Cryptocurrencies price prediction: BTC, XRP & Crypto Market - American Wrap - 23 06

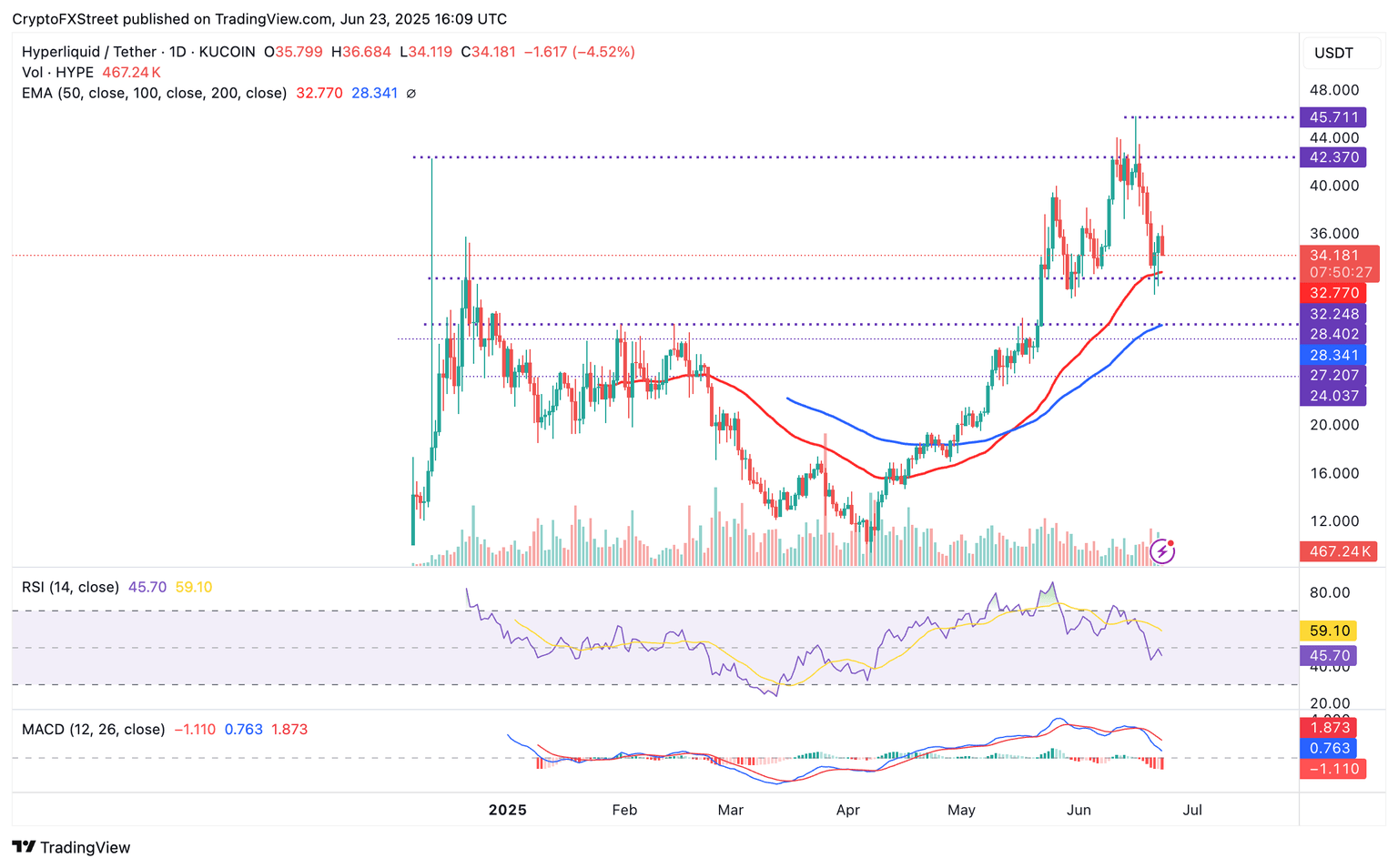

Hyperliquid Price Forecast: HYPE offers mixed technical signals amid steady futures open interest

Hyperliquid (HYPE) has maintained a prolonged downtrend since reaching its new all-time high (ATH) of around $45.71. The Middle East tensions-triggered crash over the weekend extended HYPE’s pullback 32% below the ATH. Support at $30.00 proved helpful, providing liquidity for the upswing that tested resistance at $37.00 before correcting to trade around $34.15 at the time of writing.

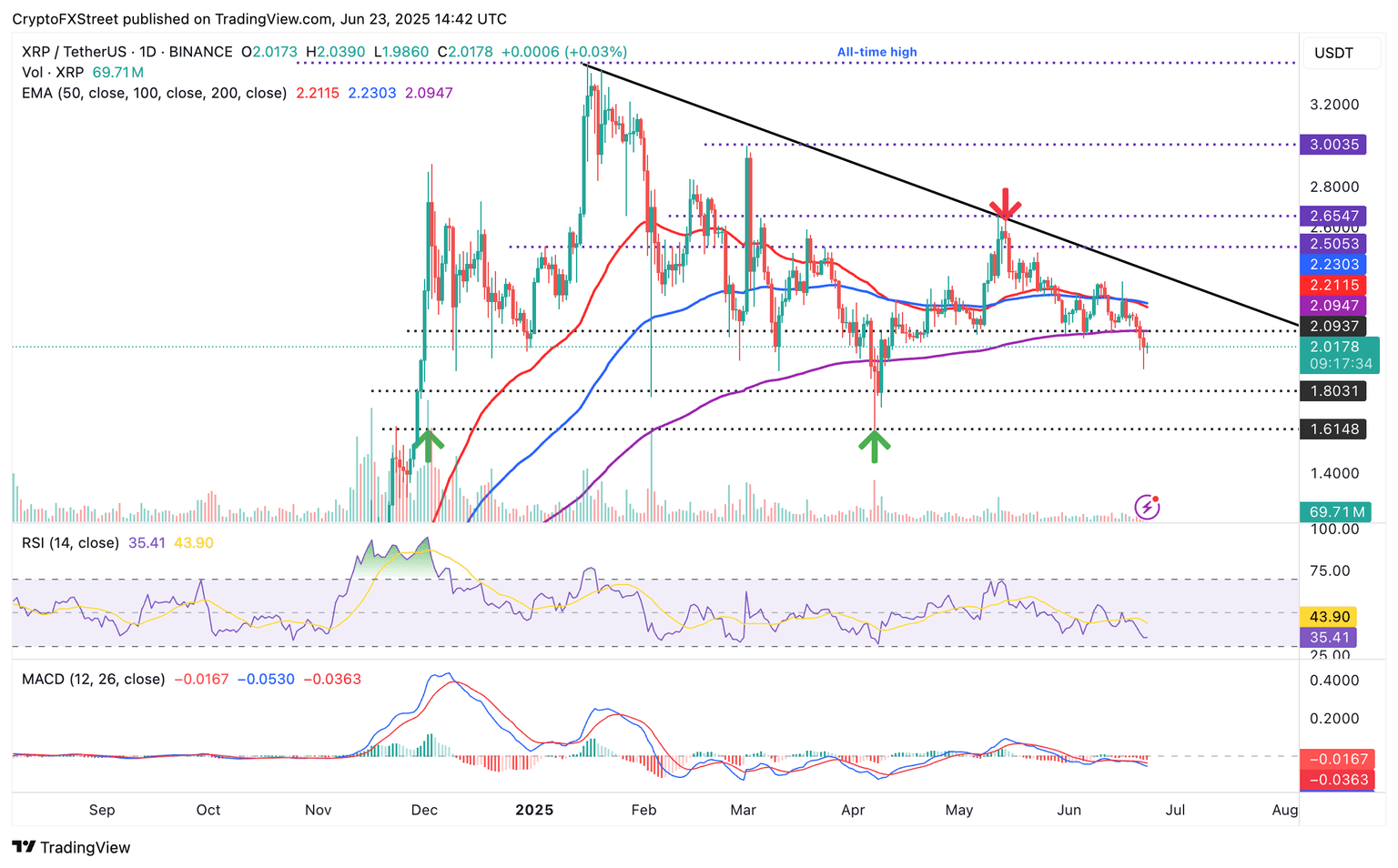

XRP rebounds above $2.00 amid steady inflows and drop in exchange reserves

Ripple (XRP) faces increasing downside pressure as it trades slightly above $2.00 at the time of writing on Monday. The sell-off over the weekend followed United States (US) strikes on Iran on Saturday, triggering massive liquidations. XRP is currently constrained between support at $2.00 and resistance at $2.09 after bouncing from lows of $1.90, reached on Sunday.

Bitcoin Price Forecast: BTC rebounds to $102,000 as MetaPlanet buys the dip, geopolitical fears linger

Bitcoin (BTC) price rebounds slightly, trading around $102,000 at the time of writing on Monday after dipping to $98,200 the previous day. Institutional investors further supported the price recovery as MetaPlanet added 1,111 BTC to its treasury reserve. However, traders should be cautious as the US attack on Iran sparked market-wide risk aversion on Sunday, triggering over $656 million in liquidations.

Author

FXStreet Team

FXStreet