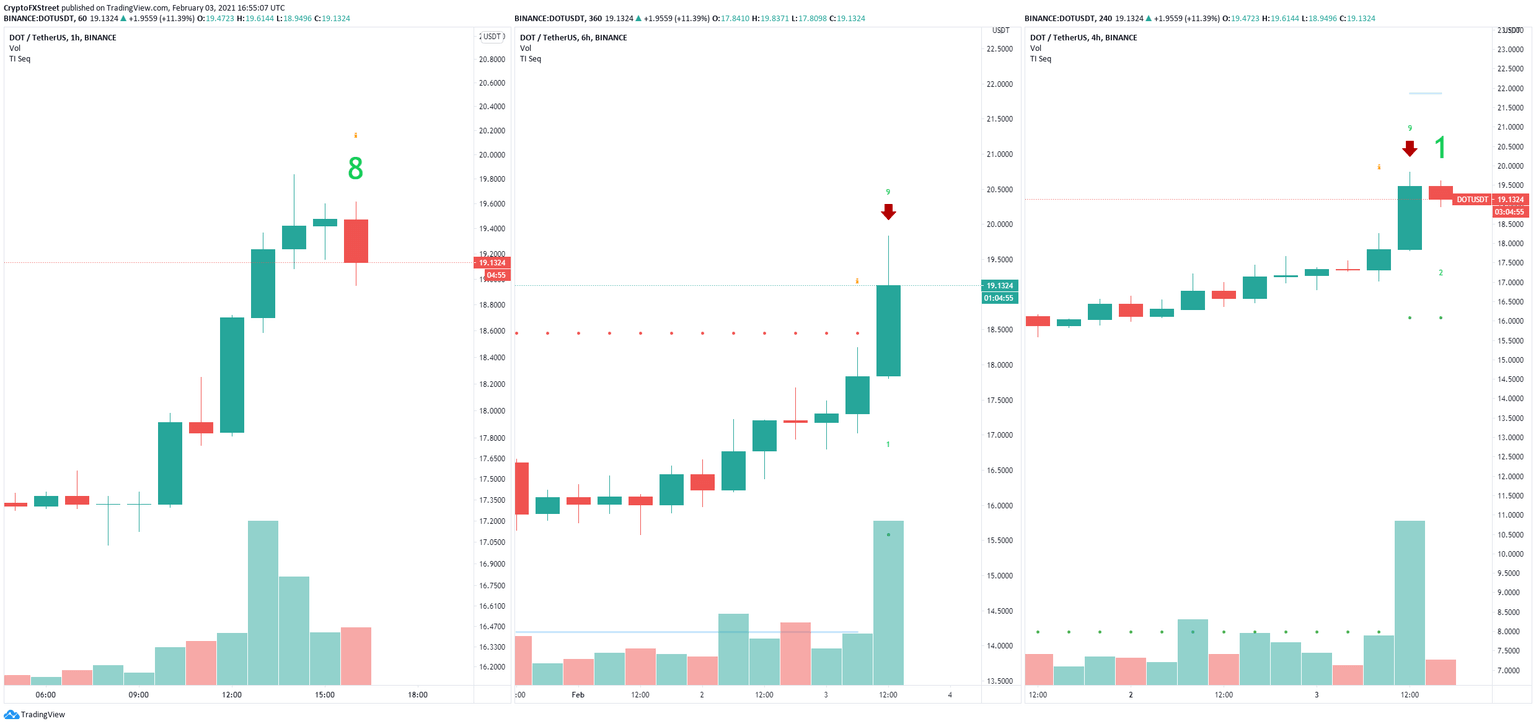

Polkadot Price Prediction: DOT is poised for a significant correction to $16, suggests technicals

Polkadot has reached a new all-time high on February 3 at $19.83 hitting a market capitalization of over $17.4 billion, almost surpassing XRP which stands at $17.8 billion. Unfortunately, many on-chain metrics and indicators show that Polkadot must face a correction.

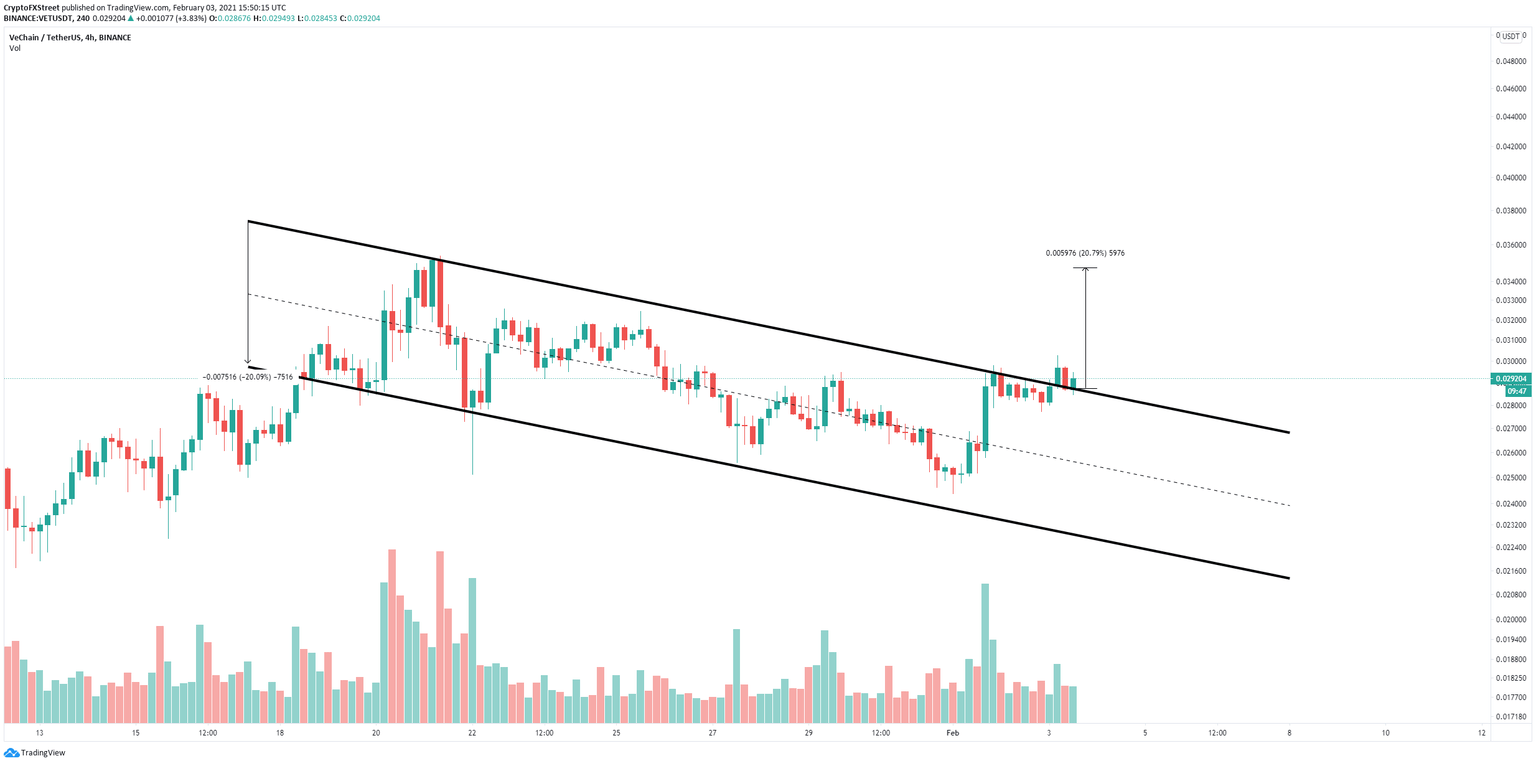

Vechain Price Forecast: VET sees a breakout and defends crucial support level aiming for $0.034

After a rally towards $0.035 that peaked on January 21, Vechain has been under a consolidation period hitting a low of $0.024 on February 1. Since then, the digital asset has recovered significantly and broke out of a parallel channel.

Author

FXStreet Team

FXStreet