Stellar Price Forecast: XLM risks wedge breakdown as Open Interest declines

- Stellar extends the declining trend for the third consecutive day, risking a wedge breakdown.

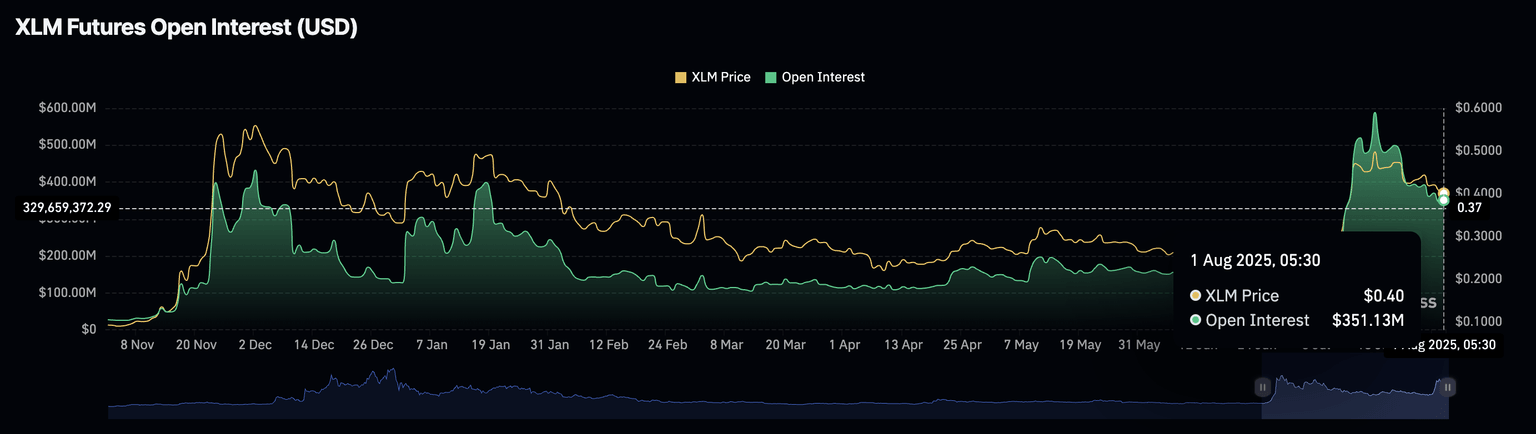

- XLM open interest loses over $200 million within two weeks, signaling a sharp decline in traders’ interest.

- The Protocol 23 upgrade, focused on network improvements, goes to the validator vote on August 26.

Stellar (XLM) edges lower by 3% at press time on Friday, extending the downtrend for the third consecutive day. Both the derivatives and technical risks further losses as bullish momentum and open interest decline.

However, the upcoming Protocol 23 upgrade aimed at boosting smart contract development on the Stellar network could pivot the XLM prices.

Validators to vote on Stellar’s Protocol 23 upgrade

The Protocol 23 upgrade for Stellar aims to enhance smart contract functionality with faster and cheaper transactions, thereby attracting institutional players. PayPal’s long-awaited PYUSD, a stablecoin pegged to the US Dollar, could be launched on the Stellar network after the upgrade.

The upgrade was officially launched on the Stellar testnet on July 17 and is scheduled for a vote by the validators on August 26. If approved, the Mainnet voting will be conducted on September 3. Sidelined investors may witness the new protocol upgrade hype driving the buying pressure.

Declining traders’ confidence wipes out over $200 million from XLM Open Interest

The broader cryptocurrency market pullback sputtered the interest in Stellar since its annual high of $0.5206 on July 18. CoinGlass’ data shows the XLM Open Interest (OI) at $351.13 million, down from the $588.33 million peak on July 18. This massive capital outflow of $237 million over the last two weeks indicates a sharp decline in the value of open futures and options contracts, suggesting lowered confidence among traders.

XLM Open Interest. Source: Coinglass

XLM risks wedge breakdown, targets $0.30

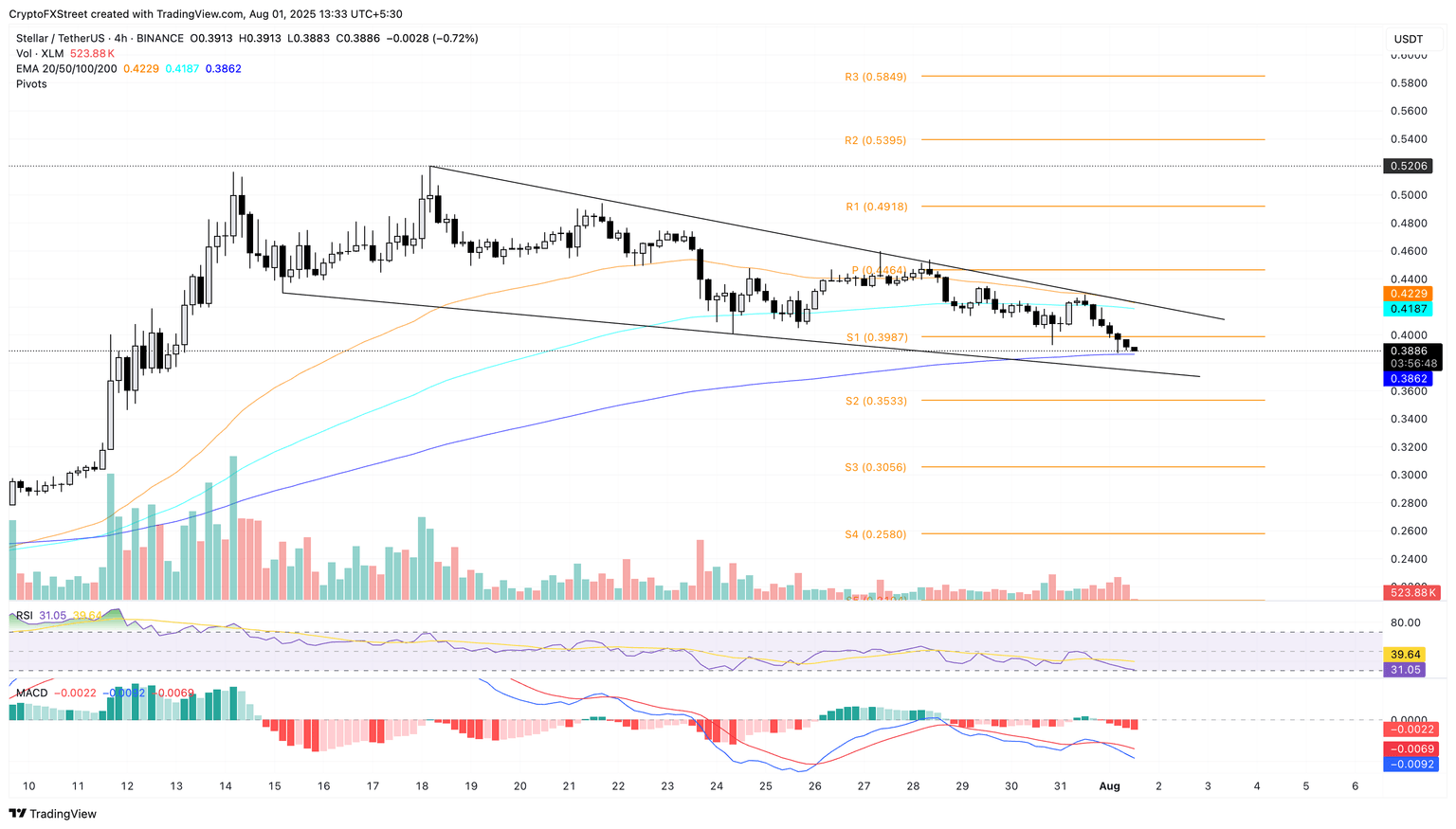

XLM is testing the 200-period Exponential Moving Average (EMA) at $0.3862 on the 4-hour chart, underpinned by the declining Relative Strength Index (RSI) at 31 on the same time frame, signaling a surge in selling pressure.

The Moving Average Convergence Divergence (MACD) indicator on this chart, characterized by the successive growth of red histogram bars, indicates increased bearish momentum.

It is worth noting that the price action on the 4-hour chart has formed a wedge pattern by two converging trendlines (the resistance trendline is formed by connecting July 18 and July 27 peaks, while the support trendline is extrapolated over July 15 and July 24 lows).

If XLM closes decisively below the 200-period EMA at $0.3862, it could test a support trendline at $0.3732. Below the trendline, a potential breakdown trend could test the S2 pivot level at $0.3533, followed by the S3 pivot level at $0.3056.

XLM/USDT daily price chart.

Looking up, a potential bounce back from the 200-period EMA could extend the reversal run to the 100-period EMA at $0.4187.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.