Cryptocurrencies Price Prediction: Chainlink, Bitcoin & Polygon — Asian Wrap 27 February

Chainlink price prediction: Here's why LINK is gearing up for a 10% price rally

Chainlink (LINK) price is in a short-term uptrend, the asset is close to a key resistance level at $7.41. Although LINK has flipped this hurdle into a support floor previously, investors are awaiting a climb above key resistance to confirm the continuation of the uptrend.

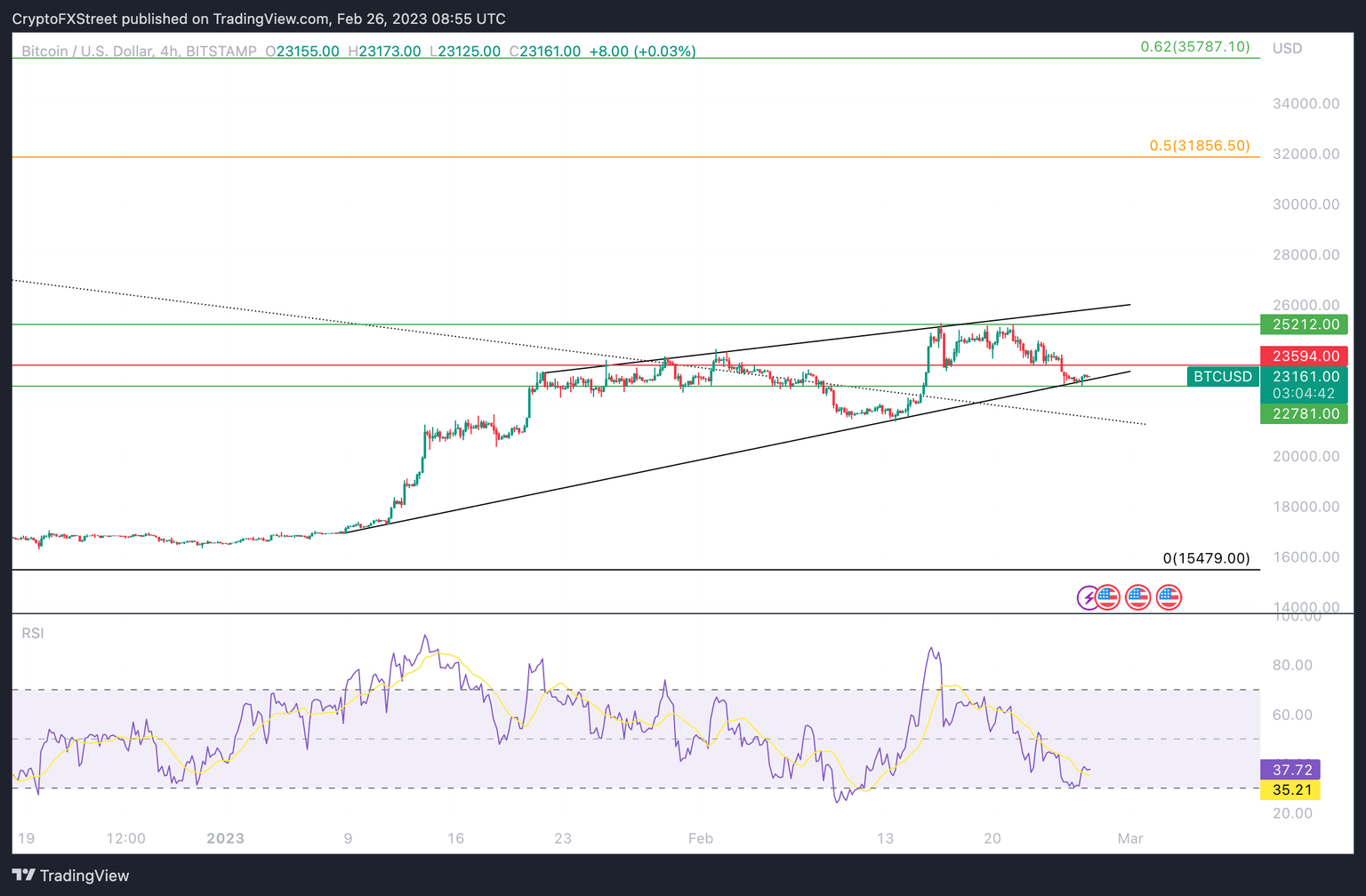

Here’s why Bitcoin miners are bullish and what it means for BTC

Bitcoin miners are engaged in an arms race in computing power. The recent recalculation increased BTC mining difficulty by 9.95%, despite the spike miners are deploying capital to expand operations. This reveals a bullish bias among Bitcoin miners and fuels a positive sentiment among BTC holders.

What to expect from MATIC price with Polygon’s series of partnerships and upcoming zkEVM launch

MATIC, the native token of the Ethereum scaling solution Polygon is on track to recoup its recent losses. Polygon network entered a series of partnerships with name brands like Mastercard, Starbucks among others, helping MATIC gain popularity as the token of the largest Ethereum sidechain.

Author

FXStreet Team

FXStreet