Cryptocurrencies Price Prediction: Dogecoin, Litecoin and Stellar Lumens – European Wrap 3 March

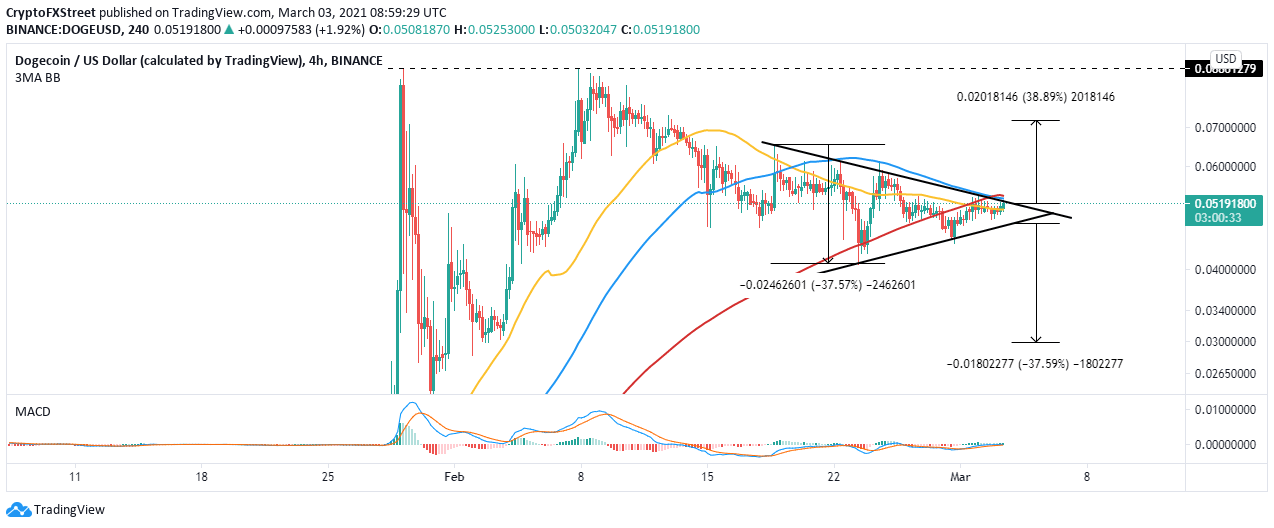

DOGE stalls ahead of 38% technical breakout

Dogecoin bulls have been keen on recovery since the price drop at the beginning of March. However, the momentum continues to lose steam, leading to lethargic price action. DOGE must break above a critical seller congestion zone to open the door for a huge technical liftoff. Read more...

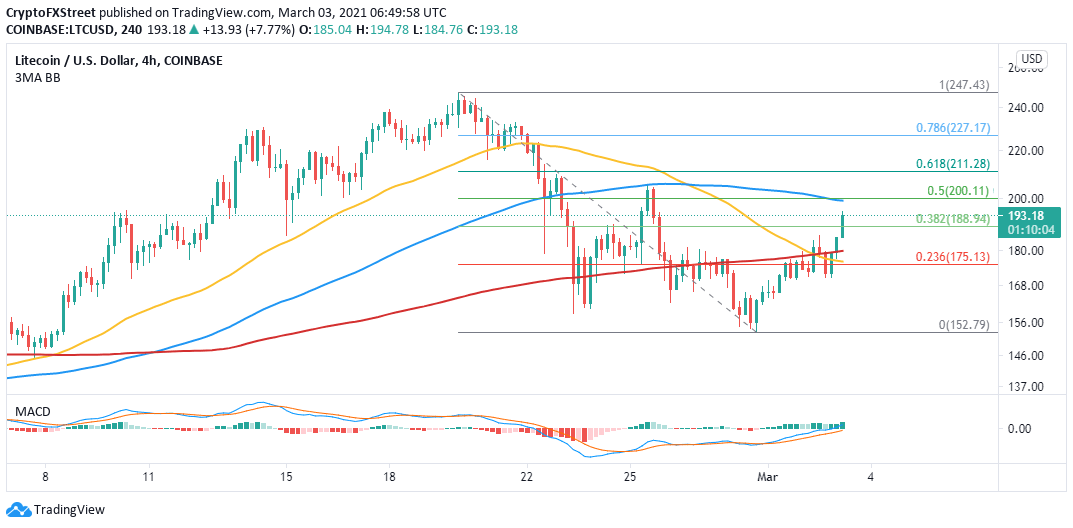

LTC lifts off the Launchpad while $250 beckons

Litecoin has set out north after bouncing from support at $152. Initially, recovery was gradual but became rapid after LTC stepped above the 200 Simple Moving Average on the 4-hour chart. If a near-term confluence level is broken, Litecoin may see massive buy orders triggered in anticipation of an upswing to $250. Read more...

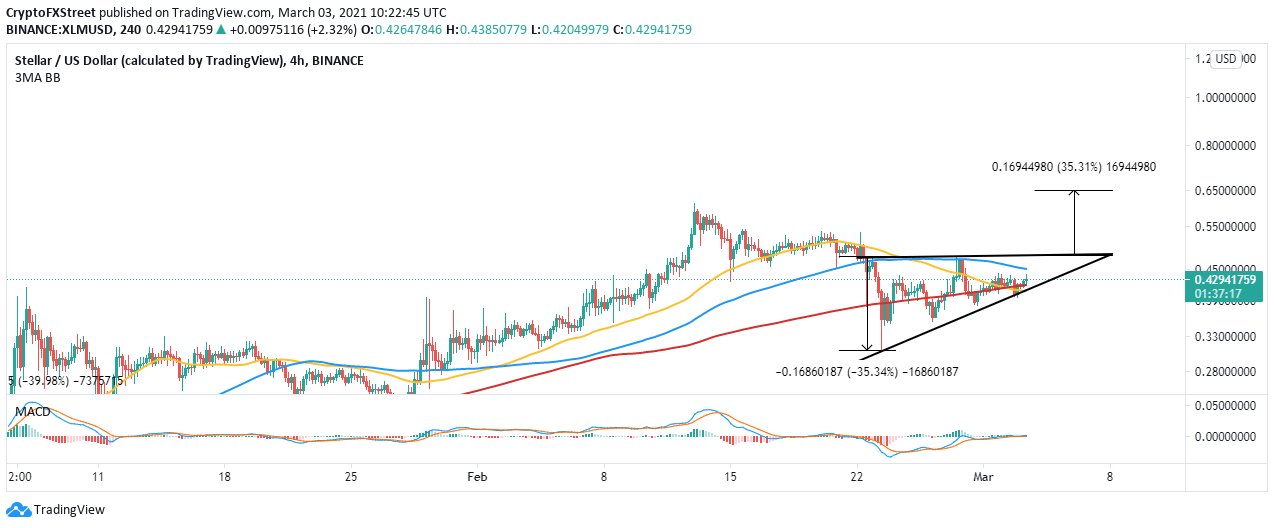

Stellar could sprint to $0.65 if crucial technical pattern confirms

Stellar stalled at $0.48 following the dip to $0.3. Sideways price action seems to have taken precedence, but XLM appears to be leaning to the bullish side. The cross-border token is also trading between two key levels that might determine its future. Meanwhile, Stellar is looking toward a 35% technical breakout, aiming for $0.65. Read more...

Author

FXStreet Team

FXStreet