Cryptocurrencies Price Prediction: Bitcoin, Ripple & Ethereum – Asian Wrap April 22

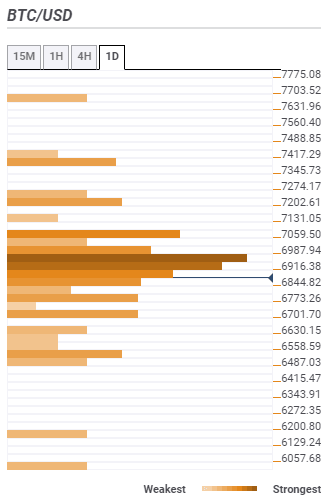

Bitcoin Price Prediction: BTC/USD resilient at $6,800 as oil and stocks topple

Bitcoin price has found balance following a brief free-fall from last week’s highs around $7,341. Moreover, the crypto is staying above the 50-day SMA as a show of strength in the market where bears are threatening to bring the bulls to their knees. The oil market in the United States suffered the biggest blow in history following a drop into the negative on Monday.

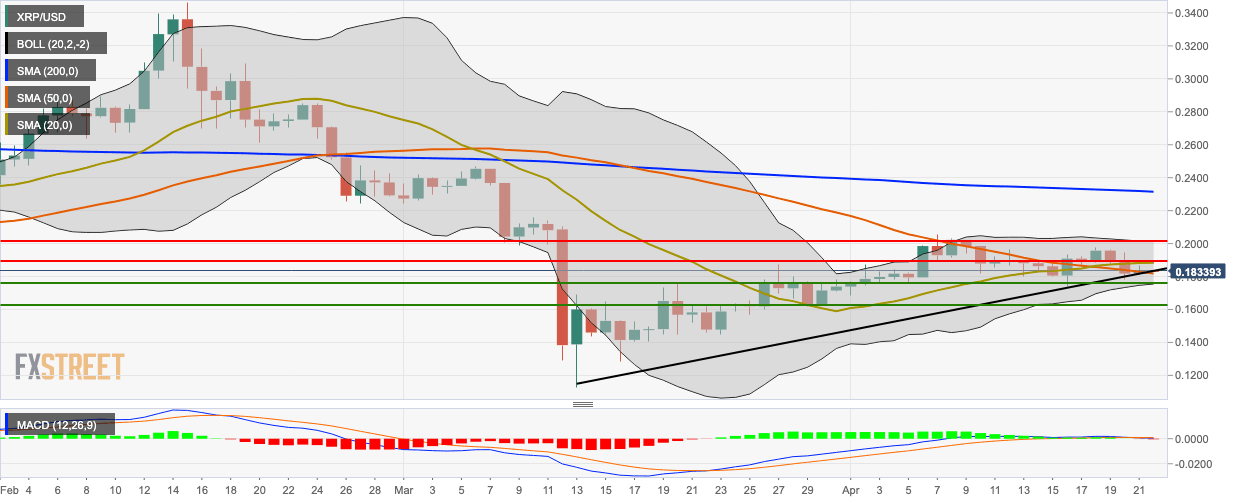

Ripple Price Analysis: XRP/USD bulls stay in control as upward trending line holds strong

XRP/USD went up from $0.1834 to $0.1847, as the bulls remained in control of the market. The price bounced off the support provided by the upward trending line and broke above the SMA 50 curve. The 20-day Bollinger jaw has narrowed, showing decreasing price volatility.

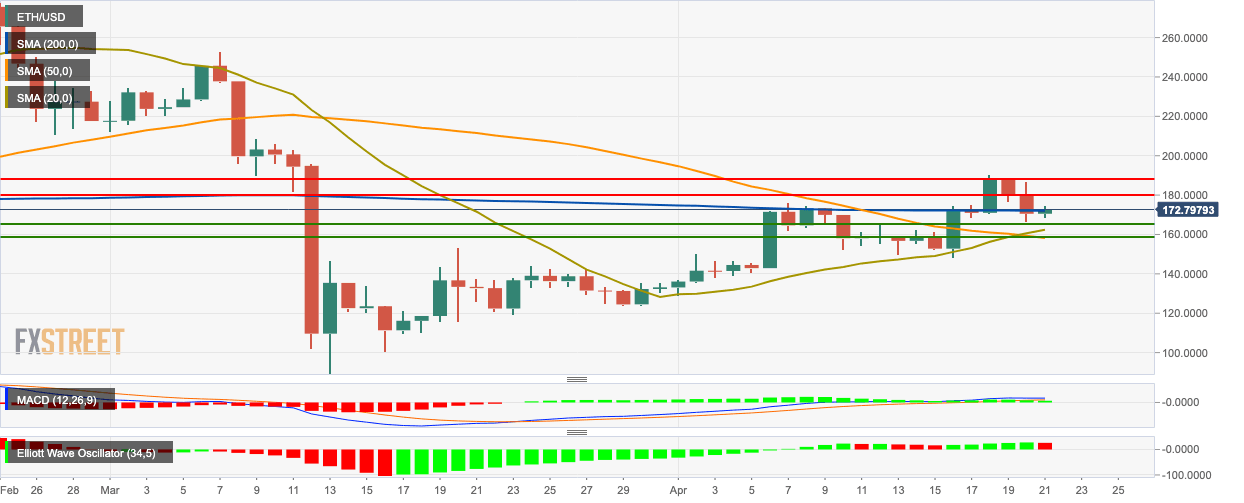

Ethereum Price Analysis: ETH/USD price action remains sluggish as bulls and bears cancel each other out

ETH/USD went up from $170.50 to $172.75 as the price managed to break above the SMA 200 curve. The price is still hovering above the SMA 20 and SMA 50 curves. The MACD shows decreasing bullish momentum, while the Elliott Oscillator had a red session following five straight green sessions.

Author

FXStreet Team

FXStreet