Cryptocurrencies Price Prediction: Bitcoin, Shiba Inu and Ethereum – European Wrap 29 April

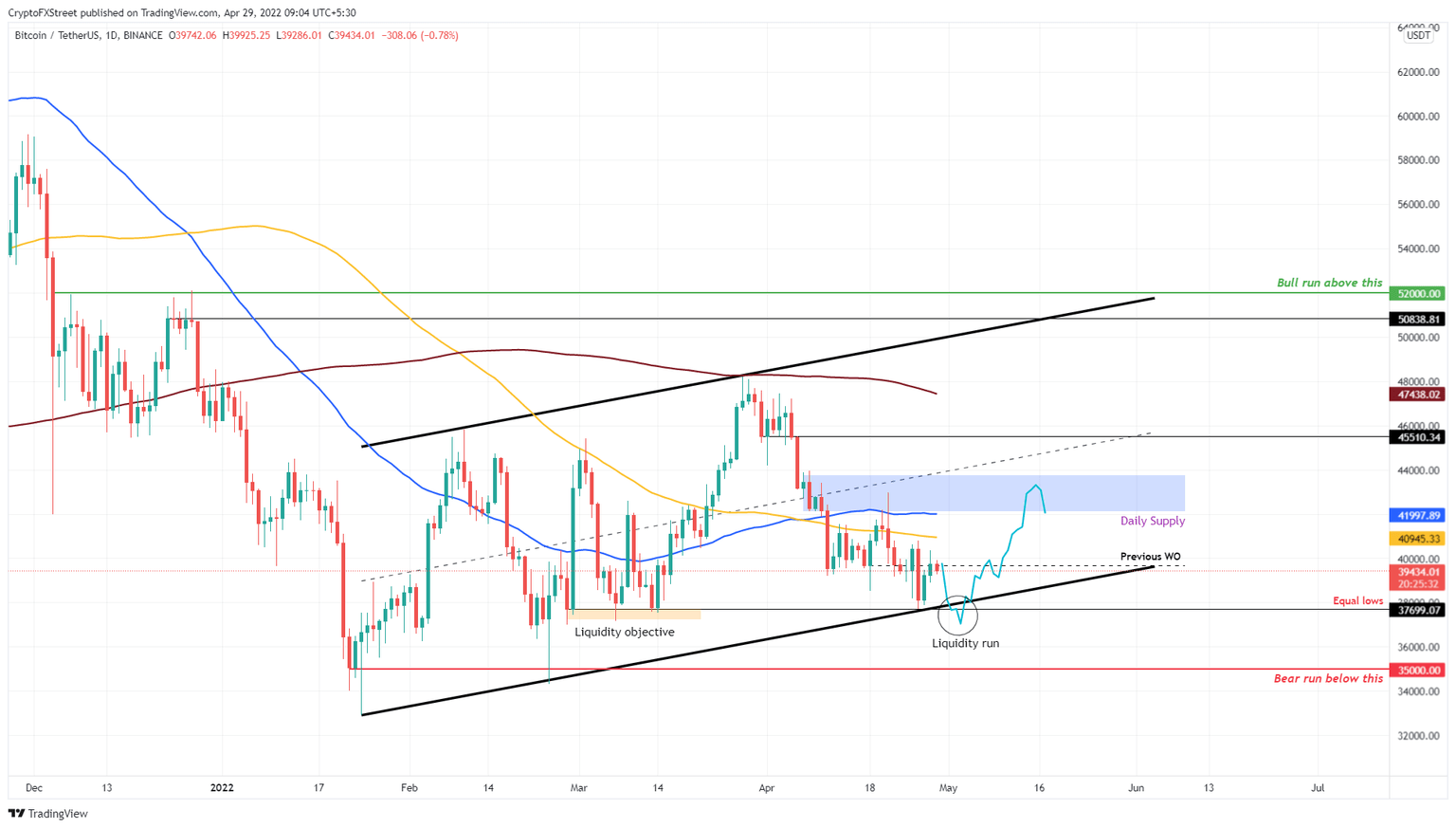

Bitcoin Weekly Forecast: The long squeeze before a run-up to $45,500 is still in play

Bitcoin price has prematurely triggered a minor run-up, leaving its downside objective unfulfilled. Therefore, investors can expect BTC to slide lower and collect liquidity below a significant level before triggering a full-blown impulse move.

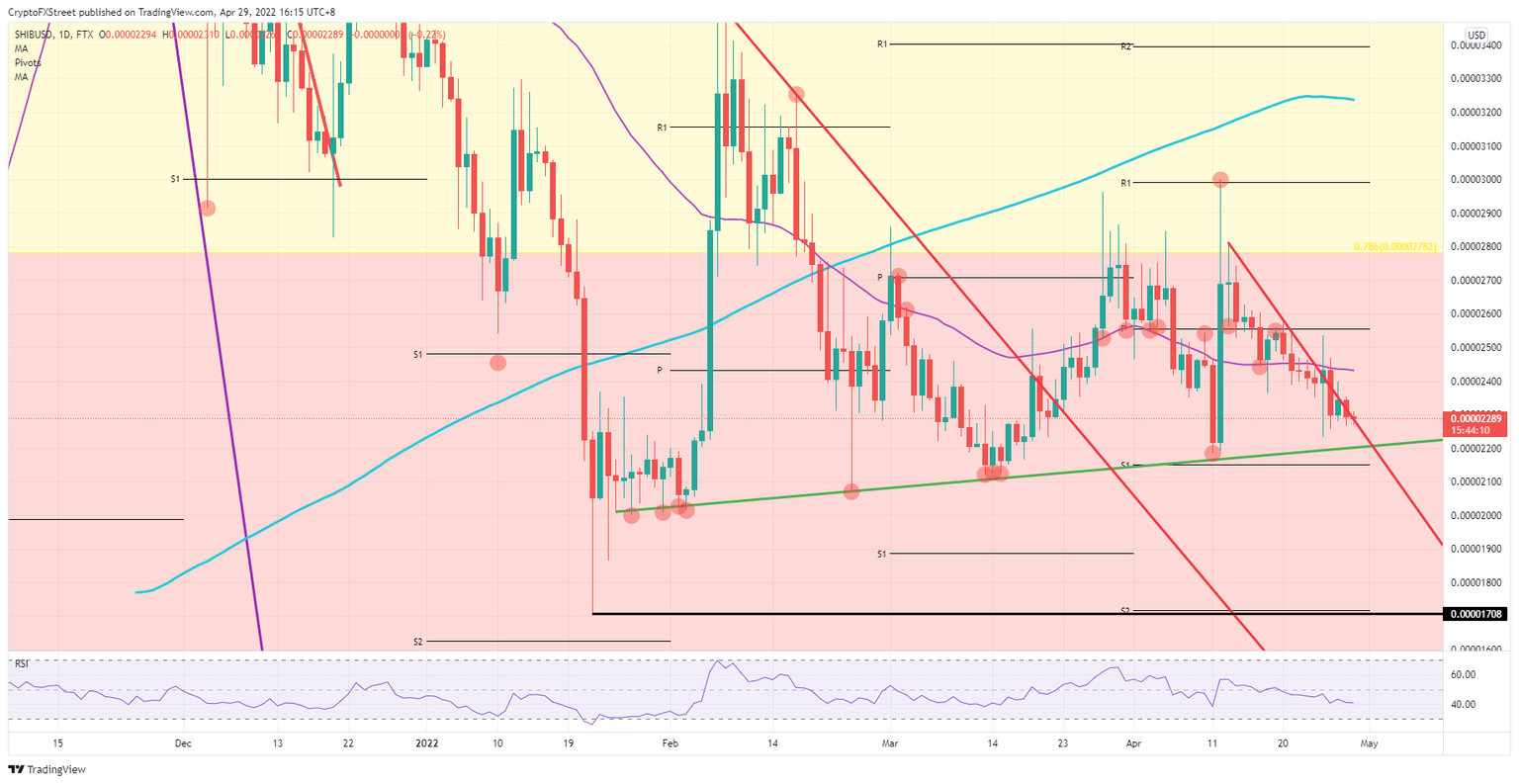

Shiba Inu price consolidates after mixed sentiment from Apple

Shiba Inu (SHIB) price looks heavy in ASIA PAC as investors are again reassessing the situation after the sigh of relief following Facebook’s earnings on Thursday. Mixed earnings from Apple and Amazon over the weekend, however, are giving investors new reasons to fret. Although a slip towards $0.00002200 could be in the making, a bullish pop is also possible going into the weekend. The 55-day Simple Moving Average (SMA) has been put forward again as the first hurdle to tackle before hitting $0.00002500.

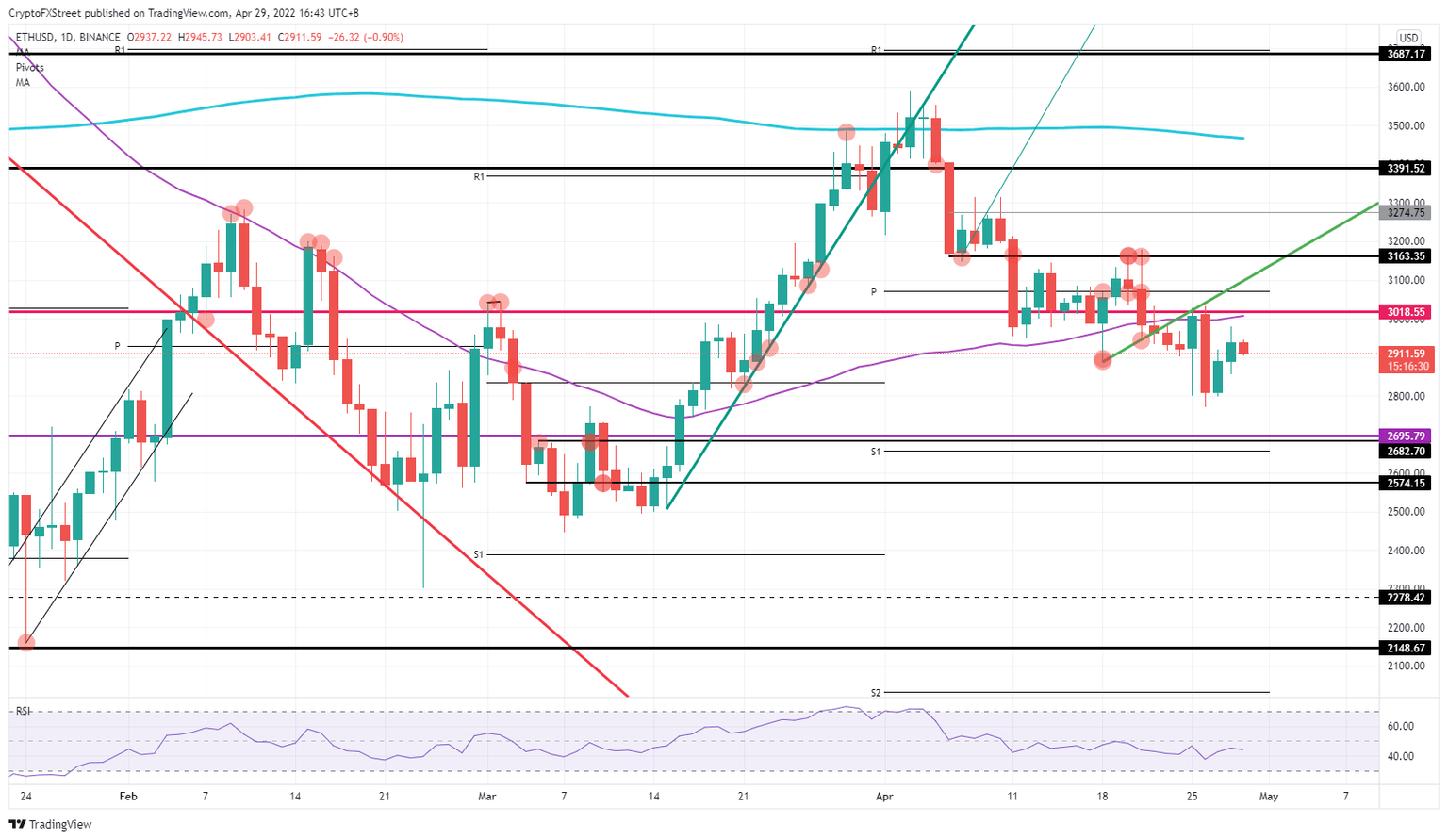

Ethereum price set for 15% gains over the weekend

Ethereum (ETH) price is set to jump over the weekend despite the brake worried investors have put on price action in the past week. Although trading volume has been more significant over the past week and should thus come with more solid movements, price reaction has been distorted by geopolitical headlines, earnings, and whipsaw moves in stock markets. All those headline risks are starting to fade into the weekend, resulting in a probable jump higher in prices as bulls use the flatlining Relative Strength Index (RSI) to seize control and ramp price up to $3,500 by Sunday.

Author

FXStreet Team

FXStreet