Cryptocurrencies Price Prediction: Bitcoin, SPX6900 & Ripple — Asian Wrap 1 August

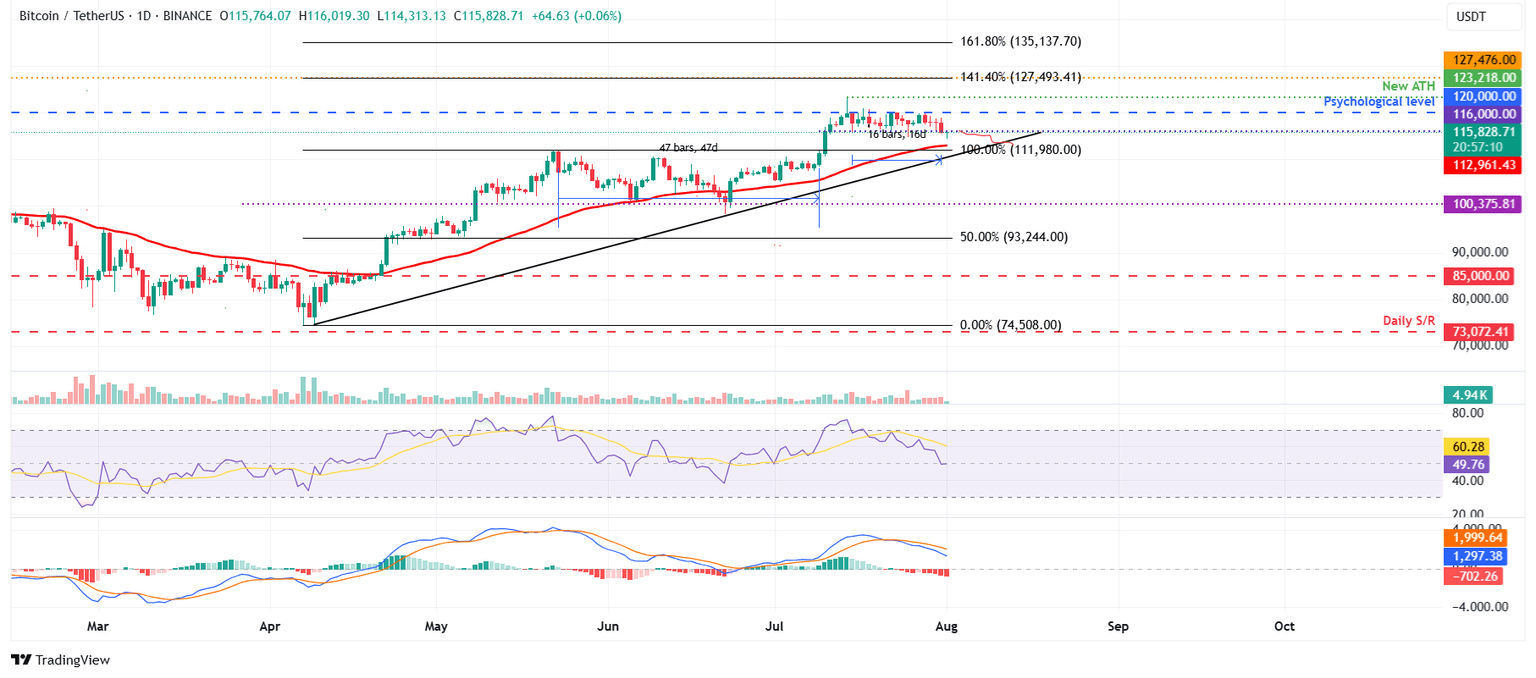

Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – Bears set sight on $112K BTC, $3,500 ETH, $2.78 XRP

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) price action are showing signs of weakness as bears gain control of the momentum. BTC and ETH close below their key support levels, while XRP hovers around a critical level, all hinting at potential downside moves in the near term.

SPX, VIRTUAL, PENDLE lead the fall amid Bitcoin’s third major profit booking

SPX6900 (SPX), Virtuals Protocol (VIRTUAL), and Pendle (PENDLE) are leading the broader cryptocurrency market pullback on Friday, underpinned by a major sell-off move in Bitcoin (BTC). SPX edges higher by nearly 1% at press time on Friday after four consecutive days of losses. The uptick holds the meme coin above its 50-day Exponential Moving Average (EMA) at $1.55.

Ripple Price Prediction: XRP could accelerate losses below $3.00

Ripple (XRP) price is on the back foot, retracing slightly to trade at $3.09 on Thursday. An attempt to step above resistance at $3.32 failed, reflecting low demand retail and a shift in market sentiment, following Wednesday's United States (US) Federal Reserve (Fed) interest rate decision.

Author

FXStreet Team

FXStreet