Cryptocurrencies Price Prediction: Bitcoin, Stellar & Crypto – European Wrap 1 August

Bitcoin Weekly Forecast: BTC 16-day consolidation ends — fakeout or real breakdown?

Bitcoin (BTC) price closes below its lower consolidation limit at $116,000, ending a 16-day consolidation phase this week. BTC declined 3.4% so far this week, and the breakdown comes amid a steady macroeconomic backdrop, with the US Federal Reserve (Fed) holding interest rates unchanged, signaling risk-off sentiment. Market participants are also digesting positive developments for the digital asset space, such as the release of the crypto policy report from the White House.

Stellar Price Forecast: XLM risks wedge breakdown as Open Interest declines

Stellar (XLM) edges lower by 3% at press time on Friday, extending the downtrend for the third consecutive day. Both the derivatives and technical risks further losses as bullish momentum and open interest decline.

However, the upcoming Protocol 23 upgrade aimed at boosting smart contract development on the Stellar network could pivot the XLM prices.

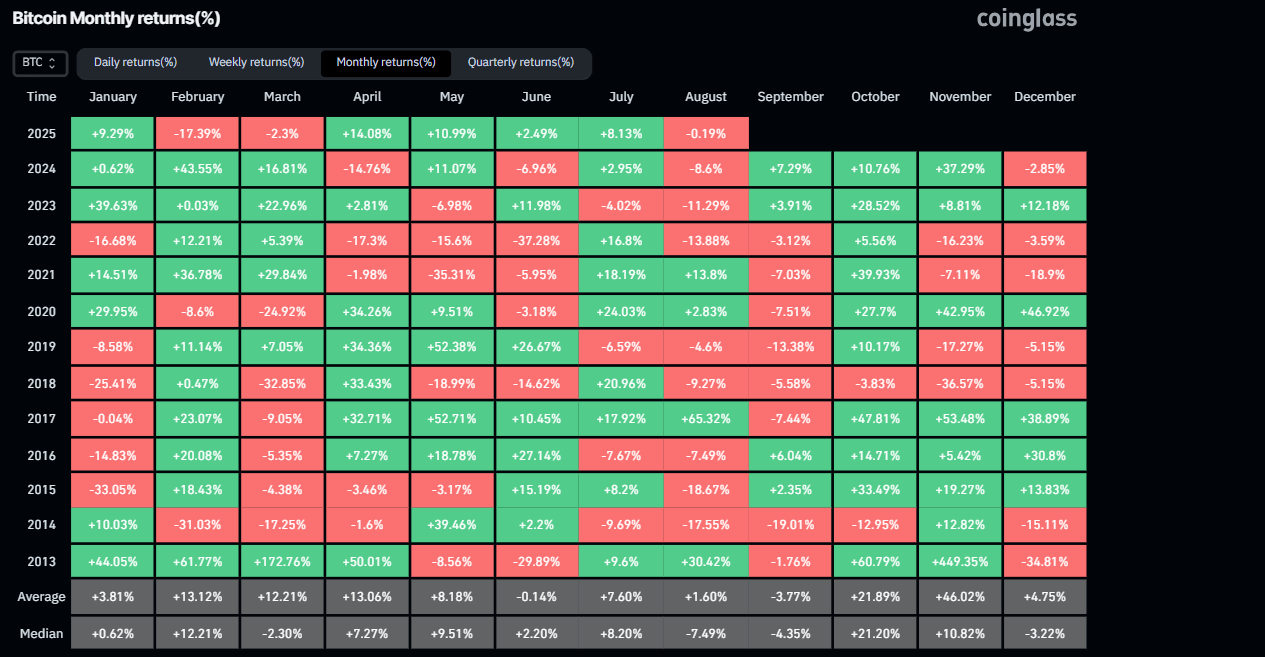

Crypto: A weak start to a difficult month

The crypto market lost 2.7% over the past 24 hours to $3.75 trillion, the level of a week earlier. As this was not the first day of decline, the biggest hit was to altcoins, with ETH losing 5.6% and XRP losing 6%, compared to a 3% loss for BTC.

The cryptocurrency sentiment index fell to 65, its lowest level since 8 July, after three weeks of extreme greed. Clearly, the inability to grow disappointed speculators and increased bearish sentiment.

Author

FXStreet Team

FXStreet