Cryptocurrencies Price Prediction: Cardano, Official Trump & Litecoin — Asian Wrap 28 October

Cardano Price Forecast: ADA eyes breakout as whale accumulation and on-chain data turn bullish

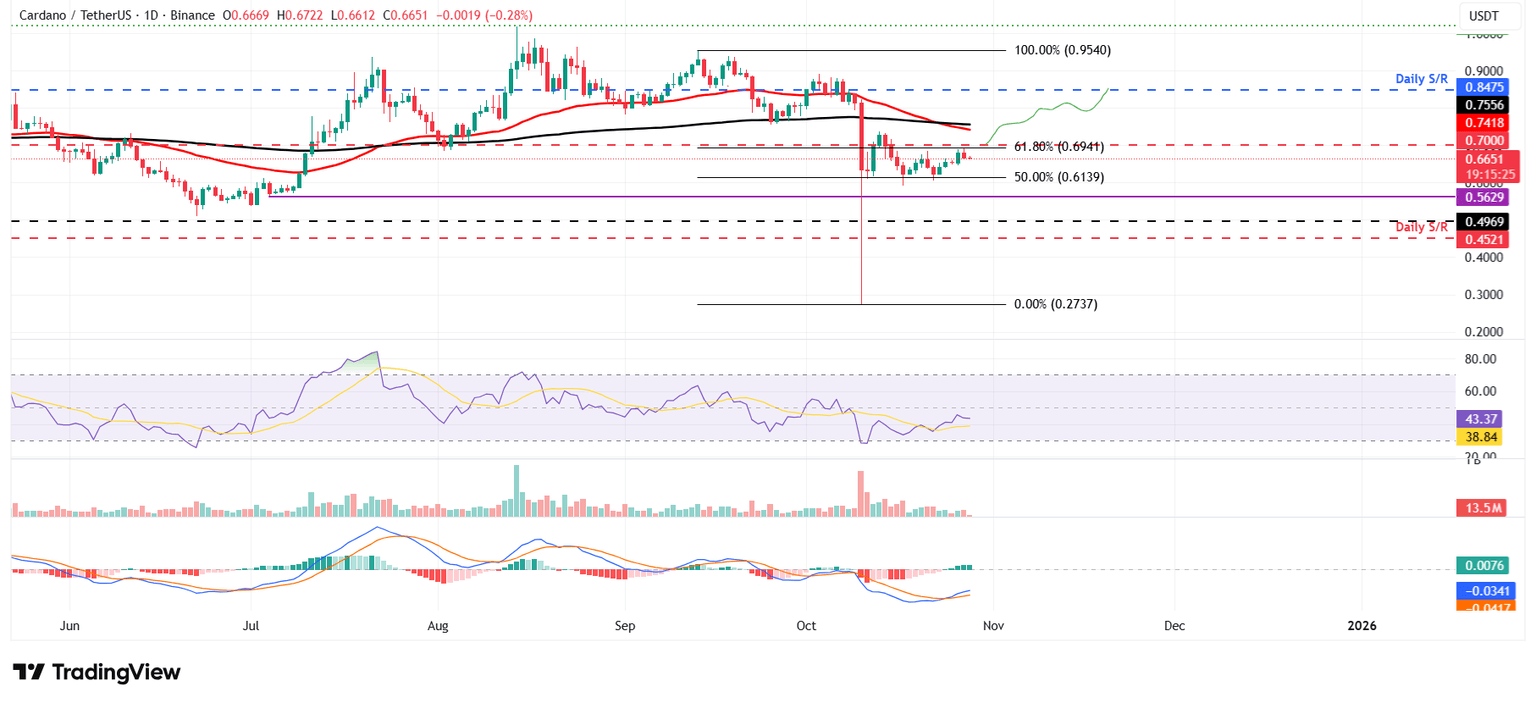

Cardano (ADA) is trading around $0.66 at the time of writing on Tuesday, after being rejected from a key level the previous day. On-chain data shows whale accumulation rising, fueling optimism for a potential breakout. The technical outlook also supports a rally ahead, as momentum indicators signal a fading bearish trend. The metric indicates that whales holding between 1 million and 10 million ADA tokens (yellow line) and 10 million and 100 million tokens (blue line) have accumulated a total of 100 million ADA tokens from October 15 to Tuesday. During the same period, wallets holding between 100,000 and 1 million ADA tokens (red line) have shed 30 million tokens.

Top Crypto Gainers: Official Trump, Helium, Hedera shine bright among rising altcoins

The Official Trump token edges lower by over 1% at press time on Tuesday, after Monday's 13% jump. The TRUMP token struggles to surpass the 50-day Exponential Moving Average (EMA) at $7.113. If the intraday losses flip positive, a decisive close above this average line could target the overhead resistance trendline, part of the falling channel pattern, at $7.927.

Litecoin Price Forecast: LTC eyes $135 as spot ETF launch on Nasdaq boosts bullish momentum

Litecoin (LTC) price hovers around $99 at the time of writing on Tuesday, after rallying 7% in the previous week. LTC’s spot Exchange Traded Fund (ETF) is set to debut on Nasdaq on Tuesday, sparking renewed investor interest and fueling bullish momentum. Moreover, on-chain data support a bullish outlook, as transaction volumes are at their highest levels since mid-2023 and social engagement around Litecoin is surging.

Author

FXStreet Team

FXStreet