Cryptocurrencies Price Prediction: Bitcoin, Polkadot and Dogecoin – European Wrap 4 February

Bitcoin Weekly Forecast: BTC sets a bull trap before ultimate crash to $30,000

Bitcoin price has shown an increase in buyers over the past two days, leading to a quick run-up. This uptrend will likely last as BTC retests a crucial psychological level, luring buyers into a bull trap. Investors need to be cautious of a reversal that sends the big crypto in a tailspin.

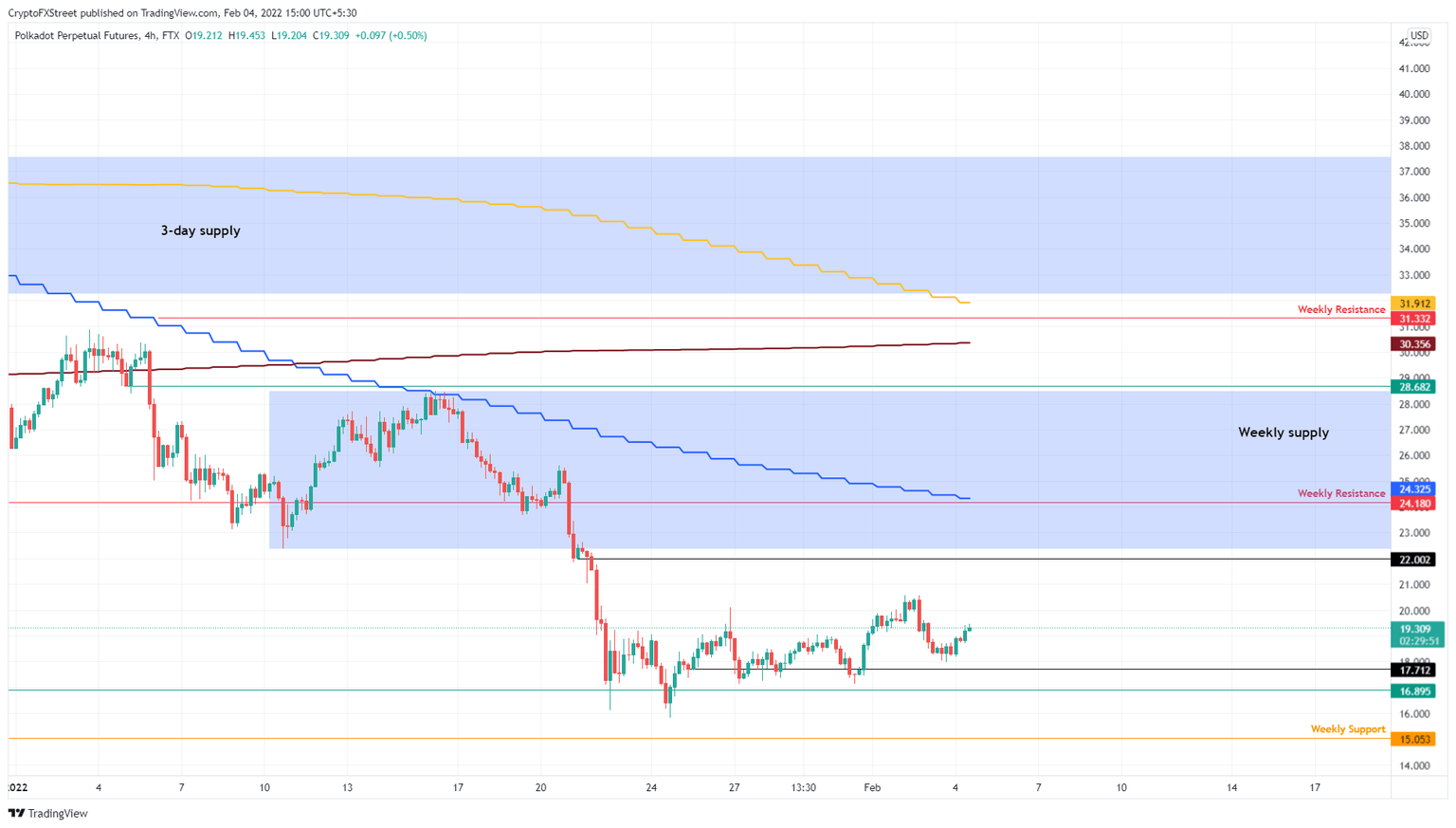

Polkadot price stares at a 15% gain as DOT shows signs of life

Polkadot price is on a leg-up that could extend higher and retest a resistance barrier confluence. Investors have the opportunity to position themselves in the right direction and capitalize on this short-term up move.

Dogecoin nears 500,000 holders while DOGE price remains stagnant

The Shiba-Inu-themed memecoin, Dogecoin, has hit another milestone, reaching nearly half a million holders. Large wallet investors on Binance Smart Chain hold over 325 million Dogecoin tokens, implying that DOGE is a popular choice among whales.

Author

FXStreet Team

FXStreet